Peer pressure can be daunting, especially when our own group of friends have mostly achieved the “peak moment” of their life.

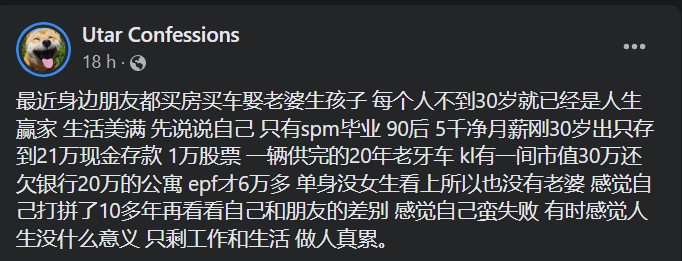

The Utar Confessions page shared an anonymous confession about a man who wished he had a better life after seeing how his peers were leading their respective dream lives.

“My friends are all buying houses, cars, married and having children, all before the age of 30.”

For illustration purposes only

He said that all his friends were already “winners” before age 30, and the anonymous man, who just turned 30, expressed his feelings about his situation. He revealed that he only graduated with an SPM certificate and earns a monthly wage of RM5,000. But here’s what else he has in his possession.

- Savings of RM210,000

- A fully-paid 20-year-old car

- RM300,000 condominium unit (still owes the bank RM200,000)

- Retirement fund (EPF) of RM60,000

The man is currently single and claims it’s tough for him to find a partner as no women are expressing interest.

“I’ve worked hard for 10 years, but when I look at my friends’ achievements, I still feel like a failure,” he added.

He also said that sometimes he feels tired and thinks life is meaningless as it has been repetitive for a long time.

“Do what’s important first… Invest”

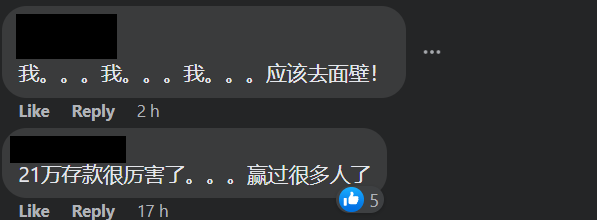

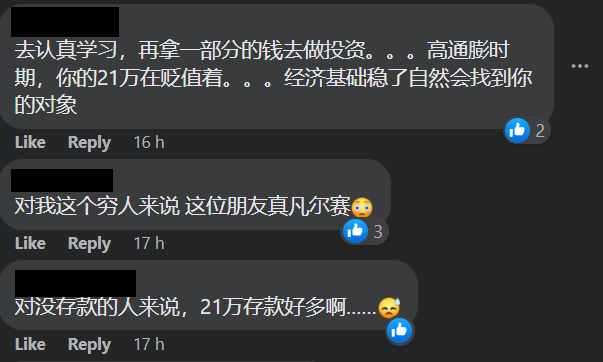

Some netizens have since commented, and most of them have made it clear that he has a lot in his possession compared to what most Malaysians may have.

“I should really reflect on myself.”

“RM210k of savings is great. You’re a step ahead of so many people.”

In the meantime, a netizen suggested the man take part of his money and go for investment.

“Invest your money and take this opportunity to learn. When the economy stabilises, you’ll find what you need.”

“For someone who does not have savings, RM210k is a lot!”

It’s always wise to have savings of your own. Do you think the man has more than enough to survive, and should he feel envious of his peers?

Also read: ‘Credit card & loans’ – M’sian With RM5K Monthly Income Struggles With RM200K In Debt