Though Malaysia’s public transportation infrastructure is improving bit by bit, we still have a long way to go in terms of ease of connectivity for most people. Whatever the case, most Malaysians are still purchasing cars to make their lives easier and we all know how expensive imported cars can get.

So why are they so expensive?

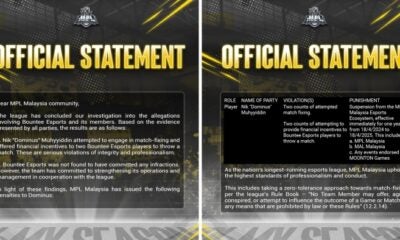

It is the excise tax. Excise tax is an additional tax that needs to be paid when purchases are made on a specific item or good. In this case, it would be on the imported car.

Here’s a look at just how much excise tax you can be charged for passenger vehicles in Malaysia.

Source: MAA

To illustrate just how expensive this can really be, we’ve put our own comparison together.

Just a heads up, the prices does not include all the other expenses involved when purchasing a car such as licence plate payment or road tax. Also, there are no specific criteria for the cars selected for comparison.

Luxury options

Porsche 911 GT3

Source: Porsche

| Country | Germany | Malaysia |

| Price of vehicle | RM625,390 | From RM829,268 |

| Tax rate | 19% | 105% |

| Tax price | RM 118,825 | RM870,732 |

| Total price | RM 744,212 | RM1,700,000 |

Lexus LC 500

Source: Lexus

| Country | Japan | Malaysia |

| Price of vehicle | RM479,356 | RM940,000 |

| Tax rate | 8% | 105% |

| Tax price | RM38,348.50 | RM987,000 |

| Total price | RM517,705 | RM1,927,000 |

2017 Aston Martin DB11

Source: Car And Driver

| Country | United Kingdom | Malaysia |

| Price of vehicle | RM867,566 | RM975,610 |

| Tax rate | First year rate | 105% |

| Tax price | RM10,990 | RM1,024,390 |

| Total price | RM878,558 | RM2,000,000 |

Summary

If you compare the actual price of the vehicle, the amount that you would pay isn’t too bad. It comes down to the total price though and this is affected by the excise tax. Most of the countries have local taxes of less than 20% whereas Malaysia has an excise tax of 105%.

Crazy right? This results in the total end price not just doubling but for the Lexus model, coming up to almost triple of the price you would pay for it in Japan!

Affordable options

Honda Civic Sedan 1.5

Source: Honda Malaysia

| Country | Japan | Malaysia |

| Price of vehicle | RM90,786 | RM124,092 |

| Tax rate | 8% | 75% |

| Tax price | RM7,263 | RM93,070 |

| Total price | RM98,049 | RM217,160 |

Haval H2

Source: Haval

| Country | China | Malaysia |

| Price of vehicle | RM90,786 | RM81,814 |

| Tax rate | 7.5% | 75% |

| Tax price | RM4,617 | RM61,307 |

| Total price | RM95,403 | RM143,121 |

Volkswagen Golf TSI Comfortline

Source: Volkswagen

| Country | Germany | Malaysia |

| Price of vehicle | RM97,560 | RM149,888 |

| Tax rate | 19% | 75% |

| Tax price | RM18,536 | RM112,416 |

| Total price | RM116,096 | RM262,304 |

Summary

As compared to when you’re purchasing a luxury car, these cars are a bit more on the affordable side. With a tax rate of 75% though we’re still on the higher side when it comes to being taxed.

One interesting thing to note here is how the Haval H2 is actually cheaper here in Malaysia but because of the taxes, Malaysians still end up paying more than their Chinese counterparts. T_T

And there you have it! Never knew exactly how much tax you’re paying for an imported car do you! Well now you do!

Also read: 5 Important Things to Take Note Of If You Plan to Get a Secondhand Car in Malaysia