Buying your very first car can be scary as it might be the biggest purchase of your life to date. Though it might be fun to show off to everyone how much of an ‘adult’ you are, a car also comes with years of commitment and responsibility, which is why it’s so important to choose wisely before purchasing!

Want to know how to make a good decision before getting a car? Read on to find out five super crucial tips to estimate how much you can afford to dish out on a new ride:

1. Try and get approved for a loan first to set a budget

Most people would choose their dream car first before going to different banks to try and get a loan. However, if you want to be smart with your budget, you should go to the bank and get approved for a loan first before even choosing a car.

This way, not only can you set a budget limit for yourself from the start, but you can also get professional consultation (there’s no better source to get financial advice from than the bank!) to know your affordability rate based on your wage.

2. Make sure you maintain a good credit score before applying for a loan

In case you didn’t know, a credit score is a score given to you based on your credit history (including the level of debt, repayment history, etc.) which will depict your ‘creditworthiness’. Banks tend to look at your credit score to determine if you will pay back your loan on time. So basically, the higher the score, the better you will look as a borrower to potential lenders.

Most of the time, a good credit score will equal a better loan rate. This means that banks will apply a lower interest rate to your loan, which can open up more options for you to choose from! Other than paying off your hire purchase loan, you can also achieve a good credit score by getting a credit card and paying it off on time every month. Just remember not to overspend with that card though!

3. See if you can pay more than the minimum amount for the down payment

The minimum amount for down payments is usually 10% for new cars and 20% for used cars. And of course, there’s nothing wrong with it. But if you’re trying to look out for yourself in the long run, it would be ideal if you can afford to pay more than that.

This is because down payments are usually paid for by cash, which means most people would save up for their down payment before applying for a loan and getting a car. Instead of doing that, why not practice a little patience, accumulate your cash a bit more and dump a hefty down payment so you can enjoy a lesser monthly instalment and lower interest rates in the long run!

4. Make sure your monthly instalment doesn’t exceed 20% of your monthly salary

Once you’ve figured out your loan amount and the down payment, it’s time to calculate your monthly instalment. The general rule of thumb for this is to avoid paying more than 20% of your salary for your car. BTW, we’re talking about your pre-tax salary here!

So for example, if you’re earning RM3,500 per month, you should be paying not more than RM700 for your car monthly.

You don’t want to look like this at end of every month!

Of course, it’s possible to spend more but we don’t want to encourage spending your whole month’s salary on your car and not be left with anything for yourself or your savings.

(This is also why we advise that you pay more for the down payment!)

5. Factor in the after-sales expenses for the car

If you think buying a car and paying for it monthly is all there is to it, then we’re sorry to ruin your fantasy. Apart from the monthly loan payment for your car, there are also a variety of other after-sales expenses that come with owning one, such as:

- Road tax

- Yearly car insurance

- Maintenance services

- Car wash and paint jobs

Even this small thing will cost you quite a sum!

So before you go and drop all your life’s savings on that flashy new car, it’s best to just stick within your budget to save yourself your wallet from suffering.

With all these tips we just listed, you might be thinking “then what car choices are we even left with leh?” Actually, you can find many car brands offering attractive deals and promotions that will definitely lower the price tag of your dream car. In fact, you’re just in luck as Honda is actually having an amazing promotion now!

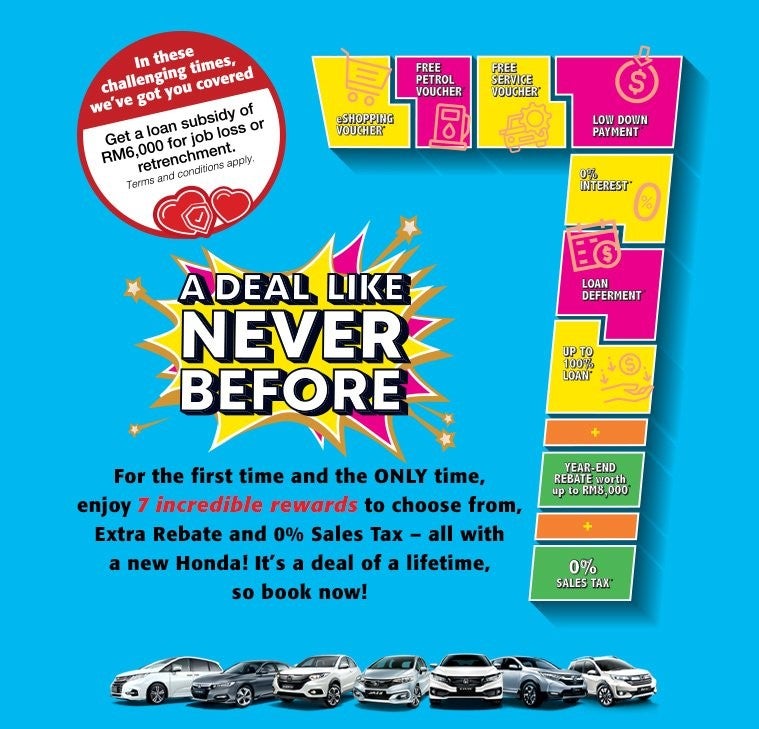

Honda is offering not one, not two but SEVEN remarkable rewards that you can choose from when you purchase a new Honda car from now until 30th November!

The seven rewards that you can choose from include:

- A Lazada e-shopping voucher worth up to RM3,000 with 6 months validity

- A free Petronas petrol voucher worth up to RM3,000 with 3 years validity

- A free car service voucher worth up to RM3,000 with 3 years validity and applicable at all Honda service centres

- Enjoy low down payment rates (the amount and percentage is subject to monthly model rebates)

- Enjoy 0% interest rate for the first 6 months of your loan instalment (T&C of respective banks apply)

- Enjoy loan deferment (T&C’s of respective banks apply)

- Get up to 100% loan (a working adult with no less than 6 months experience and a minimum salary of RM2,700)

Not only that, but you’ll also get to enjoy extra rebates and 0% sales tax. You tell me who else can give you a deal this good???

On top of these rewards, Honda is also offering a Special Care Package, where you can get a loan subsidy of RM6,000 if you’ve experienced job loss or retrenchment after purchasing a new Honda car.

Let’s imagine a situation: Stacy is a new owner of a Honda car and she suddenly loses her job due to MCO. She’s left with no income but still has to pay her car instalment worth RM1,000 per month. With this Special Care Package, she can utilise RM1,000 monthly to cover herself for the next six months!

With all these rewards and rebates, you can really enjoy mega savings and who knows, you could even get your dream car for practically a steal! But as we mentioned, this deal will only be available from now until 30th November 2020 so hurry, guys! For more information on these amazing rewards or how to get in touch with Honda, visit their website here.

Which of these amazing deals would you choose? Tell us below!