In Malaysia, saving money has become increasingly crucial in light of the current economic situation. With inflation rates rising and economic uncertainties prevailing, prudent financial management is essential for individuals and households.

By cultivating a habit of saving, Malaysians can build a financial buffer against unexpected expenses and future economic downturns. So here’s a list of ways you can save your money (which you may not even know about)!

1. Check the bank’s interest rate in DETAIL

Most of us would just open a savings account in a bank we’re most familiar with, or our parents would deem ‘the best’.

However, most savings accounts only offer typically 0.05% to 0.25% interest rate per annum, and it differs from bank to bank.

So before opening your account, check each bank’s rates and the types of products on offer to get the best bang for your buck.

For example:

- Maybank’s Basic Savings account – 0.25%

- MBSB’s Cash Rich Savings account – 1.85%

If you did not pick the second account, that’s 1.6% of interest you’re losing out!

2. Store your savings into Fixed Deposits

Consider putting your savings into fixed deposits for higher interest rates, especially if you don’t plan on withdrawing them. While flexibility is attractive, sticking to fixed deposits can yield better returns.

Fixed deposit interest rates differ from bank to bank.

For example, here are some standard rates for 12 months maturity:

- Maybank: 2.8% p.a.

- Public Bank: 3.1 p.a.

- CIMB: 3.1% p.a.

Tip: Actively look out for fixed deposit promotions which may offer higher rates for a limited time only.

For example: CIMB currently has a promo for a 3.9% p.a. interest rate. If you have RM10,000 in savings, here’s the difference in cash that you get back each year:

- Savings account with 1.85% – RM185 per year

- Fixed deposit with CIMB’s 3.9% – RM390 per year

That’s a RM205 difference! And this would get only exponentially bigger as you add more savings into your FD.

3. Diversify through investments

Investments come with varying risk profiles, from conservative to moderate to aggressive. Based on your appetite for risk, you can try out different types of investments.

Conservative investments: Bonds or unit trusts that ensure ‘principal protection’ – This means you will not lose the amount you invested.

High-risk investments: Forex, stock purchases, and riskier unit trusts which project higher returns. But of course, with the expectation of high returns comes the possibility of losing a lot of money as well.

At the end of the day, the idea is: Diversifying into investments with higher returns than your standard fixed deposit rates will help you hedge against yearly inflation.

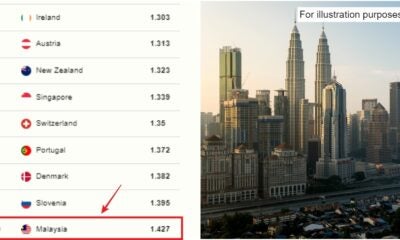

4. Invest into a stable currency

Unfortunately, Malaysian currency isn’t as stable as some others. So, if you have additional savings, you can actually buy some USD, SGD, or EUR to keep. These currencies are considered ‘stable’ and are projected to only continue to increase in value over a long period of time, from observing their track record of the past 20 years. So, as these currencies grow over the years, you’re less likely to lose out on value due to currency exchange or due to a weakening Ringgit.

5. Spend less and save up because money makes more money

Getting to grow up and getting your big paycheck monthly can definitely make us all want to spend it IMMEDIATELY. Part of adulting is to get a car and a house right? Well, if you want to avoid taking additional loans and having monthly instalments, it’s better to save!

With Malaysia having tons of public transport, why waste money on buying a car whose value WILL depreciate over the years? And all those added expenses – Car insurance, servicing, petrol money, monthly loan payments.

Compare the price of housing you’re buying VS to rent. If renting is cheaper, don’t tie yourself down to mortgage payments yet until you’re financially stable. Saving money can indirectly help you make more money by providing financial stability and opportunities for investment.

Now that you know these tips, will you be trying any of them? Let us know in the comments!

© IRL

Read More: “YOLO or save money?” – 21yo M’sian Student Buys House With RM500K Savings by Not Going Out