The National Higher Education Fund Corporation (PTPTN) is looking into stopping funding for university courses where student repayment rates are under 30%.

PTPTN is exploring ways to work with universities to encourage borrowers to repay their loans, one of which is continuing to fund courses with a high repayment rate.

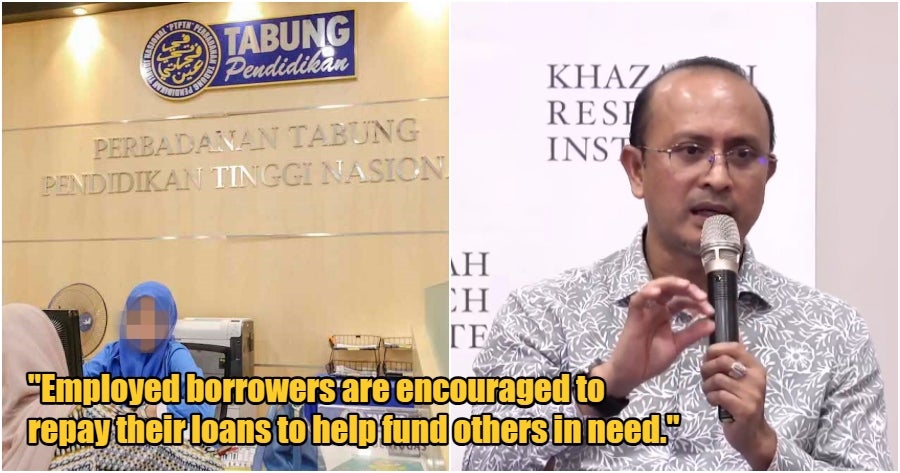

For illustration purposes only

“Those who are employed are encouraged to repay their loans”

During a webinar by Khazanah Research Institute, PTPTN CEO Ahmad Dasuki Abdul Majid revealed how PTPTN might consider stopping funding for courses in certain universities where loan repayment rates are below 30%.

“Our approach is based on a repayment model. We encourage those who are employed to repay their loans, so we can use that money to help others who need loans,” he said.

He mentioned that they’re trying to work with universities to make this happen.

He also shared that PTPTN was set up to help students with good SPM results continue their higher education at public or private institutions.

Low minimum wages are a concern

The Head of the Research and Development Department at AKPK, Mohammad Mafrukhin Mokhtar, also addressed the debt-to-income ratio, agreeing that low minimum wages are a concern.

“The salary gap in terms of programmes is also different. Let’s say they graduate from an arts or human science programme, (the salary) might be around RM2,000. But if we look at the medical field, it could be around RM6,000.”

With that said, however, Mafrukhin highlights that while it cannot be denied that salary is important, a high salary doesn’t necessarily point to overall well-being because it boils down to an individual’s financial behaviour. All in all, AKPK advocates for a responsible attitude toward debt repayment and spending habits.

RM2.7 million in loans have not been repaid

As of September, Ahmad Dasuki said the fund has handed out RM74 billion in loans.

In a reply to parliament earlier this week, Higher Education Minister Datuk Seri Dr Zambry Abdul Kadir shared that PTPTN has approved a total of 3,951,404 loans, amounting to RM71 billion by the end of last year.

Over 2.7 million loans haven’t been repaid, totalling RM32 billion still outstanding.

Zambry also mentioned that 2.8 million loans (72%) went to Bumiputera students, while 1.1 million loans (28%) were given to non-Bumiputera students.

What are your thoughts on this? Let us know down in the comments below!

Also read: Government Says Cancellation of PTPTN Debt for Underprivileged M’sians May Not Happen