In 2022, over 287,000 Malaysians were declared bankrupt, with most of them being young adults. In a span of 2 years, have we improved in terms of financial literacy?

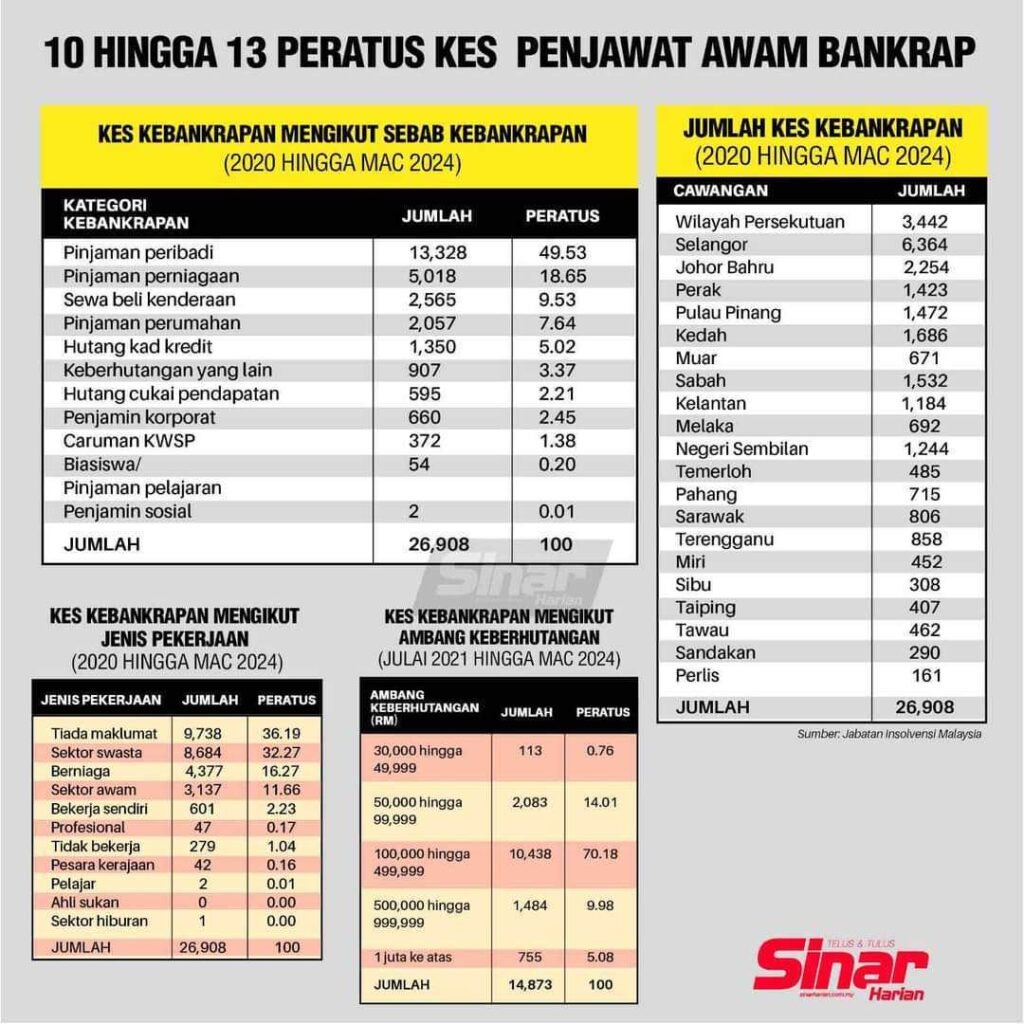

According to the latest data from the Malaysian Insolvency Department, some of us are still trapped in the cycle of unwise financial management. As of March this year, most civil servants were declared bankrupt due to personal loans, with 13,328 of them suffering the consequences of the loan, followed by business loans, which affected 5,018 of them.

For illustration purposes only

The data shows an increasing trend in bankruptcy, with the percentage of bankruptcy among civil servants in 2020 being 12% and decreasing to 10% in 2021. It rose again to 11% in 2022 and 13% in 2023.

The state that records the most bankruptcies is Selangor, with a total of 6,364 as of March this year, followed by the Federal Territory which records a total of 3,442 bankruptcies.

For illustration purposes only

According to data collected from July 2021 to March 2024, over 5% of civil servants faced bankruptcies exceeding RM1 million. Most civil servants (70.18%) who were declared bankrupt suffered a loss between RM100,000 and RM499,999.

You can refer to the data that was shared by Sinar Harian below, and the complete statistics on the official website of the Malaysian Insolvency Department.

In a statement, the director-general of the Malaysian Insolvency Department (Mdl), Datuk M Bakri Abd Majid said disciplinary action can be taken due to serious indebtedness, in addition to tarnishing the image of the public service.

“The department heads should monitor the level of indebtedness of officers under their respective supervision and be sensitive to changes in their behavior,” Bakri added.

What do you think of the bankruptcy among Malaysians?