If you don’t have a car, then relying on public transport or your friends’ kindness to ferry you around is already a way of life. Plus, ride-hailing apps have been getting popular all over the world since it provides a convenient way for us to get from point A to B.

Source: bbc

However, if you are a frequent user, then you should probably take a second look at your transactions. According to CNA, there appears to be some fraudulent issues with Uber in Singapore as a few users have reported that they were being charged for rides they never took. That’s scary!

These users said that they were charged for “phantom rides” that often took place in faraway locations and they were usually charged on the credit or debit cards they had registered into the app. These charges that appeared in their transactions were usually in foreign currencies such as US dollars, euros and British pounds.

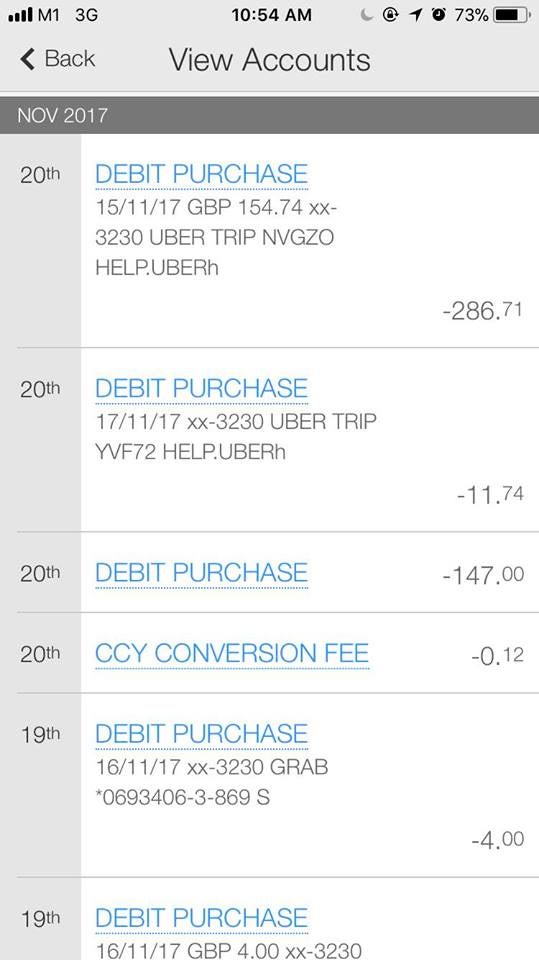

Source: facebook

One of the victims, Daphne Maia Loo, shared her complaint on Facebook when she posted a screenshot of her bank account with several transactions from Uber, where one was as much as S$286 (RM870). She explained that she had linked her debit card to her Uber account and noticed something wasn’t right when her balance didn’t add up.

Upon checking, she discovered several strange Uber transactions in her OCBC debit card. She immediately informed Uber, who said that they would reverse all the charges but needed Loo to submit a fraud claim for every unauthorised transaction with her bank.

Source: adweek

Currently, she has about 15 of these fraud transactions but there are still several pending transactions she has not received yet. She said, “I’m pretty sure I will get my money back (most of it anyway), as there will be a few dollars lost during currency conversions but I’m willing to let it slide.”

“All the bookings for Uber charged on my card were not made from my Uber app as I did not receive any billing notifications from Uber via the app or email. My card was used on someone else’s Uber app – someone based in UK – as the charges were in GBP,” she added.

Source: uber manila

Uber said that they have since blocked the account that was using her card details to pay for rides. Loo is not the only victim that has had their card details stolen. Another Uber user was shocked when she discovered over 30 transactions amounting to S$1,300 (RM3,970) on her DBS Bank card.

Uber is currently reviewing her case and will be issuing a refund but she said that she will only be paying in cash from now on. A media coordinator had also fallen victim to this identity theft, when her Citibank credit card was charged with S$92 (RM280) in euro and Canadian dollars for Uber rides.

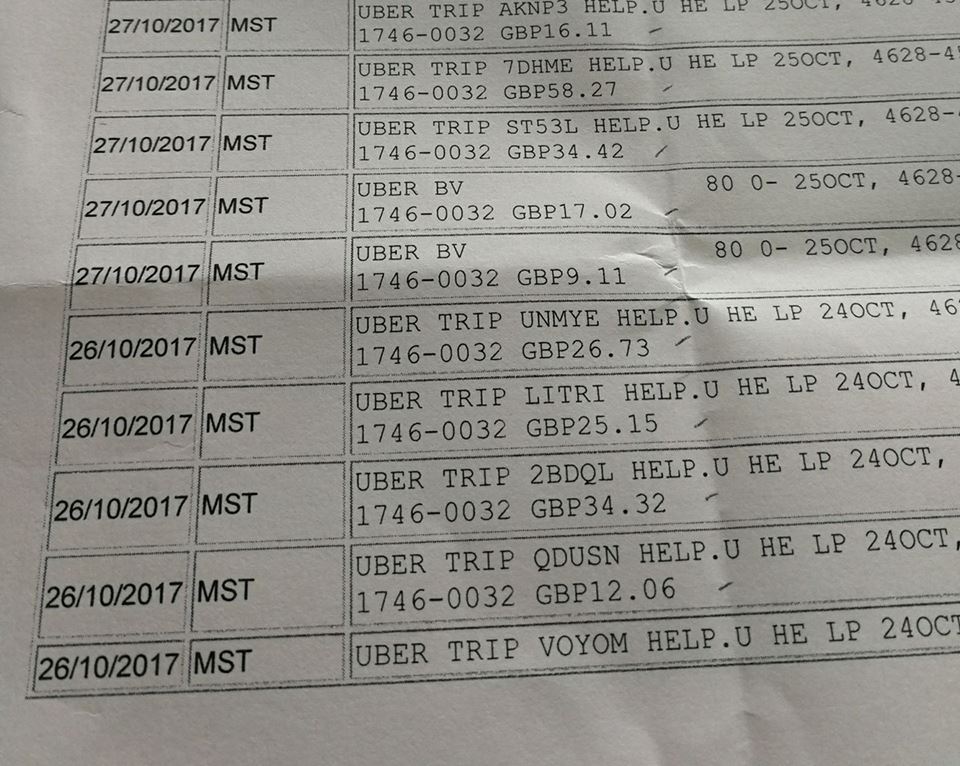

Source: facebook

However, perhaps Richard Toh is one of the biggest victims as he was charged more than S$4,000 (RM12,222) on his DBS credit card for over 75 transactions on Uber and Nintendo Europe. That’s a whole lotta money! In his November 3 post, he also said, “While at DBS Bank this morning to file a report, two other customers were there with the same problem within a span of 10 minutes. I can only imagine how widespread this problem may be. How many DBS customers are affected?”

Well, something should definitely be done to stop these identity thefts from happening as it looks like it is not the first time this incident has occurred. Uber Singapore said that they are currently investigating this issue.

Source: all singapore stuff

“We would like to assure the public that payment information is encrypted when you enter it into the Uber app. However, there are myriad reasons why such incidents occur – including whether the user is maintaining good habits in safeguarding personal information security, whether the device has been compromised, or even issues with the financial institution and its products.”

Uber promises to work with the bank to refund the charges and advises users to lodge a report with their bank and Uber immediately.

Although there are currently no reports of this happening in Malaysia, always be vigilant and check your transactions every now and then!

Also read: Your Selfies Online May Be Stolen to Scam Netizens into Buying Sex Services, Here’s Why