The government made available flexible withdrawals for KWSP contributors, known as the Flexible Account, or Account 3, which came into effect last year.

However, many contributors withdraw from Account 3 to support their luxury lifestyles and not for emergency use.

Tasek Gelugor Member of Parliament Datuk Wan Saiful Wan Jan, recently expressed his opinion on the need to review the effectiveness of implementing the Flexible Account or Account 3 of the Employees Provident Fund (EPF). According to him, the government’s action to create a Flexible Account or Account 3 is ineffective.

“Many who take out this Account 3 are not from the poor, but rather to finance unnecessary luxury activities.”

“This means that the government’s policy to create Account 3 has not been successful, not effective. What should be done is to create a targeted withdrawal policy,” Wan Saiful said during the recent Parliament session.

Wan Saiful said he had met contributors who showed millions of Ringgit in their EPF accounts.

“One person has RM1.3 million and the other has RM1.8 million in their accounts. But the one with RM1.3 million works as a dishwasher and the other is hospitalised, unable to pay the bills.”

Wan Saiful highlighted the importance of savings for old age and said it’s tough to save up until later because of today’s high living costs. He suggested the government enforce targeted withdrawals and not the existing flexible withdrawals.

“The house has to be auctioned. Some cannot afford to pay the bills, some have to borrow from the loan sharks.”

“They need help today, not waiting until they are 50 or 55 years old to withdraw EPF money. How fair is it if we force them to apply for living expenses assistance (Bantuan Sara Hidup), ” he said.

What do you think of the enforcement of the Flexible Account?

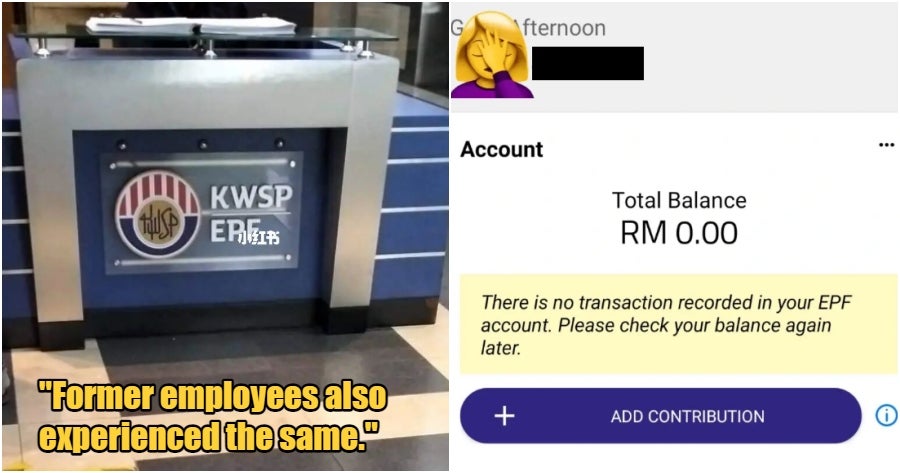

Also read: M’sian Company Skips EPF Payment For Months, Employees Report & KWSP Officers Come Knocking