As part of Malaysia’s commitment to promote the use of low-carbon transport and support the development of the electric vehicle (EV) industry, customers can enjoy import duty and excise relief for new registrations of Tesla zero-emission EVs that are fully imported (CBU) and also the abolition of 100% of road tax.

Tesla owners can also claim income tax relief of up to RM2,500 for expenses related to the cost of installation, rental and purchase, including equipment or subscription fees for EV chargers for the assessment year of 2023.

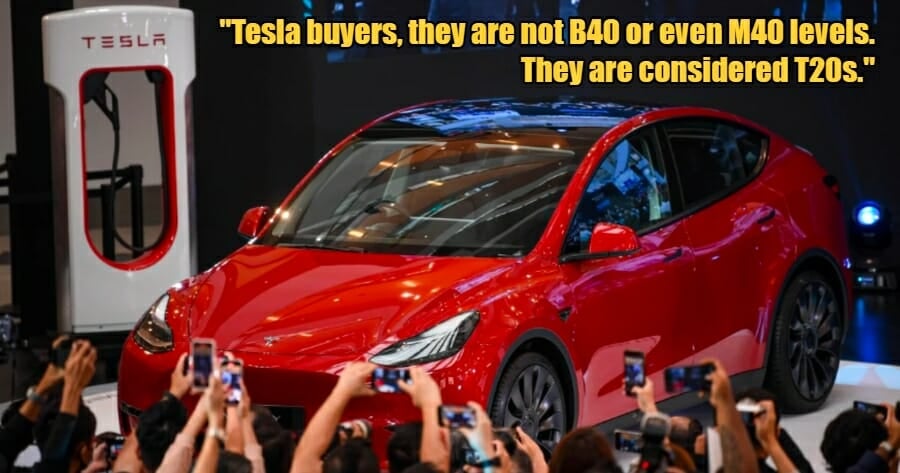

Though, there is now a debate online on this as many believe that only those from the T20 community can afford Teslas and that they should be taxed. Among those who believe this is the Ahmad Muslim Badawi Badawi Facebook page.

They wrote, “I don’t care about the incentives to attract investors, but for me, Tesla buyers, they are not B40 or even M40 levels. They are considered T20s. For me, the government should not ignore the taxes that need to be charged.”

“It’s not fair for those who buy Myvi or buy a Rahmah Axia among the B40s, it should these brands that are considered a luxury, the government has the right to tax the rich and distribute it to the needs of the underprivileged who purchase Axias and Myvis.”

It is important to note that the cheapest Tesla is priced at RM199,000.

Netizens were split on this opinion as some agreed with them while others didn’t.

“I agree (to tax Tesla purchases).”

“On the justification of going green and environmentally friendly, the rich are getting richer.”

“There is a long term benefit which is that the environment will be cleaner and healthier.”

“Is the income tax of the T20 community not enough? If this is the opinion of B40s and M40s, that’s enough, work on yourselves.”

We can see where both sides are coming from in this debate, so we want to hear your opinion on this.

Do feel free to share your thoughts in the comment section.

Also read: Journalists Conduct Undercover Investigation to Prove M’sian Vape Stores Sell to Minors