As March comes to a close, companies and individuals get ready for tax season in Malaysia. Now, every individual in Malaysia who is liable is required to declare their income to the Inland Revenue Board of Malaysia (LHDN) annually. During this period, many people will scramble to find the receipts of the items they purchased last year so that they can minimise the amount of tax they have to pay.

Source: azmy kelana jaya

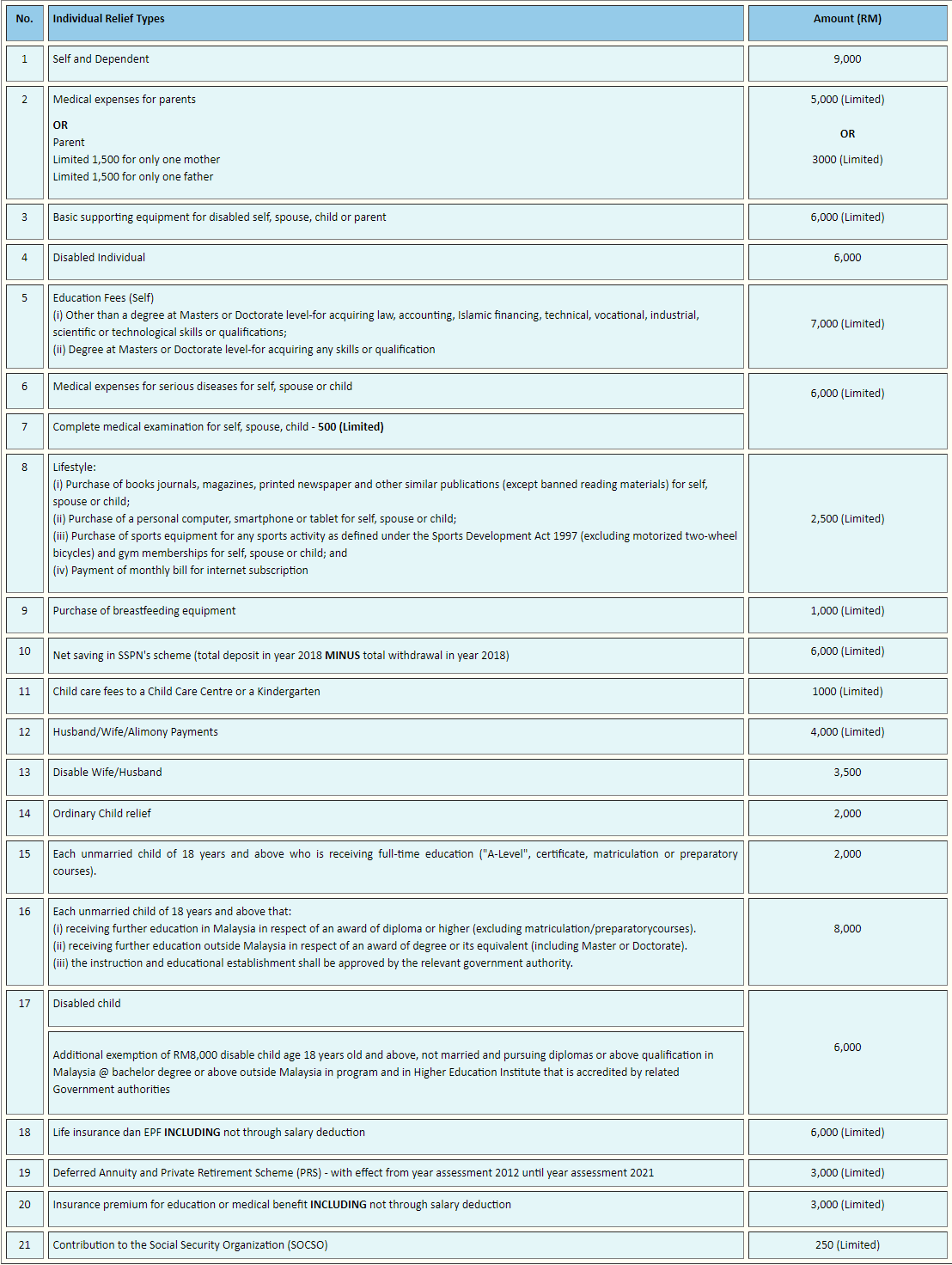

This year, there are 21 tax reliefs available for us to take advantage of.

Yay, can save money!

It’s really simple too, all you need to do is key in the relevant claims when you are doing your e-Filing and the system will calculate it for you.

This is the full list of tax reliefs that you can claim, so make sure you utilise it!

Source: lhdn

Here are some of the more common reliefs that you likely don’t wanna miss out:

1. Parents

Source: istock photo

There are actually two amounts you can claim for your parents; one of them is medical expenses which can go up to RM5,000 for both parents while another one is only set at RM1,500 per parent which amounts to a total of RM3,000. So, if your parents are healthy and strong (thank God!), then you should use the RM1,500 each instead when filling in your form!

Claim up to: RM5,000

2. Education fees (self)

Source: post grad study malaysia

You can make use of this if you are pursuing a Certificate/Diploma/Bachelor’s Degree in Law, Accounting, Islamic financing, Technical, Vocational, Industrial, Scientific or Technological skills or qualifications. Other tertiary education that is eligible includes any course of study for a Masters or Doctorate degree.

Claim up to: RM7,000

3. Complete medical examination for self, spouse, child

Source: kabar medan

This amount can be claimed when you undergo a thorough medical examination for yourself, your husband/wife or your child.

Claim up to: RM500

4. Lifestyle

Source: mmo

Now, this tax relief is probably one that we would use the most. Under this category, items that are applicable include books, magazines, printed newspapers, purchase of personal computer, smartphone or tablet, buying sports equipment or gym memberships and your monthly internet subscription. Wow, sounds like a lot of stuff! So do dig out your receipts!

Claim up to: RM2,500

5. Net saving in Skim Simpanan Pendidikan Nasional’s (SSPN) scheme

Source: tootify

If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well! However, any amount that is withdrawn after your first deposit in 2018 is not counted. It should be calculated as the total deposit in the year 2018 MINUS total withdrawal in the year 2018.

Claim up to: RM6,000

6. Life insurance and EPF INCLUDING not through salary deduction

Source: economic times

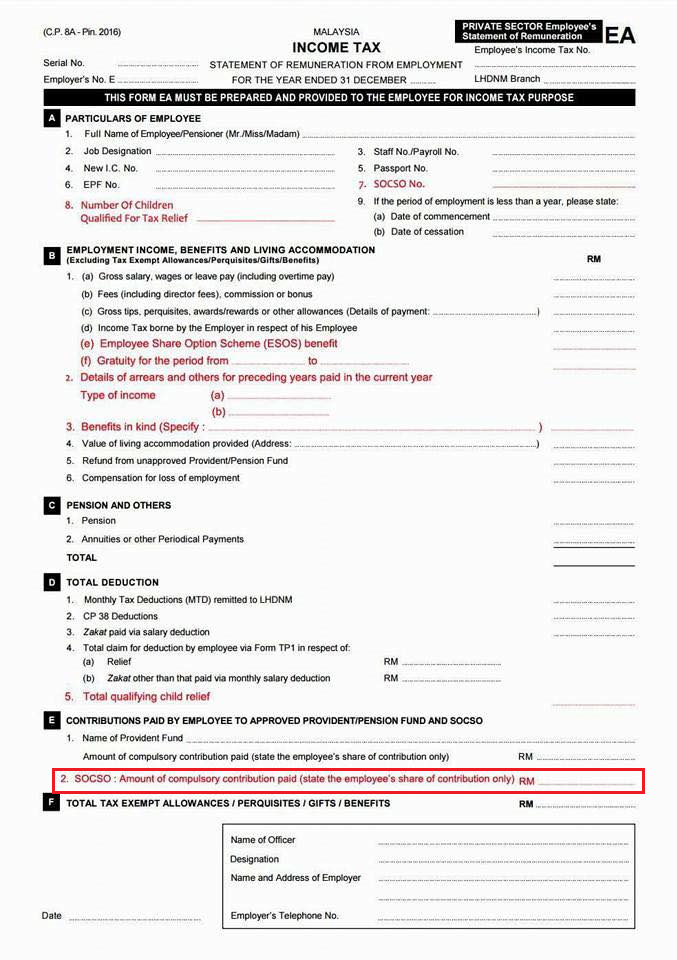

Most of us have some sort of life insurance in place and this is where you key in your reliefs. Calculate the sum of your life insurance premium plus the total EPF contributions (Hint: Look at your EA form) you have paid in 2018 for the grand total.

Claim up to: RM6,000

7. Deferred Annuity and Private Retirement Scheme (PRS)

Source: mmo

Similar to the above, you will also need to calculate the total you have paid for PRS and the premiums for any deferred annuities as well.

Claim up to: RM3,000

8. Insurance premium for education or medical benefit INCLUDING not through salary deduction

Source: great eastern life

Don’t forget to claim the tax reliefs for your education and medical insurance as well! Yes, it’s different from life insurance.

Claim up to: RM3,000

9. Contribution to the Social Security Organization (SOCSO)

Source: facebook

Now, you need your EA form to fill in your e-BE form and you will find a category which mentions your SOCSO contributions. Key in the amount stated there to get your tax relief.

Claim up to: RM250

BONUS: Tabung Harapan donations

Source: kosmo

Did you know that if you had donated money to Tabung Harapan then you are entitled for tax relief as well? Based on a press release by Finance Minister, Lim Guan Eng, he said that this amount is eligible for a tax deduction. Under Subsection 44 (6) of the Income Tax Act 1967, he said that whoever that donates to Tabung Harapan should keep the receipts as they can get a tax benefit dollar for dollar with no cap, so make sure you claim it!

Remember to file your income tax before the due date on 30 April 2019! Although the deadline would usually be extended to 15 May 2019, it’s better to just submit it and get it done as soon as you can!

Also read: Never Filed Income Tax Before? Here’s a Simple Guide on How to Do It Online!