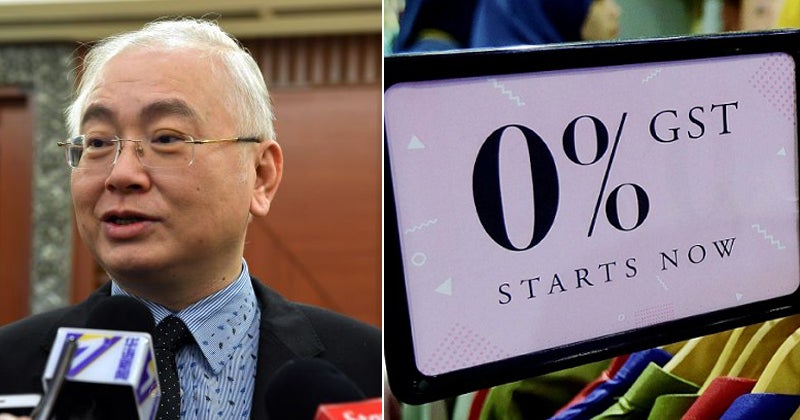

Pakatan Harapan’s (PH) government promise to abolish the Goods and Services Tax (GST) was realised as Parliament passed the Service Tax Bill 2018 and the GST (Repeal) Bill 2018 on Wednesday (Aug 8).

However, Datuk Seri Dr Wee Ka Siong, Deputy President of the Malaysian Chinese Association (MCA), has urged the government to study the effects of a lower GST rate before abolishing it entirely, as reported by The Star.

Source: the star

Wee suggested that a parliamentary select committee should be formed to look into the effects of implementing a 3% GST during the transition period of replacing GST with the Sales and Services Tax (SST).

“During this period of transition, we should set the GST rate at maybe 3%, and we collect it until the end of the year.”

“We may take about three to four months to conduct the study with members of both political sides, and finally we can achieve a consensus,” he said, adding that this is to alleviate the burden of the people.

Source: fmt

The Ayer Hitam MP also questioned the effectiveness of SST to lower the cost of living in Malaysia. He gave an example, where he said that he would be forced to pay a 16% tax rate for changing car tyres at a service centre.

He further claimed that under the SST regime, it would be easier to evade taxes through “legal” methods by setting up subsidiary companies.

What do you think about a 3% GST rate? Share your opinions with us in the comments below!

Also read: LGE: Shocked That BN Govt Allegedly Stole RM18 Billion GST Funds to Be Spent Freely