It’s no secret that the rising costs of living are affecting all of us and how much we save, especially for those from low-income households. Malaysians’ spending habits have been closely monitored by economists since the early 90s, and a lot of changes in the way we spend money have happened in just the past two decades.

Source: the star

Now, according to Khazanah Research Institute’s (KRI) recent study entitled “The State of Households 2018: Different Realities”, a number of alarming statistics about Malaysian household incomes have been discovered. Here are just some of the study’s findings;

- In 2016, households from a majority of districts earned less than Malaysia’s national median household income (RM5,228).

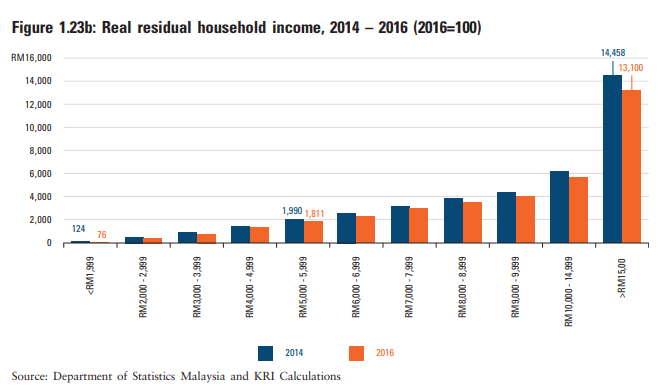

- Households earning around the median household income had around RM1,811 left over in 2016, while in 2014, these households had RM1,990 left over.

- In greater KL, the average household income level is almost double than that of the rest of Malaysia.

- Households earning below RM2,000 only have RM76 left over after household expenses are deducted. This amount is less than in 2014, which saw these households having RM124 left over instead.

- From 2014 to 2016, households earning below RM5,000 have been cutting back on consuming food, although they have been spending more money on it due to high food inflation.

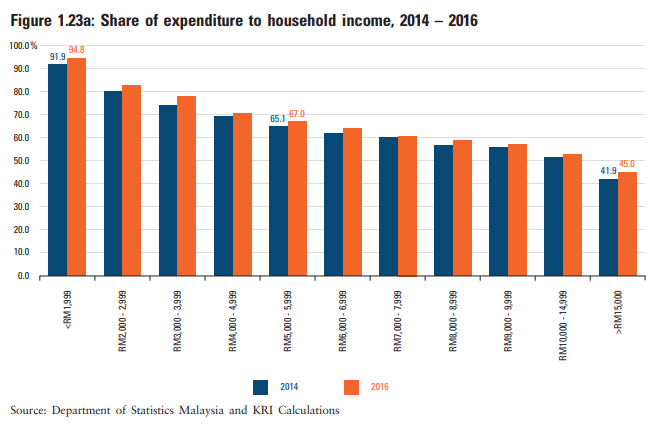

- From 2014 to 2016, the residual household income has reduced for all income classes, while the share of household expenditure per household income has increased for all income levels.

Source: khazanah research institute

Source: khazanah research institute

The study highlighted the alarming situation most households from the Bottom 40 per cent (B40) were going through, pointing out that they could be potentially vulnerable to economic shocks or emergencies.

Overall, the study appears to show the effects of rising costs of living and changes in lifestyle on Malaysians’ spending patterns.

Read KRI’s entire report here!

Also read: Young M’sians Advised to Buy ‘Second-Hand’ Houses Because They’re Cheaper