Do we live only to work and pay bills? If we’re well equipped with financial literacy and earn a good figure every month, hopefully, that’s not the case. Unfortunately, some people only earn so much and struggle to make end meets at the end of every month.

In a viral X post, a Malaysian man shared the unfortunate circumstances of his friend who had no choice but to work 3 jobs at once just to support himself. He gets RM3,500 from his main income, but once his pay is deposited monthly, RM1,000 will flow out immediately.

For illustration purposes only

He has to pay for his house loan every month with that amount.

“Other than his primary job, he’s involved in the dropship business and works part-time as an e-hailing driver.”

The man also said that his friend had just obtained the key to his house not long ago, and what was supposed to be a shelter became an immediate (and unexpected burden).

For illustration purposes only

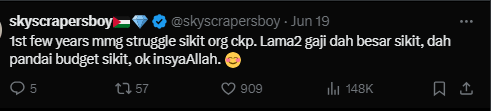

“His life gets messed up financially after he bought the house. I see him struggling every month, despite working 3 different jobs to support himself.”

In his tweet, the man also mentioned that his friend is well aware of his tweet, which has gone viral, but fortunately, he’s still surviving despite the hardships.

“He also thanked everyone for the support and advice here.”

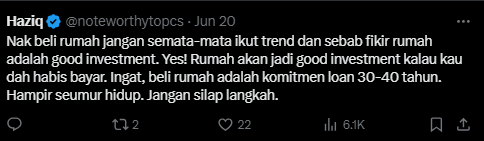

Social media users took the opportunity to support the struggling man and convince him that, in time, things would get better.

“You’ll struggle for the 1st few years. When you earn more and are good at budgeting, it’ll be better.”

“It’s important not to follow trends just because you think buying a house is a good investment. Yes, IF you have settled the loan, which involved up to 30 – 40 years of commitment. Don’t make the wrong move,” said a user.

To those with assets, how do you plan your finances monthly?