After going through MCO, Malaysians have realised just how important it is to have sufficient savings. This is why a lot of us are finally looking into different ways to grow our funds. However, it’s also normal for first-time investors to find the whole process to be a bit daunting. Well, if this sounds like you, make sure to read on as we dive into some of Malaysians’ most common concerns about investments:

1. “How do I save faster but not get locked in like with Fixed Deposits?”

Fixed Deposit (FD) is a great low-risk option for newcomers. However, it is more apt for long-term savings because:

- It comes with a tenure so you won’t be able to touch your money for a certain period of time.

- If you do need to withdraw for emergencies, you’d have to pay a penalty or lose all the interest you accumulated.

- This also means you’d have to make sure you have extra savings in hand to avoid early withdrawals.

If you’re looking for something with more liquidity, you can opt for a Money Market Fund (MMF), another low-risk investment that has potentially higher interest rates as compared to FDs since the interest rate is calculated daily. Users can also choose to withdraw their money anytime without having to pay a penalty. This way, you’re free to make on-the-spot decisions with your cash.

2. “I want to invest but it seems complicated and I don’t have the time to plan”

Trying to invest with zero background knowledge is a recipe for disaster. Especially when you have to learn all the financial jargon, figure out tenures and so many more. One thing that can help you is by choosing an asset allocation strategy:

- An asset allocation strategy in investment is a strategy to balance risk and reward, especially when you plan to divide your funds into different categories. This way, you won’t end up losing all your money by ‘putting all your eggs in one basket’.

- For example, you can put a portion of your money in an FD so that you know you won’t be tempted to use it, and save the rest of your funds in an MMF account where it is more liquid.

The good thing about MMF is that, since it doesn’t have tenure, you can treat it like a normal savings account while also reaping the benefits of an investment by earning daily interest. Plus, the beginner-friendly onboarding process can be done within minutes online. Cool, right?

3. “I can’t afford the minimum Fixed Deposit amount of RM5,000”

Yes, there is a minimum deposit amount required for FD accounts. While the rates may vary, the average is around RM5,000 for a one-month tenure and RM1,000 for two months and above. So, if you’re interested in opening an FD account, we’d recommend taking a longer tenure and opting for the RM1,000 deposit. Though it means you’d make a longer commitment, it can also reward you with higher interests in the long run.

However, if you can’t afford the deposit amount due to high commitments, try checking out MMF where you can start saving up with a minimum deposit of only RM1. You might be thinking, “is that even possible?” Back in the day, it wasn’t and would require a RM10,000 deposit, minimum. But thanks to the advancement of Fintech, MMF has become a lot more accessible today.

4. “I’m scared of losing all my hard-earned money!”

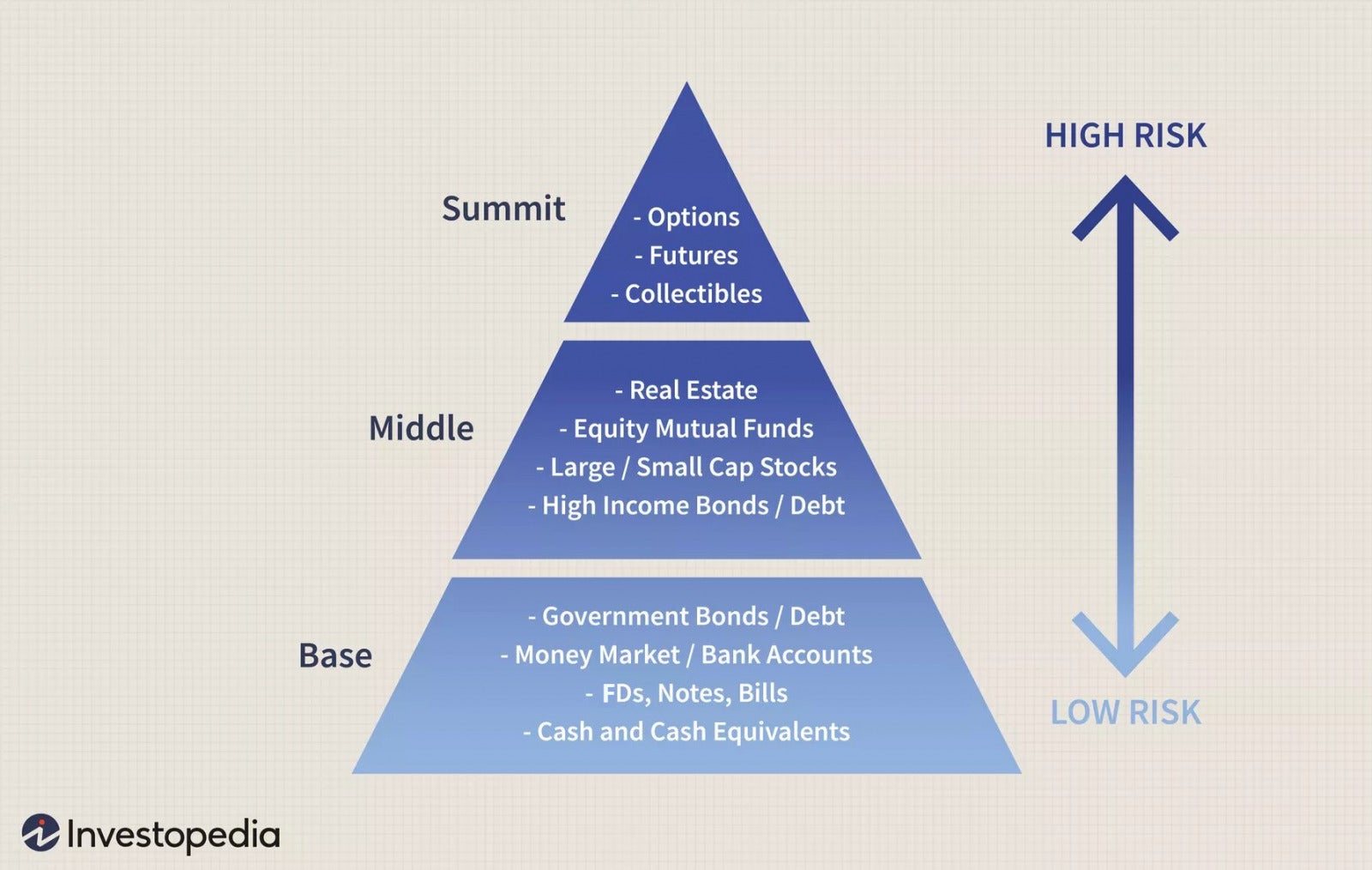

It’s very easy to be intimidated by the concept of investing, especially due to the stigma around it. This is why, before you jump into any investment, you’d first need to determine your risk appetite.

The scale goes from being conservative (only interested in low-risk investment) to highly aggressive (willing to take high-risk investment). Some factors to determine this include:

- Time horizon: How long do you want to invest? Is it long-term or do you need to maximise your rewards in a year so you can get married or buy a house?

- Bankroll: How much money can you lose? Do you have a lot of other commitments to fulfil?

Once you know where you stand on the risk scale, you can approach your investment based on this:

If you consider yourself as risk-averse, we’d recommend sticking to low-risk investments such as Fixed Deposits or Money Market Funds just to be safe. Try to avoid high-risk investments that are extremely volatile such as:

- Crypto

- Stocks

- Foreign Exchange

5. “Are Fixed Deposits the only low-risk investment available?”

If you think FD might not be the right fit for you, you can try its alternative which is MMF. If you’re unsure where to begin, why not check out this new app called Versa!

Versa is a digital money management platform that lets you earn interest rates on par with Fixed Deposits but with more liquidity and no lock in periods!

Yes, it’s basically like Fixed Deposits but better! Here’s all you need to know about Versa and its perks:

- The minimum deposit amount starts from only RM1.

- The interest rate is counted daily and you can earn up to 2.4% per annum.

- There is no lock-in period and you can withdraw your savings with a 1-day withdrawal notice with no penalty.

- You will have high liquidity like a Savings Account and earn interest that is on par with a Fixed Deposit account.

Can I really earn a potentially higher interest rate than a Fixed Deposit account?

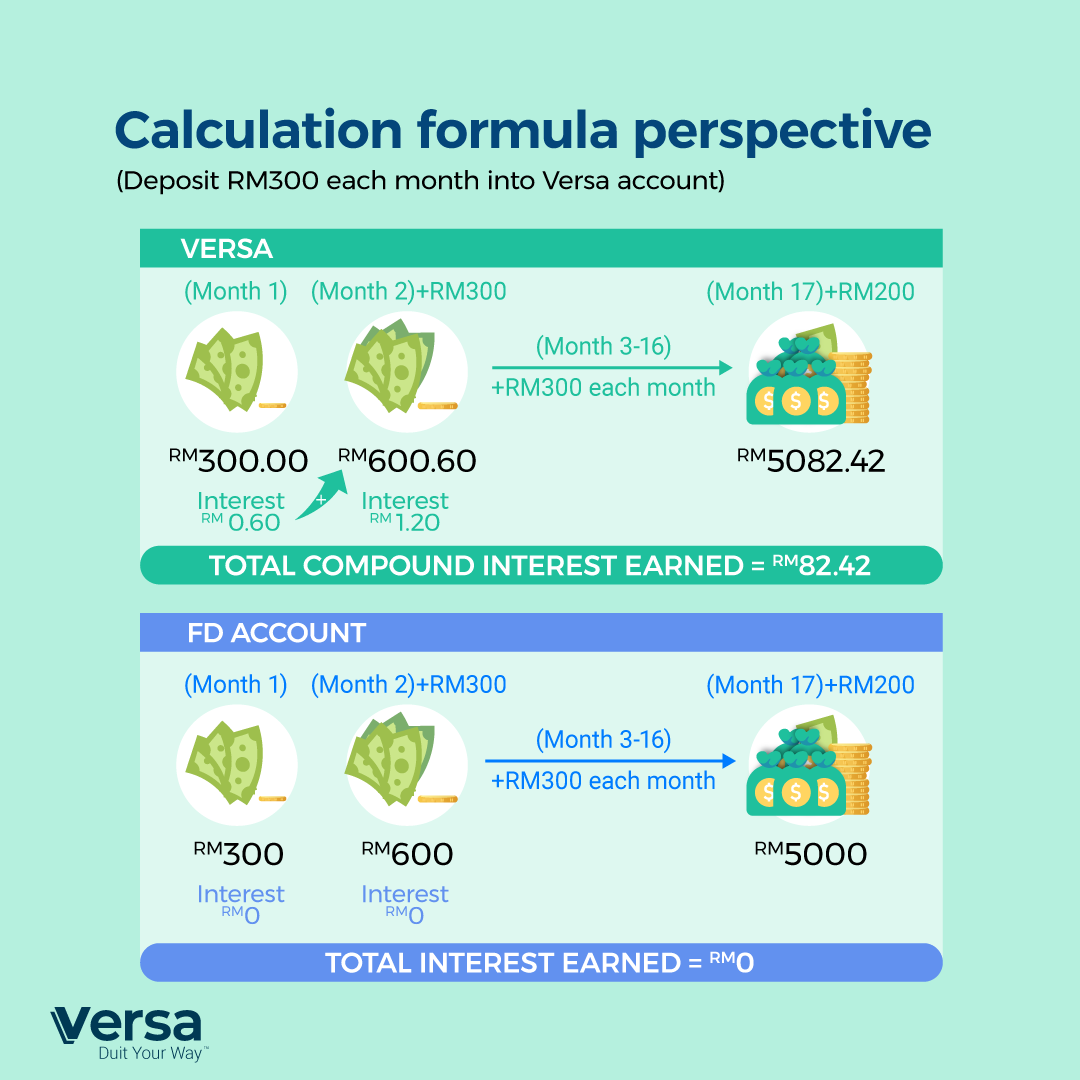

Well, we’ve calculated the numbers for you and it’s true! Here’s a breakdown:

Situation: You want to save up RM5,000 emergency fund but can only afford to save RM300 per month due to commitments.

- With Versa, there is no minimum deposit required so you can start earning interest with your savings from day 1. After 17 months, you’d already achieve your RM5,000 goal while earning over RM80 in accumulated interest.

- With Fixed Deposits, after 17 months, you’d also achieve your RM5,000 goal but due to the RM5,000 minimum deposit, you can only start earning interest AFTER that 17th month.

This makes Versa a great option if you’re looking for a short-term investment but would like to maximise your reward. And BTW, Versa is licensed under Securities Commission Malaysia which means you can save with no worries.

Sounds great! How do I sign up?

Easy! After you have downloaded the app and successfully registered an account with your email, you can start your onboarding process with 3 simple steps:

View this post on Instagram

- Verify your account by taking a clear photo of your MyKad.

- Next, verify your identity by taking a selfie of yourself. (Make sure you’re not wearing a cap or glasses)

- Key in some required information such as personal details, employment details, and more and you’re done!

At this point, just wait for Versa to verify your account and then start depositing your savings to see your money grow. Simple, right?

On top of that, we have more good news…

Versa has also just launched their #DuitTogether referral programme where you and your friend can both get a RM10* reward in your Versa accounts!

*Terms & conditions apply.

All you have to do to enjoy this referral programme is:

- Refer a friend to sign up with Versa using your referral code.

- Your friend needs to successfully register and make the first minimum deposit of RM100 into their Versa account in a single transaction.

- You and your friend will both get to enjoy the RM10 reward in the form of units in your Versa accounts!

Easy peasy! There’s also no limit to the number of people you can refer so you can start sharing Versa with your parents, uncles, aunties, friends, colleagues and everyone lah! Good things must be shared and this time, you’re being rewarded for it!

So, come on guys! It’s about time we all start saving smartly and be more financially responsible especially during these trying times. For more information on Versa or the #DuitTogether programme, head to their website here. Don’t forget to also download their app here to start your saving journey!

P/S: With any investment, there is no such thing as being completely risk-free. While Versa is considered a low-risk investment, please remember to always manage your finances responsibly and make smart decisions, okay!

Do you have any concerns about investing you’d like to voice out? Share with us below!