Finance Minister Tengku Datuk Seri Zafrul Aziz has urged financial institutions to waive accrued interest on hire purchase customers or profit on fixed-rate Islamic financing loans customers during the six-month moratorium period.

The move which came after an upsurge of demands from members of the public, Tengku Zafrul added that there were some financial institutions offering loan moratorium without charging accrued interest or compounded interest on the loans.

Speaking to The Star, Tengku Zafrul said “There is a possibility that this can be implemented. I would like to recommend that those involved in offering the moratorium to consider waiving the accrued interest for hire purchase or profit for fixed-rate Islamic financing loans during the six-month period.”

Surely good news to the public, the move to resolve the issue was under the purview of Bank Negara, with the Ministry of Finance taking a proactive step to discuss with Bank Negara and financial institutions for a decision based on the people’s needs.

“The government is sensitive to the voice of the people especially the B40 and M40 groups.”

“I hope that this view can be considered by Bank Negara and the financial institutions in the country.”

Having clarified by Bank Negara that there had been a confusion of interest as a result of inaccurate source of information, let’s hope that both the ministry and Malaysia’s financial institutions come up with a solution that will benefit all parties.

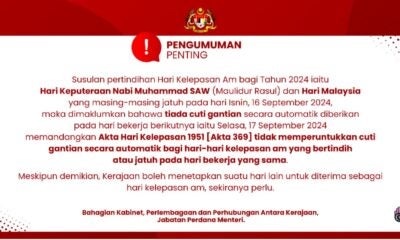

Also read: Covid-19: BNM Foregoes All SME & Individual Loan Repayments For 6 Months