Financial management has never been more important especially at times where the pandemic and the surging prices of goods hit together.

To spend money is inevitable especially if you’re in a relationship. If you’re wondering how to save more money during this tough time, then this may come in handy!

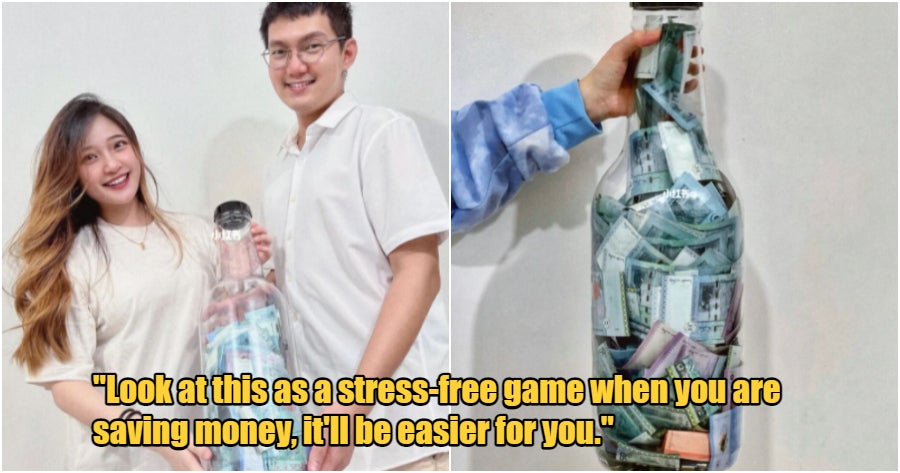

Recently, a Malaysian couple had shared a useful tip on money management via a platform known as 小红书. According to her post, she revealed how her partner and she managed to save an amount of RM13,359 in just 356 days, which is just within a year!

According to Kher Ying, the woman who posted the tips, her method of saving is not just simple, but also interesting. Here’s how you can start saving with your partner!

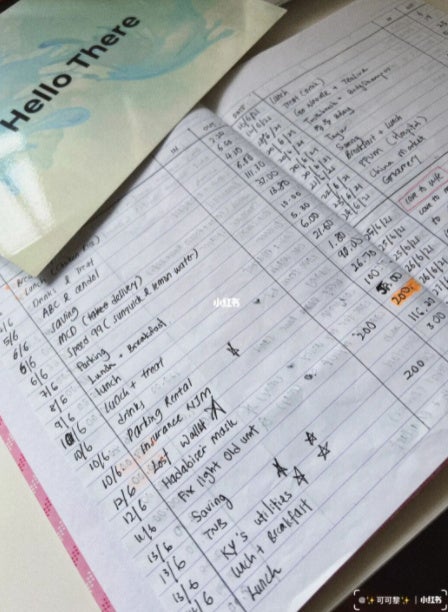

All you have to do is just to follow the number of the days and save your money based on the corresponding number. For instance, assuming you kickstart your saving plan on the 1st of January, then start with RM0.10, followed by RM0.20 on the next day and so on. Once it has reached a year, you can save an amount of RM6679.50.

With your partner, you’ll be able to save up to RM13,359 in just a year!

“On average, you just need to save RM18.30 per day, which is almost equivalent to the price of a beverage from Starbucks.”

Ying added that regardless of how much your earn, this method will work as long as you are committed to it and that to save money is not as tough as we often perceive. It’s all about finding a method that we can get used to and be comfortable with.

“Look at this as a stress-free game when you are saving money, it’ll be easier for you,” she explained.

Not only that, but she also reminded the people to record and track the flow of the money in order to avoid any unnecessary and reckless spending. She also said that this is also a good way to identify our bad spending habits.

We’ll never know what fate has in store for us, just like none of us foresaw the pandemic which has sent a lot of people into a financial burden. It’s definitely not too late for us to start saving for the rainy days!

Also read: M’sian Defies Trend & Purchases a Perodua Kancil, His Dream Car After Saving For 18 Months