When the Sales and Service Tax (SST) was implemented on 1 September 2018, many people were questioning if their electric bills will also be taxed by SST.

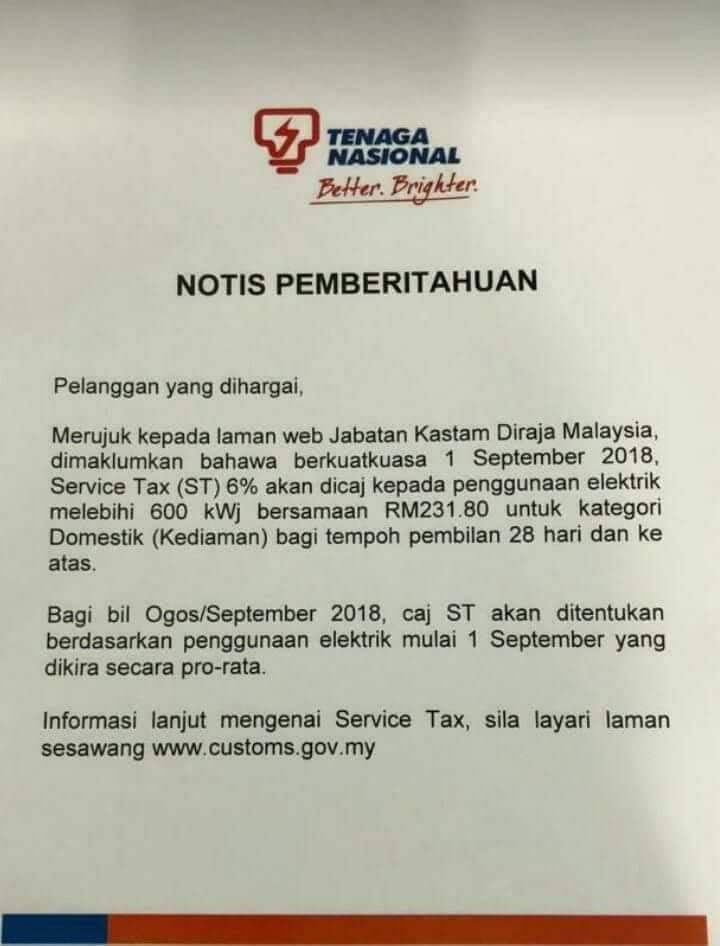

Providing an answer to that question, TNB (Tenaga Nasional Berhad) has released a notice to its consumers stating that they do, in fact, charge SST but this will depend on how much electricity customers use.

Source: siakap keli

According to their website, TNB can charge 6 per cent of Service Tax to residential customers because they are permitted to do so under the Service Tax Act 2018 but not all customers will be affected.

Their website stated,

“As a registered taxable person, TNB is complied to charge Service Tax for (the) provision of electricity.”

However, SST will only be charged to customers whose monthly consumption of electricity is more than 600 kWh (kilowatt hour) with a bill amounting to more than RM231.80 within the billing period of 28 days and above.

Source: beetify

Hence, residential customers with an electric consumption of less than 600 kWh within the billing period of 28 days and above will not be taxed. Moreover, non-residential customers (i.e. business owners with buildings not used for habitation) are also “not govern under Service Tax Act 2018”.

On a side note, do keep in mind that SST will be charged on the customers’ entire consumption of electricity if their billing period is less than 28 days.

Source: wan electrical

Meanwhile, bills issued for the months of August/September 2018 will be taxed based on the electric consumption starting from 1 September 2018, reported Siakapkeli.

Therefore, not all TNB customers will be charged SST because only residential consumers with a monthly electric consumption of more than 600 kWh will be taxed 6 per cent of Service Tax.

Still having some doubts? Head over to TNB’s website for more info!

Also read: New Update to Your TNB Bill Could Save Malaysians Time and Hassle, Here’s How