The World Bank has proposed raising the Employees Provident Fund (EPF) withdrawal age to 70 years old, saying the current 55-year limit is too low for Malaysia’s increasingly ageing population.

In its latest report, “Should Malaysia Expand Its Social Pension? Global Evidence, Design Issues and Options,” the bank suggested that setting the withdrawal age between 65 and 70 would better reflect the country’s current demographic trends.

“Malaysia’s social pension age should be set between 65 and 70”

China Press reported that the World Bank’s report mainly focuses on non-contributory social pension schemes, especially the “Senior Citizens Assistance Fund.”

The bank previously recommended that Malaysia gradually raise its retirement withdrawal age to address the challenges of an aging population and longer life expectancy, which could affect the financial security of older citizens.

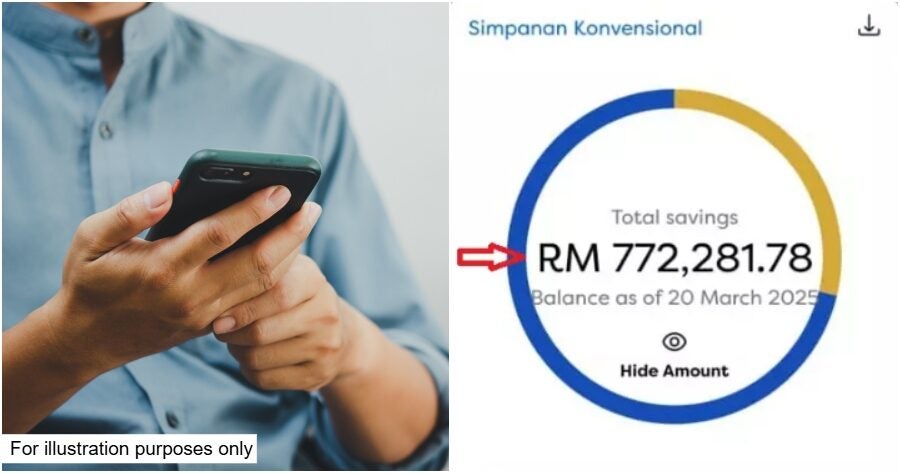

For illustration purposes only

The bank noted that a higher retirement age would allow retirees to enjoy larger average benefits from social pensions.

At present, Malaysians can access their social pension at age 60, which the World Bank says is far below most other countries and no longer keeps up with longer, healthier life expectancies since the scheme began in 1982.

Therefore, it is recommended to gradually raise Malaysia’s social pension eligibility age to between 65 and 70 to keep the system sustainable as people live longer.

Data from the 2022 Household Income and Expenditure Survey showed poverty rates rise sharply with age, highlighting the need for better-targeted aid.

The bank also suggested expanding social pension coverage to include more elderly citizens without retirement savings or fixed pensions.

Dosm, 2024. Measure is of mean monthly income for a household.

It allows higher pensions without straining the national budget

From an economic standpoint, the World Bank suggests that it’s better to roll out both measures, expanding coverage and raising the eligibility age, at the same time. Doing one first and delaying the other could hurt public trust and put more strain on government finances.

The report also notes that setting the new eligibility age between 65 and 70 would better reflect Malaysia’s current reality, where people are living longer and healthier than they were 40 years ago.

For illustration purposes only

To avoid affecting current recipients, the proposal recommends keeping their benefits as is, while the higher eligibility age would apply only to new applicants.

This approach would also give the government room to offer higher pension payouts to eligible recipients without putting too much pressure on the national budget.

What are your thoughts on this? Let us know down in the comments!