Most Malaysians have already gotten their super essential COVID-19 vaccination shots. So, it’s high time that we get our lives back on track, and Budget 2022 is standing by us!

With the biggest package ever of RM332.1 billion, we’re hopeful that Budget 2022’s long list of incentives and financial aid will steer us towards the right path, especially for Malaysian youths, working adults and those looking for a job. Here’s what you can expect:

1. The perks of being Youthful

Discounts for PTPTN payment

If you’re one of many undergraduates who signed up for the PTPTN loan, then you’d be pleased to know that the government introduced a tiered discount model to help you pay it off:

- 15% discount when paid in full

- 12% discount when 50% of outstanding balance repaid in a single payment

- 10% discount if paid through salary reduction/scheduled debit

Tablets for (almost) everyone!

Smart technology is pretty much commonplace these days, and those who can’t afford it are sometimes left behind. This is why the government is allocating RM450 million to provide tablets to 600,000 university students in the B40 group.

2. Looking to change careers or struggling to find one?

Whether you’re someone who thinks it’s time to switch jobs or you’re having a hard time finding the right one, take a look at the RM4.8 billion JaminKerja (Jamin Kerja Keluarga Malaysia) initiative that created 600,000 jobs to combat the unemployment rate!

JaminKerja – Hiring Incentives, Upskill & Reskill

It’s great news that the unemployment rate has dropped to 4.6 per cent as of Aug 2021, but we can do better! The government is aiming to reduce it to 4 per cent by 2022 with JaminKerja.

A RM2 billion carrot will serve as a huge incentive to get employers to hire more workers, and give 300,000 unemployed individuals the opportunity to join the national workforce.

Here are the incentives for employers to expand their headcount:

- Unemployed individuals (16 – 50 years old)

- 20% wage subsidy for the first six months

- 30% wage subsidy for the next six months

- Only for those in the >RM1,500 income range

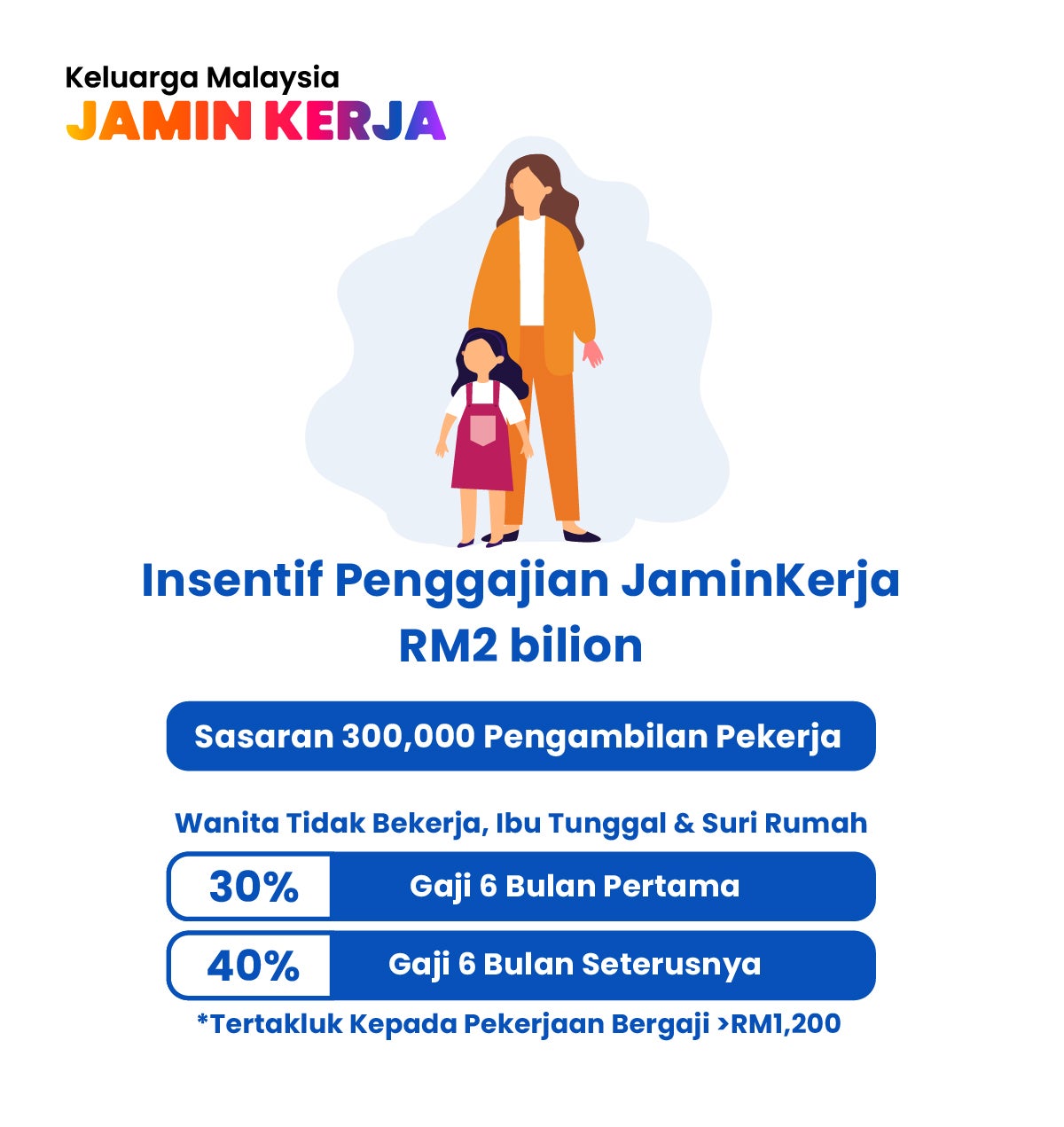

- Unemployed Women, Single Mums and Housewives

- 30% wage subsidy for the first six months

- 40% wage subsidy for the next six months

- Only for those in the >RM1,200 income range

- Disabled, orang asli and convicts

- 30% wage subsidy for the first six months

- 40% wage subsidy for the next six months

- Only for those in the >RM1,200 income range

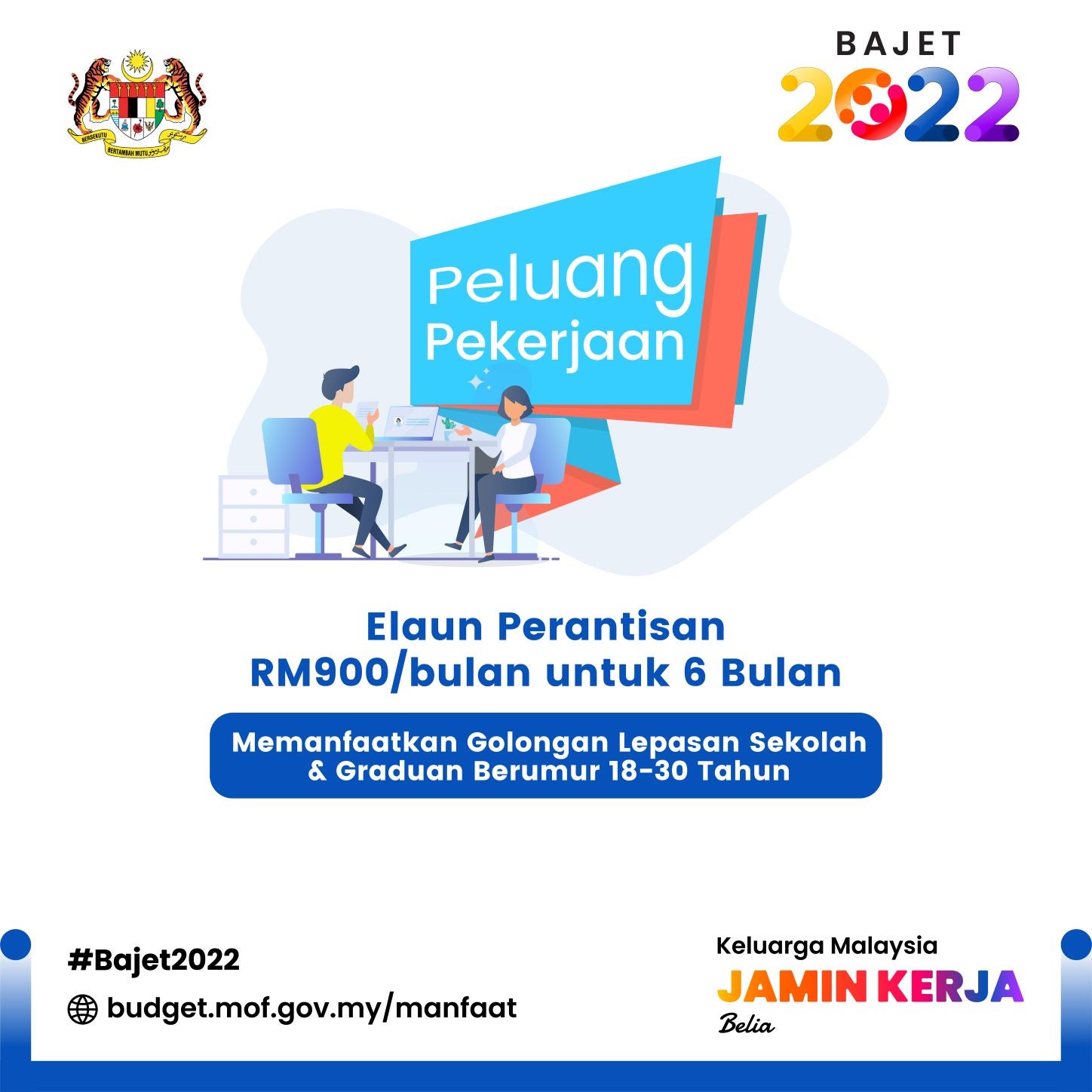

For those who just graduated high school or college and are looking for a job, we’ve got just the thing for you.

- Apprenticeship allowance (18 – 30 years old)

- RM900 monthly allowance for six months

- Job offers are for executive positions

- Diploma and above only

And there’s more! Another programme to find short-term employment will be implemented as well. The government is targeting 80,000 job opportunities across the private sector and Government-Linked Companies (GLCs).

For those who want to upgrade their skill set or venture into a new line of work, you’re in luck! RM1.1 billion has been allocated for training and upskilling programmes for 220,000 trainees to help you advance your career. How will this be done?

- Place & Train

- Global Online Workforce (GLOW) Programme

And on top of that, you are entitled to increased tax relief for expenses in attending such training courses, ranging between RM2,000 and RM7,000!

3. Easing the financial burden of working men and women

Social security is a very real concern that’s constantly on the minds of Malaysian working adults. To ease such worries, the Finance Ministry has decided to increase tax relief for private-sector social protection and encourage voluntary EPF contributions.

Tax relief

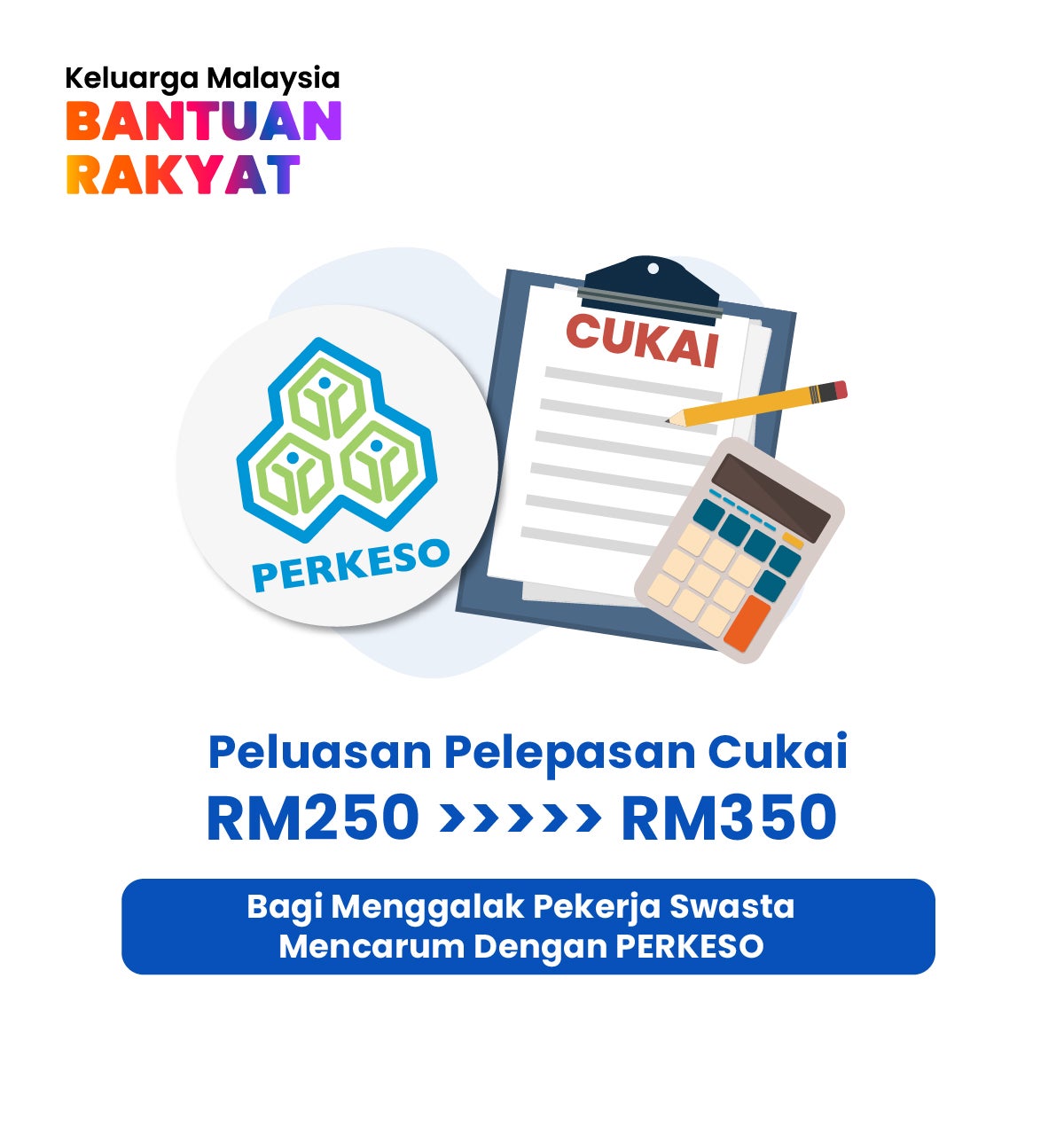

- SOCSO / PERKESO

- Private sector employees can claim RM350 (up from RM250) in tax relief for SOCSO contribution, which will be expanded to cover contribution through the Employment Insurance Scheme (EIS)

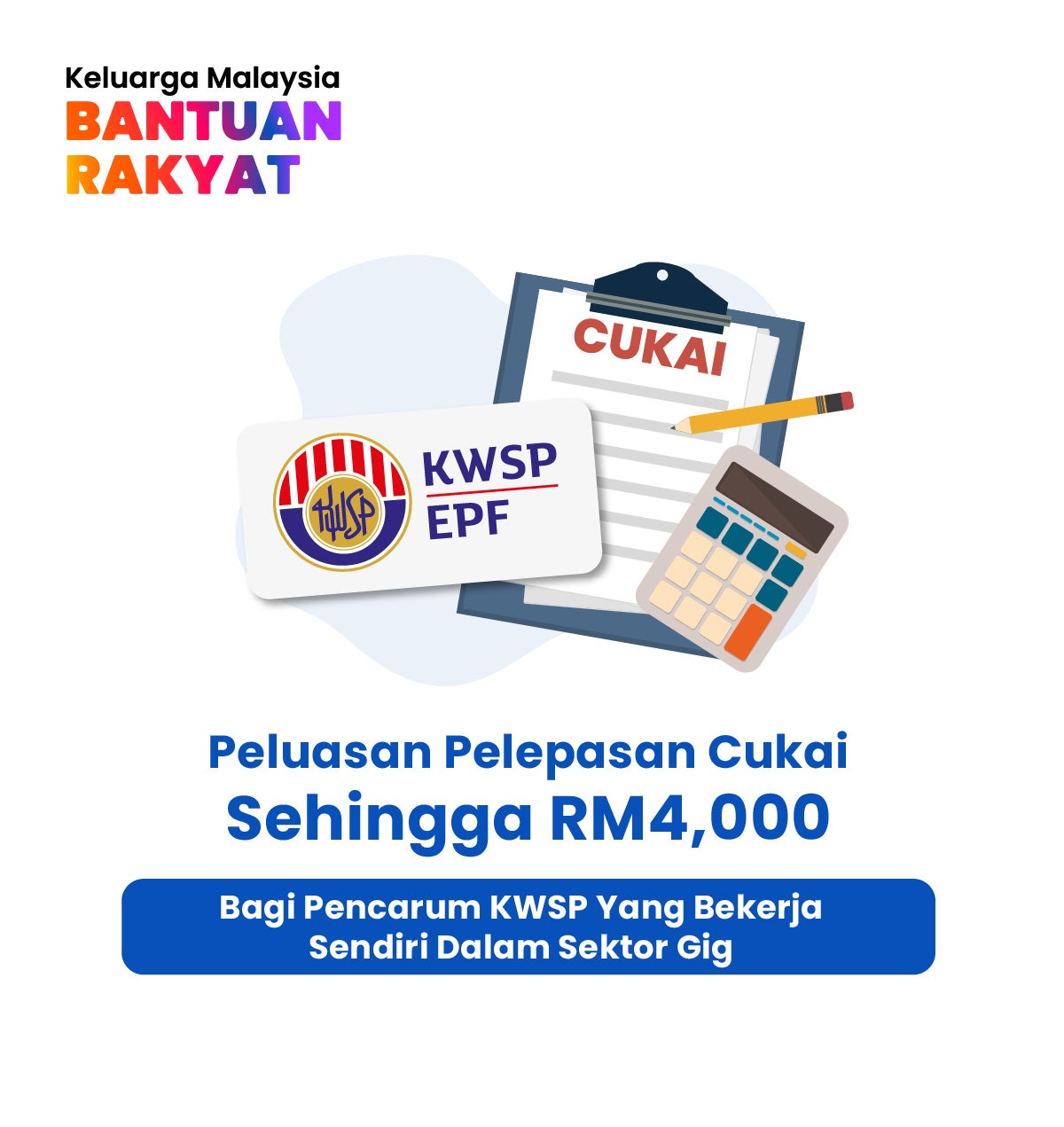

- EPF/KWSP

- Tax exemption of up to RM4,000 for voluntary contributions by those self-employed and gig workers. Check out the i-Saraan initiative below for more good news

- Increase the ceiling of insured salary

- To improve social security coverage, the maximum amount of insured salary has been raised from RM4,000 to RM5,000.

- 9 million employees are expected to benefit from this initiative.

- Expansion of i-Saraan for voluntary EPF contribution

- The Government has allocated RM30 million to encourage self-employed and informal sector workers to save more for their retirement and extended the initiative to include those aged 55 to 60

- Up to 15% a year (RM250 max) will be given for each voluntary EPF contribution.

There is so much more to Budget 2022, but we simply can’t mention it all without being long-winded.

Here’s a quick tip! Check out the Budget 2022 website to fish out more information and benefits that can help make 2022 a better, brighter year for you.