Good news for all Employee Provident Fund (EPF) members! The RM50 minimum contribution requirement has been scrapped for those who voluntarily contribute to their accounts and it will come into effect starting the 1st of July, 2018.

Source: the star

This means that members can contribute any amount to their retirement savings fund but the maximum amount accumulated yearly remains capped at RM60,000. The voluntary contribution can be done either through the 1Malaysia Retirement Scheme (SP1M), self-contribution and top-up savings contribution.

In a statement released on the official EPF website, EPF deputy CEO Datuk Mohd Naim Daruwish said, “A little savings set aside today will go a long way in ensuring the retirement wellbeing of our members in the future. Therefore we want to ensure that members are able to contribute in any amount, at any time within their financial abilities through the flexibilities introduced.”

Source: nst

He also said that EPF has decided to provide this option of a flexible contribution scheme as they want a retirement agenda that is truly inclusive, even for Malaysians who are self-employed. As for non-Malaysians, they can also do the same as long as they have a legal work permit and had registered as an EPF member.

Other than the removal of the RM50 minimum contribution, the top-up savings contribution scheme is further enhanced by enabling the members to contribute any amount to the Account 1 of their children who are also EPF members. Previously, EPF members were only allowed to contribute to their parents’ or spouse’s Account 1.

For more information, you can visit EPF’s website here or contact them here. Happy saving!

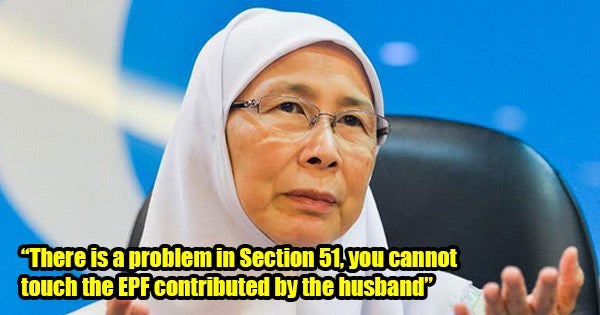

Also read: Wan Azizah: Housewives Cannot Take 2% of Husband’s EPF According to Law