A lot of Malaysians may think that their retirement is still a long way away so they don’t have to worry. Well, not to burst that bubble but even you yourself wouldn’t want to suffer when you are older, right?

Now is a good time to start saving early for your retirement as the government is giving free RM1,000 to Malaysian youths!

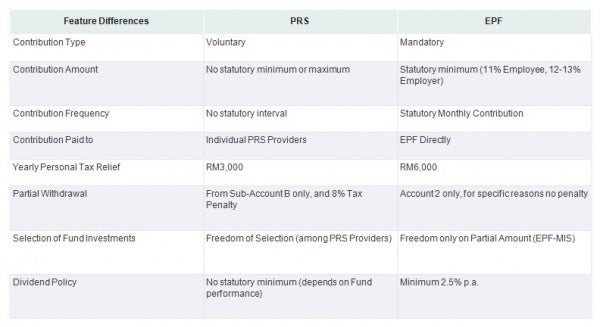

It is actually part of the Private Retirement Schemes (PRS) which is defined as a “voluntary long-term savings and investment scheme designed to help you save more for your retirement”. It’s not the same as your Employee Provident Fund (EPF) but they are similar in the sense that they tuck money away for you to use when you’re in your old age.

Source: potentash

According to PPA, the scheme is known the PRS Youth Incentive and the RM1,000 incentive has actually been introduced since Budget 2017. It was previously only RM500 during Budget 2014 but PM Najib has since increased the amount. If you have taken advantage of the RM500 incentive, sadly, you won’t be able to get the RM1,000 this time.

So for a minimum of RM1,000 that you contribute, you’ll get a matching RM1,000 from the government. Yes, just like that!

The government will make a one-off payment of RM1,000 to qualified individuals that will be used to purchase units in a PRS fund in the PRS account. It’s a long-term investment scheme! This scheme is aimed at Malaysian youths aged 20 to 31 years old and is meant to help them save more money for the future.

Source: hr in asia

Who is eligible?

- Malaysian nationals

- Individuals may be existing Private Pension Administrator (PPA) account holders or new members

- Individuals must be aged 20 and above but have not yet reached the age of 31 between 2017 – 2018

- Gross contributions reach RM1,000 during a period of two (2) years from 2017 to 2018 in a single PRS fund of a Provider

The RM1,000 will be automatically deposited into your account and you do not have to apply for it as PPA will be monitoring the accounts. The individuals that are eligible will be compiled into a list and given to the government. Payment will be made every six months, so keep a look out!

Source: ringgit insider

Currently, there are eight PRS providers in Malaysia so choose the one you want and head over to a branch to open an account.

These are the providers:

- Affin Hwang Asset Management Berhad

- AIA Pension and Asset Management Sdn Bhd

- AmFunds Management Berhad

- CIMB-Principal Asset management Berhad

- Kenanga Investors Berhad

- Manulife Asset Management Services Berhad

- Public Mutual Berhad

- RHB Asset Management Sdn Bhd

If you’re still unclear about the whole scheme, here’s the difference between PRS and EPF:

Source: hokangtao

Do take note that similar to EPF, you cannot make a full withdrawal until retirement age or only under certain circumstances. You can contribute any amount you like or whenever you like, but in the end, it will still be your money. Plus, you can get up to RM3,000 tax relief every year if you contribute!

For more information, visit PPA’s website here.

Plan ahead, people and start saving for your retirement!

Also read: Malaysian Babies Born On January 2018 Onward Will Receive RM200!