According to the Malay Mail, the Inland Revenue Board of Malaysia (LHDN) announced that all income received from employment exercised in Singapore is not liable to tax in Malaysia.

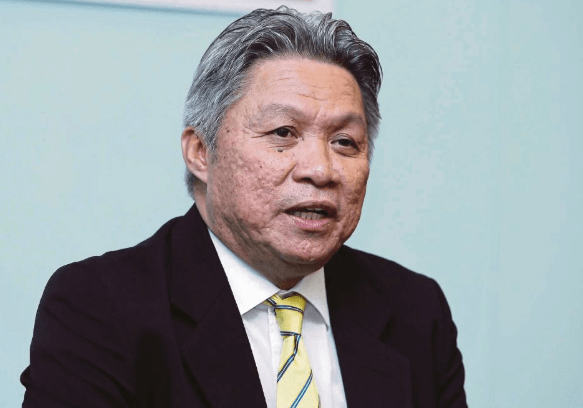

LHDN chief executive officer Datuk Seri Sabin Samitah stated that this is because this income is not derived from the exercising of employment in Malaysia.

Source: berita harian

Sabin was quoted in a statement, saying,

“For an individual residing in Malaysia for a period exceeding 183 days, the individual is deemed to be a resident for tax purposes in Malaysia under the Income Tax Act 1967 (ITA 1967).”

“However, if the said individual does not receive any income deriving from Malaysia and only receives employment income derived from Singapore, then the individual is still not liable for tax in Malaysia.”

Source: johornow

Sabin made this statement to clear doubts concerning the basic questions of income derived from Singapore and tax residence status that was published by a Chinese newspaper today (10 March). He mentioned that the resident status of an individual in Malaysia would not automatically result in the income received by the individual to be subjected to Malaysian tax laws.

Also, he added that any earnings remitted to Malaysia from abroad will be also exempted under Paragraph 28, Schedule 6 of the ITA 1967. To know more, you can visit your nearest LHDN office or call the Hasil Care Line LHDNM at 1-800-88-5436 or 603-7713 6666 (abroad).

Source: sunburst adventure

What do you think of this statement saying that earnings from employment in Singapore is not taxable in Malaysia? Let us know in the comments section below!

Also read: Employers Can Enjoy Tax Relief If They Settle Their Workers’ PTPTN Loans