Yesterday (3 March), the Employees Provident Fund (EPF), in collaboration with the University of Malaya (UM), launched the “Belanjawanku Guidebook 2019” expenditure guide. It’s a financial planning guide for both individuals and families, and it basically helps Malaysians plan for their financial futures.

In the words of EPF CEO Tunku Alizakri Alias, “A well planned and executed budget will empower you and your family towards financial independence.”

A list of detailed minimum baseline for monthly expenses, the Belanjawanku is based on the spending patterns of urbanites in Klang Valley to give supposedly accurate projections of how much one needs to earn to get an acceptable standard of living.

Here are some key insights from the report.

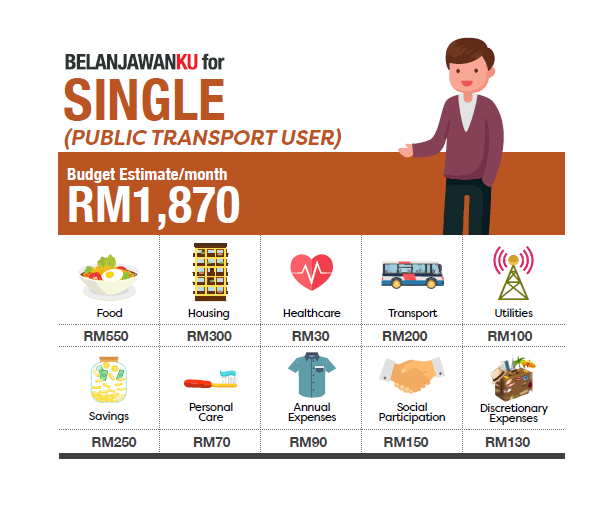

Source: kwsp

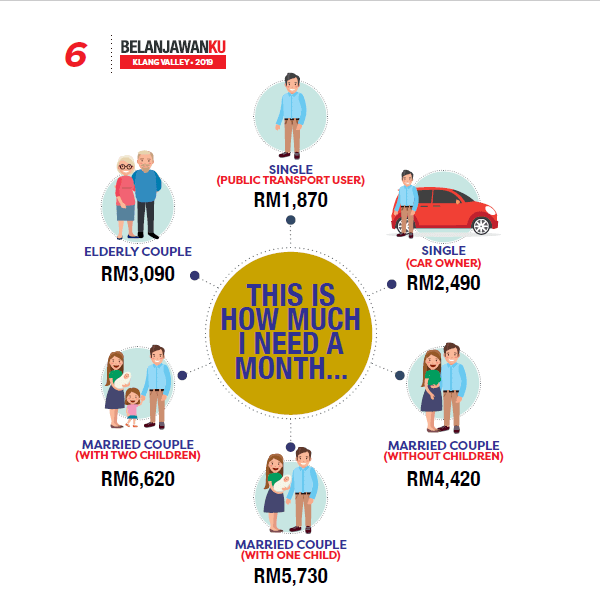

Are you a single, public-transport user? Well, you’ll need to have a minimum of RM1,870 monthly.

Spending a minimum of RM300 a month on housing (the report states these are room rental rates), you’ll be spending at least RM550 and RM150 on food and socialising respectively. Your transportation costs should only be a reasonable RM200, as opposed to…

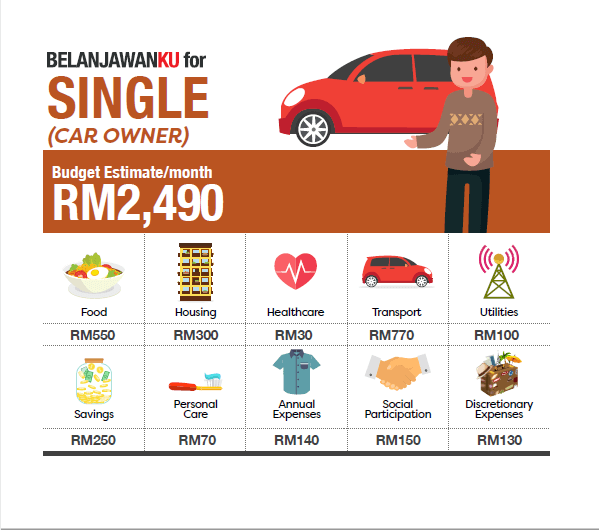

Source: kwsp

…the single car-owner.

With a car, we can see living costs shooting up a minimum estimate of RM620 a month just to have your own ride. The rest of the expenses remain the same as the public transport user.

So what happens when you and your significant other decide to put a ring on it and get hitched? Well…

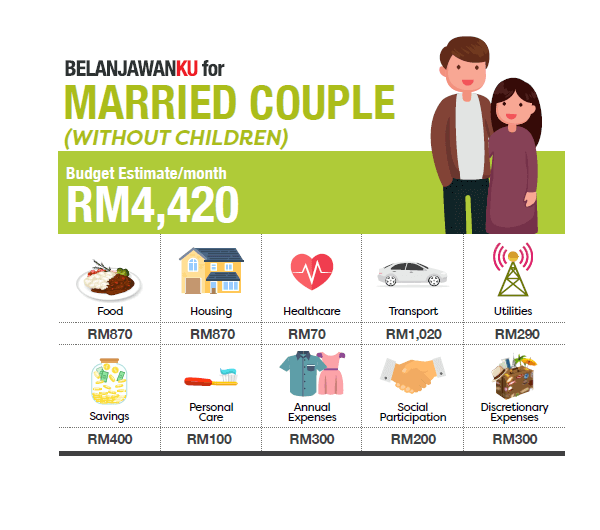

Source: kwsp

Married couples without kids will unsurprisingly spend almost double the minimum expenditure of a single person. With the money spent on housing skyrocketing as people move out of rooms and into apartments and houses, married couples do get some good news as well: savings on certain shared things like food and transport.

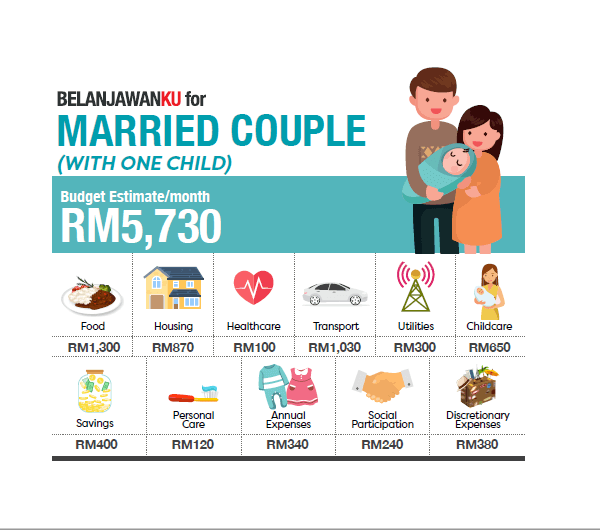

Source: kwsp

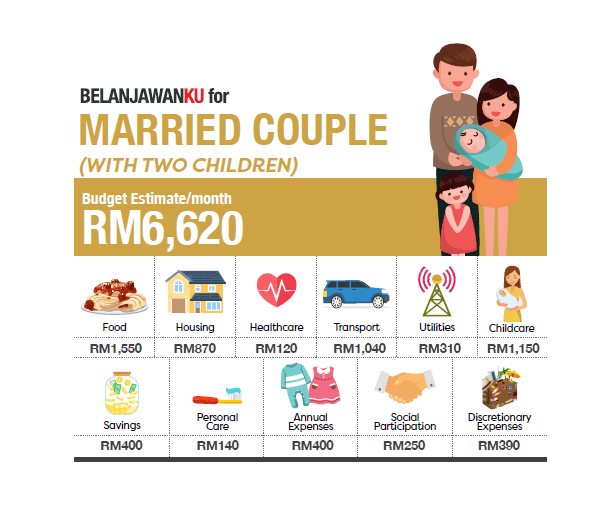

Source: kwsp

Things get a little pricier regarding any potential buns in the oven, with each kid costing about RM1,000 each.

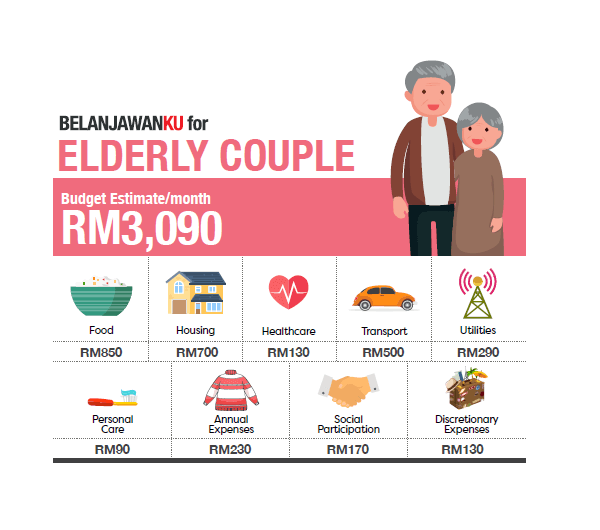

Source: kwsp

Source: kwsp

Currently, Belanjawanku only takes into account the household expenses in Klang Valley, but reports say it’ll include data for other states soon.

This new package of data reveals some interesting facts, such as:

1. The current minimum wage of RM1,100 isn’t enough for a single Malaysian taking public transport who’ll need roughly RM1,9oo to live comfortably.

2. The median income of RM2,650 in Kuala Lumpur is more than enough for a person who’s single.

3. Older Malaysians aren’t saving as much as they should, with more than half near EPF withdrawal age not even meeting retirement saving minimums.

4. Apart from food, an majority of Malaysian spending actually comes from transportation when owning a car or motorbike’ this actually overtakes food expenses for singles and couples without children.

Given that countless Malaysian youth end up bankrupt due to poor financial planning, this guide can encourage smarter planning and potentially save many from financial ruin.

Compiled by UM’s Social Wellbeing Research Centre (SWRC), the data comes from structured surveys, group discussions, industry experts, academicians, and price surveys. It’s also important to note that the SWRC will periodically update the report to keep up with changes in market prices and cost of living.

With the data here potentially driving national policies, you can download the full report in both English or BM for further reading.

Well! What do you guys think about the report? Do you feel it’s accurate? How could it be better? Let us know in the comments below!

Also read: M’sian Father Saves Money Instead of Buying 4D, Total Sums Up to Top Prize in One Year