If you’re reading this, then it most likely means that you are curious about how you can manage your monthly paychecks better to give you a head start in your life.

Fret not; you’re not alone in your pursuit of sustainable finance! Here are some savvy tips on how you can manage your next paycheck wisely and reap the benefits in the long run. Because remember: how you handle your salary (especially in your first few years of working) can affect your future financial goals!

1. Plan your expenditures carefully

In other words, make a budget! A budget is a must-have for anyone in the workforce, not just because it can help you meet necessary expenses, but because it also ensures that you spend your money on your own terms for each monthly cycle.

To put it simply, here’s what your expenditure plan should entail:

- Income – This isn’t just limited to your paycheck. It can also include tips from a service job, separate bonuses, and other cash benefits.

- Fixed expenses – This should cover your regular monthly bills and necessary expenses like housing, utilities, car payments, etc.

- Variable expenses – These expenses are the ones that may change every month such as gasoline, groceries, eating out, entertainment, etc.

- Goals – Money that falls under this category should be solely for future expenses such as emergencies, family trips, debt, retirement or anything else further down the line

Once you have a clearer view of where your money goes, find out how to adjust your expenditure plan to fit your lifestyle appropriately such as eating out less or buying cheaper groceries. It’s a surefire way to find out where you can save more!

And speaking of savings…

2. Put aside 10-15% of your salary for retirement and emergencies

While not everyone has to (or can) live and die by the 50/30/20 rule, one thing that we should all agree on is that if possible, 20% of your monthly income should go straight into your savings. At least 10% of said savings should go into your retirement while another 5% should head straight into your emergency fund (at least until you have enough money to cover living expenses for a whole year).

That being said, this suggestion is not a “one size fits all” kind of affair. Major life events or even new preferences for your retirement may warrant some changes in your savings. So make sure to re-evaluate your saving goals regularly!

“But what about the other 5%?”, you may ask.

3. Keep 5% of your earnings for future major milestones

Contrary to what some people believe, there’s a lot more that you might want to save for than just your retirement and emergencies. So on that note, 5% of your savings should be reserved for foreseeable major expenses such as a wedding, home repairs, car payments and other stuff that may require your commitment.

But remember not everyone can afford to lock away 20% of their salary each month. So if you’re one of those who can’t, then make sure to adjust your savings to a feasible scale based on your financial situation. Because after all, saving something is better than nothing!

4. Try to settle as much of your financial debts as possible

Nowadays, many Malaysian young adults have some form of debt for reasons such as paying off living expenses during unemployment or student loans. So a smart move here is to figure out how to quickly pay off any credit card debt and student loans as quickly as possible to avoid an overwhelming build-up of interest fees. Plus, your credit score will be thanking you too!

But don’t forget about loans you may have taken from friends and family members as well. Sure, there are no deadlines or interest fees per se, but financial obligations can often change the relationship dynamic between you and the people close to you. So the sooner you pay them, the better for your relationships!

5. Find out how you can earn higher returns on your savings!

A great part about growing your savings portfolio – whether through investments, fixed deposits, a savings account with high returns or more – is that you’ll be able to earn more in addition to what you’re saving! In fact, with a savings account, you can have your money working for you by contributing to the gradual buildup of your balance with little to no associated risk! You can earn more on your savings by maintaining a high monthly average balance where your bank is required to follow an appropriate incremental rate of interest.

Plus, you can earn more on savings by taking advantage of bank bonuses! Depending on where you bank, you can get introductory bonuses if you sign up for a new account and meet their requirements for said bonuses. Usually, all you need to do is transfer a minimum amount to your new account and keep it there for a certain time period.

And hey, what do you know! That’s exactly what you can do with a CIMB OctoSavers Savings Account-i!

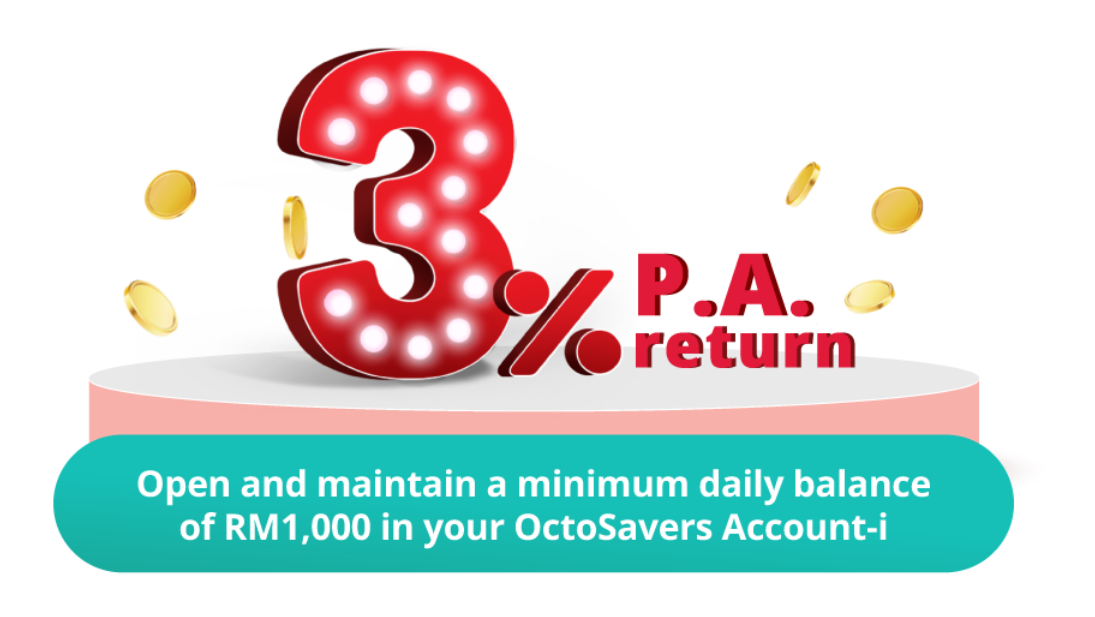

You can earn up to 3% p.a. bonus profit* when you sign up for a new CIMB OctoSavers Account-i today!

That’s right! From now until 30th September 2022, Malaysians can enjoy up to 3% p.a. return when they open a new OctoSavers Account-i within the campaign period! How? All you have to do is open and maintain a minimum daily balance of RM1,000 in your OctoSavers Account-i! Senang je!

And awesome perks don’t end there! Here’s why you should bank with an OctoSavers Account-i!:

- Convenient – Just apply anytime, anywhere online via CIMB’s Apply App for new to bank customers. Or if you’re already a CIMB customer, simply apply via CIMB Clicks!

- Hassle-free– No need to mafan come to the branch to pick up your debit card! Just arrange to have your Octo Debit Card delivered straight to your door when you sign up! Also, you can book your flights & hotel stays via the CIMB OctoTravel App and get access to exclusive deals and savings using your Octo Debit Card. CIMB OctoTravel provides complimentary Covid-19 insurance and travel insurance coverage.

- Attractive – Gain rewards when you finish game missions in CIMB Clicks after opening the account! The annual fee for your Octo Debit Card will get waived while you’re at it too! Who says saving shouldn’t be fun?!

- Extra Perks – Book your flights & hotel stays via the CIMB OctoTravel App with your Octo Debit Card to enjoy exclusive deals & savings.

So what are you waiting for?! Sign up for CIMB’s OctoSavers Account-i by downloading the CIMB Apply app from the App Store / Google Play or scan the QR code below with your smartphone!:

As a member of PIDM, CIMB OctoSavers Account-i is protected by PIDM for up to RM250,000 for each depositor.

For more info on the CIMB OctoSavers Account-i campaign, visit their official website.

*Terms and Conditions apply.