It’s that time of the year again!

If you’re a first-time taxpayer and you’re not really sure what tax reliefs are, it just means that you’re able to deduct a certain amount of money expended in the year from your total annual income. These are typically used for activities that the government encourages to supposedly lighten our financial load, as reported by iMoney.

Starting 1 March of every year, taxpayers are encouraged to start submitting their income tax return forms through the e-Filing system. With this system, taxpayers no longer need to print out the income tax form and fill it in manually.

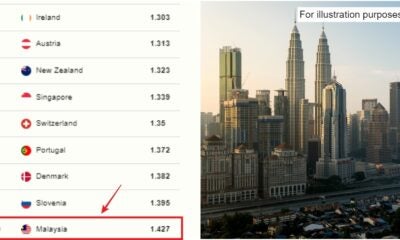

For illustration purposes only.

Tax relief

According to Lembaga Hasil Dalam Negeri Malaysia (LHDN), here’s a list of tax relief to look forward to this tax season:

1. Automatic Individual Relief (RM9,000)

An individual taxpayer is eligible for up to RM9,000 tax relief.

2. Disabled persons (RM6,000)

Any disabled person registered with the Department of Social Welfare (JKM) and certified as OKU is eligible to claim up to RM6,000. Spouses of disabled persons can claim up to RM3,500.

RM6,000 is eligible for parents with mentally or physically disabled children. Relief is claimable if the child is unmarried, regardless of their age.

For an unmarried and disabled child who is receiving full-time education in Malaysia or overseas, another relief of RM8,000 is claimable. However, they are only eligible if they are:

- Pursuing a full-time diploma or higher qualifications in Malaysia

- Pursuing a full-time Master’s or Doctorate course overseas

For illustration purposes only.

3. Parents (RM5,000)

You can claim up to RM5,000 if you have parents with medical conditions that require special treatment that is medically certified. This also includes purchases of equipment, costs of healthcare, and treatment for their health condition.

Citizens can claim up to RM3,000 for both parents (RM1,500 for each parent) if their elderly parents are:

- Biological or adoptive parents

- Malaysian residents aged 60 and above

- Aggregated annual income does not exceed RM24,000

However, if siblings are making these claims under the same parent, they have to divide the allocated amount equally.

4. Medical expenses (RM6,000)

RM6,000 can be claimed for self, spouse, or children who are undergoing medical treatments for serious diseases.

Tax relief is also claimable for the cost of fertility treatment like IVF or IUI and also RM500 relief is for full medical checkups. Note that, this can only be done at medical institutions that are registered with the Ministry of Health (MOH).

5. Lifestyle purchases (RM2,500)

Purchases of lifestyle equipment can also be claimed for amounts of up to RM2,500 for yourself, your spouse, and children. This form of tax relief includes personal computers and smartphones, reading materials, sports equipment purchases, gym memberships, and personal internet bills.

Plus, an additional relief of RM2,500 can be claimed if one has purchased a smartphone, computer, or tablet for personal use between the period of 1 June to 31 December 2020.

For illustration purposes only.

6. Self-education fees (RM7,000)

Tax relief of up to RM7,000 is eligible for those studying Doctorate, Masters, and undergraduate degrees or lower. Any course or programme for Doctorate and Masters is eligible for this tax relief. However, for undergraduate degrees or lower, only these selected programmes are eligible for claims – law, accounting, Islamic financing, technical, vocational, industrial, scientific, or technology.

7. Parenthood (RM3,000)

The purchase of breastfeeding equipment for personal use (for children aged 2 years & under) is claimable to an amount of up to RM1,000. Preschool and kindergarten fees for children 6 years & below can also be claimed for amounts up to RM3,000.

8. SSPN (RM8,000)

Parents who have contributed to the Skim Simpanan Pendidikan Nasional (SSPN) are eligible for tax relief of up to RM8,000 for their annual net savings.

9. Life insurance & investments (RM7,000)

This tax relief covers retired public servants’ life insurance, employees’ life insurance, and EPF. For retired public servants, RM7,000 is claimable for premium life insurance. Tax relief of up to RM3,000 is eligible for those who work in private sectors and public servants that are not given pension.

For their EPF contributions and other approved schemes, employees are eligible to claim up to RM4,000. Another tax relief of up to RM3,000 is eligible for any taxpayer who is making contributions in the deferred annuity scheme or the Private Retirement Scheme (PRS).

10. SOCSO

Taxpayers who made contributions to SOCSO are eligible to claim relief of RM250.

For more information on the kinds of tax relief that are available, visit LHDN’s website here.

Also read: New Zealand Raises Minimum Wage To RM58 Per Hour & Taxes For Top 2% To 39%