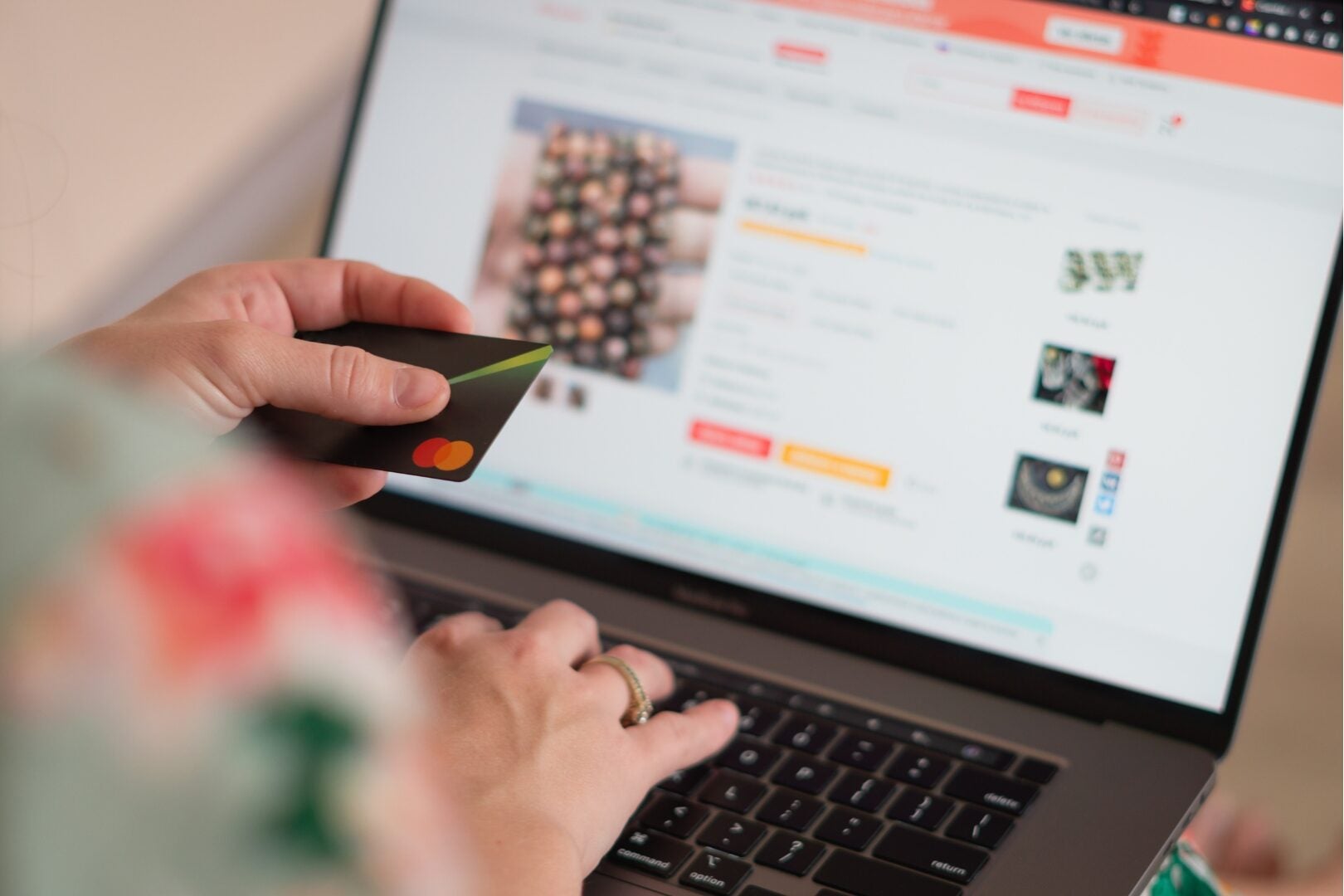

Innovation is abundant in every era of finance, from the early days of cheques (remember those?!) to credit cards being common in the past few decades. Now, in the digital age, Buy Now Pay Later (BNPL) is becoming more lucrative among users, being digitally accessible and allowing more Malaysians to access financial support in times of need.

With over 5.1 million active users across the country, it’s clear that the accessibility and utility of BNPL has made it more viable among Malaysians looking to manage their finances.

BUT, with great convenience comes great responsibility (the original quote went differently, but you get the idea); So, how do you know if BNPL fits your lifestyle? And how do you master this new, modern payment method?

Just like any financial tool, from cards to e-wallets, healthy financial habits are key to mastering your finances!

To find out the best ways to manage BNPL, we asked these SPayLater users about their experience using the service, asking why they use it and how they use it to better manage their finances.

Here’s what we found:

A lifeline for daily necessities and emergencies

Contrary to popular belief, BNPL isn’t a “shop ’til you drop” tool. In fact, ShopeePay’s recent Fikir Sekarang, Bayar Kemudian survey found that 81% of Malaysian BNPL users use it for necessary expenses, from groceries to medical bills.

The breadwinner of a family of six, Li Yuan, tells us he uses SPayLater to support his cash flow towards the end of the month for necessary purchases, including baby food and car replacement parts.

He also uses the service to help with sudden emergencies, where he shared, “It also helped me out once when our aircon suddenly broke down right before Chinese New Year, and I’d already budgeted for my CNY spending.”

A small business owner named Aizad, on the other hand, uses the service to manage his cash flow between paychecks and the income from his business.

“‘Ukur baju pada badan sendiri’. It’s best to use SPayLater to support purchases necessary for you, but if you feel like buying anything else, evaluate your finances and plan ahead before buying”, he said.

Breaking down bigger payments and savings beyond online shopping

The users we interviewed showed that BNPL has evolved far beyond just online shopping. Aizad, for one, uses SPayLater when paying for his children’s nursery fees and filling petrol at Petron.

“I manage to save a bit more money because I can use their (SPayLater) vouchers when filling up petrol, and I managed to save up to RM100 using vouchers when grocery shopping”, he explains.

Li Yuan agrees with this notion, saying that since SPayLater is readily available on Shopee, he searches for better deals online so he can make the most of his everyday purchases.

Aside from vouchers, users also found ways to save on their monthly budgets by breaking down big payments into instalment plans.

Khaleda, a tech professional in Putrajaya, uses BNPL for the above reason: “I use SPayLater importantly for my yearly road tax and car insurance. It helps me break down these big, one-time purchases that could strain my budget if paid lump sum.”

Khaleda’s advice: “Consider your SPayLater bill in your monthly budget, look at it the same way you would treat a utility bill like your phone or electricity bills, and understand your total monthly commitments.”

Here’s how they (and you) can stay on top of SPayLater bills

To avoid accidentally overspending, Aizad says BNPL users should “Decide how much of your credit limit you’re comfortable using per month, and stick to your personal budget.” (E.g., If you’re comfortable spending only RM200 a month on BNPL, make sure to stick to this.)

“While they (SPayLater) make payment deadlines obvious, I appreciate being notified early to remind myself to check my due dates and plan ahead.” says Li Yuan.

Conclusion: Better BNPL use leads to better financial management!

At the end of the day, BNPL is just like any financial tool. Providing you the ability to pay on your own terms, it can bring value to your finances when used correctly.

We can observe this with Khaleda, who feels that proper use of BNPL has helped her manage her finances better and can help other users develop financial discipline in their purchases. Whereas Li Yuan mentions SPayLater has helped him manage his personal cash flow better and now takes it into account in his monthly planning. Aizad echoes this perspective, believing that with proper management, BNPL can be a financial support tool for people in times of need, especially those without access to other financial tools like credit cards.

So all in all, it’s all about leveraging the benefits while minimising risks so that you don’t get caught off guard. The best case scenario of using BNPL wisely? You’ll find a new way to make smarter financial decisions and achieve peace of mind!

For more information on SPayLater and all things ShopeePay, visit their website and follow them on their socials: