Ever since GE14, many things are slowly beginning to change in our beloved country. One of the most significant changes taking place–that many Malaysians have been looking forward to–is the abolishing of the Goods & Services Tax (GST). Yayyyy, no more extra 6 per cent charge on every. single. thing!

Instead, the government is looking to replace GST with the Sales & Services Tax (SST) possibly by September this year; so here are some burning FAQ’s regarding the SST you might have asked once before, answered!

What exactly is the difference between GST and SST?

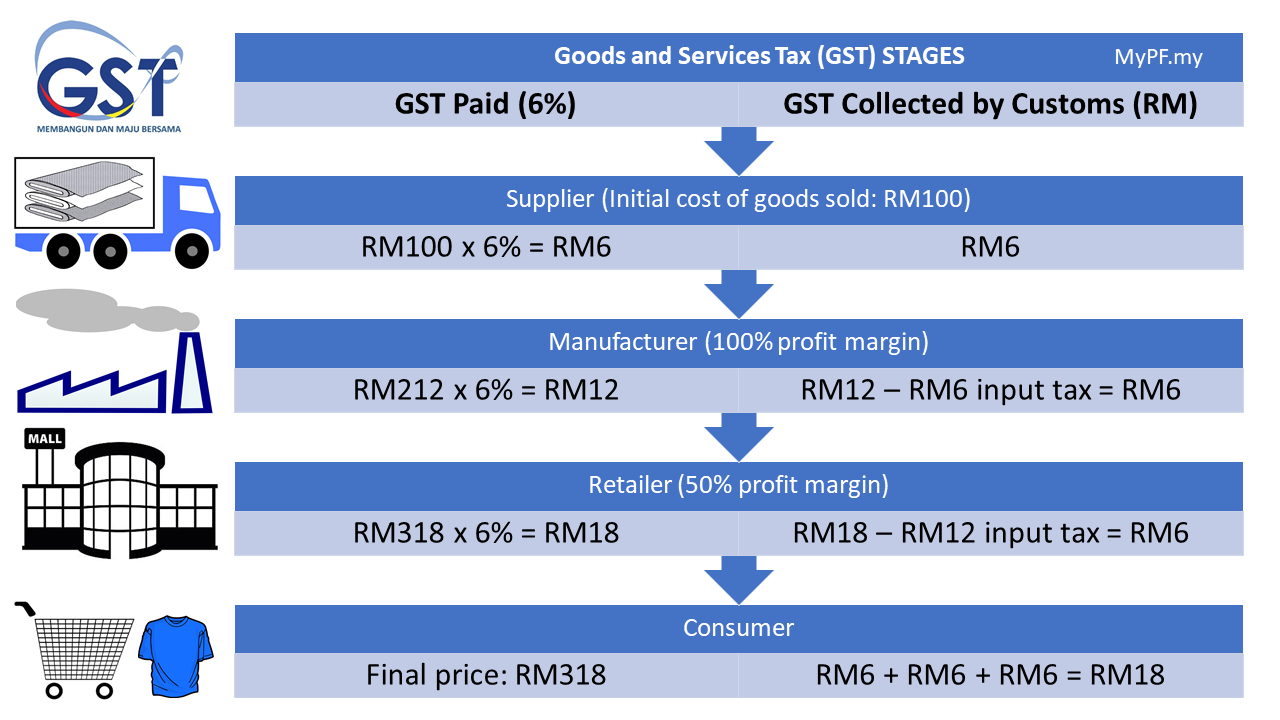

Well, the difference between the two is simply the level of taxation that each affects.

Source: mypf

GST affects every layer of the supply chain; from supplier, manufacturer, retailer, all the way to consumer, each layer would need to pay 6 per cent GST on top of whatever the cost is to Customs. By the time the consumer buys the product, the price and amount of tax they need to pay would have tripled.

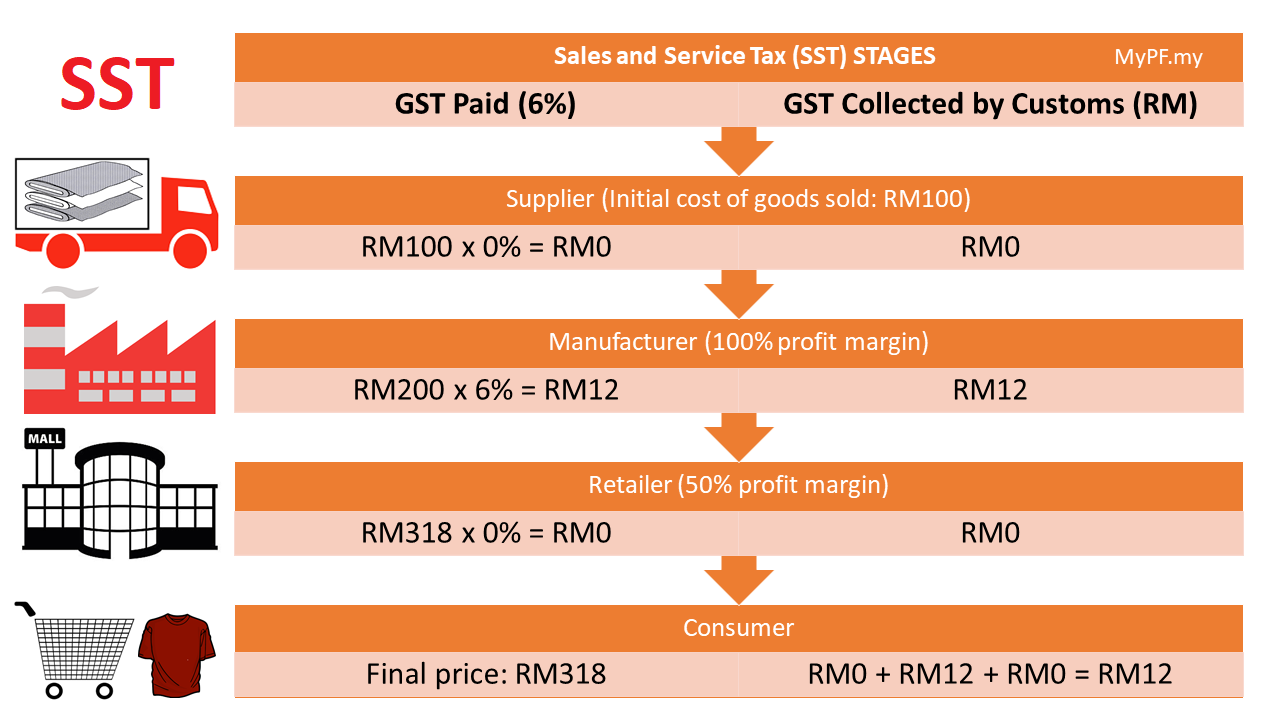

Source: mypf

On the other hand, the SST is a form of tax that only needs to be paid by the manufacturer. Wah consumers can save so much more!

Will switching (from GST) to SST actually LOWER the cost/price of things?

Having to pay an additional 6 per cent on almost everything we buy has obviously made it harder to save money and it can be quite burdensome too. Well, by switching back to SST, it does actually lower the price of a lot of things. Here are some things Malaysians can look forward to:

- Property prices expected to drop with construction materials costs lowering

- Car prices to be revised downwards especially during the months where GST is abolished and SST is not in place yet

- Cost of running businesses to go down as well

- Consumer products and stocks expected to do well

So which is actually better? GST or SST?

Source: wob

To put it simply, it really depends. A few things come into play such as, which part of the product supply chain you are in, what you’re buying, and so forth. So here’s a couple of things you need to ask when considering which is better:

Which one offers less tax?

The previously imposed SST could actually go much higher than the 6 per cent GST rate. In fact, SST rates can be anywhere between 5 and 25 per cent.

Who does it affect?

Although SST can go up pretty high, it doesn’t affect as many things as GST. GST was imposed on almost everything and on all levels of the supply chain (unlike SST), and this had often caused many businesses to spike up their prices unnecessarily making a lot of consumer items overpriced.

For SST on the other hand, although some items might get slapped with high tax rates, it affects far lesser goods. In fact, stuff like TnG reloads and inter-bank ATM withdrawals (to name a few) were never subjected to tax when SST was around.

What is subjected to high SST rates?

The official announcement for the implementation of SST has not come out yet but previously before GST was imposed and SST was still implemented, liquor was taxed at 20 per cent and cigarettes at 25 per cent. If the same rates are implemented again, it might be time to think of cheaper (and healthier) alternatives!

Now that you’ve read all the above, you be the judge! Which is better: GST or SST? Let us know your thoughts in the comments section!

Also read: 3 Ways Our Government Will Compensate For GST Shortfall, Ong Kian Ming Reveals