National Higher Education Fund Corporation (PTPTN) chairperson Datuk Seri Norliza Abdul Rahim shared that some PTPTN borrowers who are now 60 years old have STILL not completed their loan repayments.

“It is inappropriate that at such an age, there are still those who have not settled their loan payments,” Norliza said during an interview with Berita Harian.

The chairperson also said that PTPTN has to bear A LOT to support the borrowers, requiring around RM3 billion to finance the higher education costs of 450,000 existing borrowers and an average of 150,000 new borrowers each year.

“PTPTN needs to continuously have sufficient funds to meet these demands every year.”

“One of the major challenges faced by the PTPTN is recovering the funds disbursed as education loans.”

So, how many borrowers have not paid a single sen?

According to Norliza, more than 430,000 borrowers have never made any loan repayments, even once, resulting in an outstanding debt of RM5.46 billion.

This is part of the total arrears of RM11.32 billion, involving more than 1.25 million borrowers as of September.

The responsibility to repay loans crucial for the continuity of PTPTN in continuing to assist students in need. Norliza also said that if the funds are insufficient, it will affect the sustainability of the higher education fund, which is essential for helping future generations of students.

“If you are not working within the first 5 years and are unable to pay, we understand and we accept that. But what if it has been more than 10 years?” Norliza lamented.

Are borrowers not paying because it’s a low priority?

Additionally, Norliza said some borrowers genuinely cannot afford to repay, have lost their jobs, or are facing health issues. However, others are simply unaware of the importance of this responsibility.

“Some also assumed that the repayment of PTPTN loans was a low priority. This is unfair to those who are responsible and committed to repaying, many of whom come from less privileged families.”

She said that PTPTN is conducting in-depth studies to identify the main reasons why borrowers are not making repayments.

To those who have cleared their PTPTN debts, what are your tips to stay financially secure?

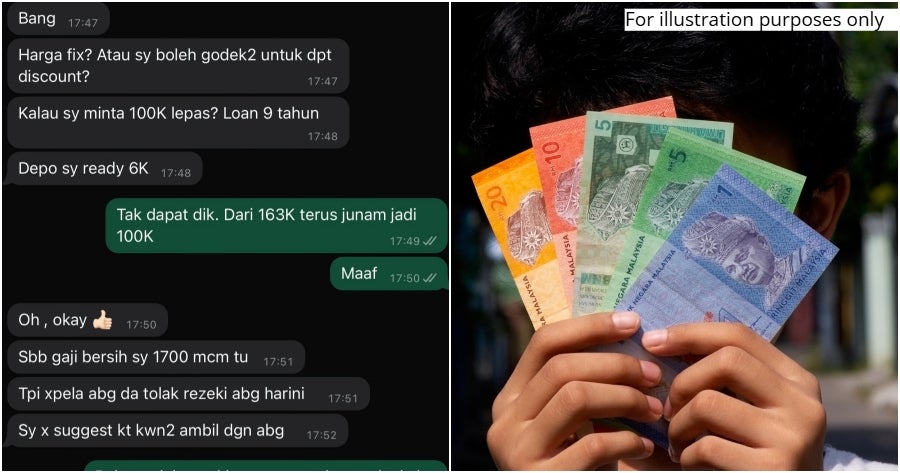

Also read: “Can I have it for RM100K?” – Gen Z M’sian With RM1.7K Salary Wants to Get a Car That’s Worth RM163K