It was recently announced that the Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS) have enabled person-to-person cross-border fund transfers via Malaysia’s DuitNow and Singapore’s PayNow.

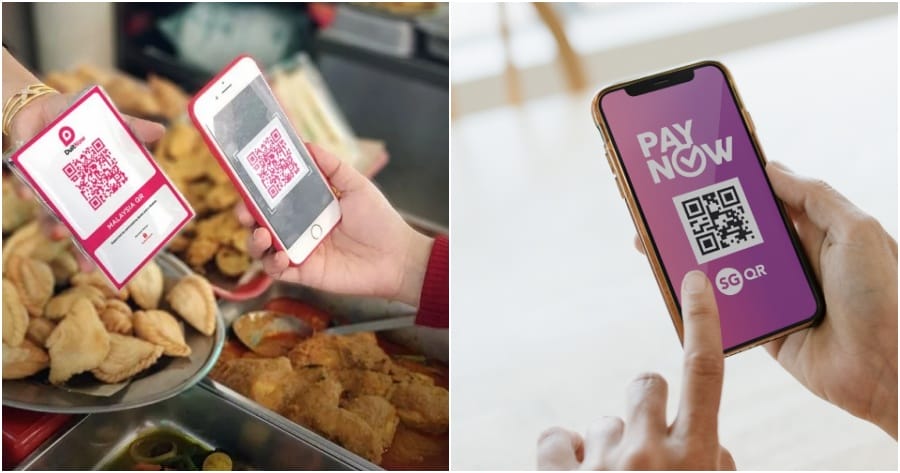

By launching the real-time payment systems connectivity, users of DuitNow and PayNow can transfer funds instantly between the 2 countries by using just the recipient’s mobile phone number or Virtual Payment Address (VPA).

In a statement, the central bank said the initiative follows the QR payment linkage announced on March 31, enabling cross-border QR payments to merchants.

Bank Negara governor Datuk Abdul Rasheed Ghaffour said cross-border payments that are fast, secure, and cost-efficient are beneficial, especially for individuals and small businesses in countries with very close economic ties, such as Malaysia and Singapore.

“The DuitNow-PayNow linkage enables us to reap these benefits towards our shared growth and prosperity while laying the foundations for scalable cross-border payment networks across and beyond ASEAN.”

Meanwhile, the real-time payment systems linkage is also the first to include the participation of non-bank financial institutions from both countries. It provides access to a broader group of users, allowing them to send and receive funds of up to RM3,000 daily using the recipient’s mobile phone number or VPA.

For users in Malaysia, the service will first be available for all Malayan Banking Bhd, CIMB, and Touch ‘n Go Digital users, with other financial institutions gradually onboarded after that.

On the other hand, the service will be made available to Singapore customers of Liquid Group, Maybank Singapore, OCBC Bank, and United Overseas Bank under a phased approach, where these institutions will progressively increase the number of eligible user groups.

“The PayNow-DuitNow linkage is the culmination of a shared aspiration by Singapore and Malaysia to facilitate cross-border payments between our two countries. This linkage represents another step toward ASEAN’s vision for regional payments interconnectivity.”

What do you think of the initiative? Let us know in the comments.

Also read: PM Anwar: DuitNow QR Payment Transaction Fee Won’t Burden Low Income Group