Technology has made many things in our daily life to be way easier than they used to be, like how we don’t need to bring cash when we go out as we can use our e-wallet.

With this technological advancement, more variants of scams have appeared and one Malaysian scam victim shared his story with WORLD OF BUZZ.

Clinton Khor, 27, used to work in the financial sector before taking the leap to further his studies.

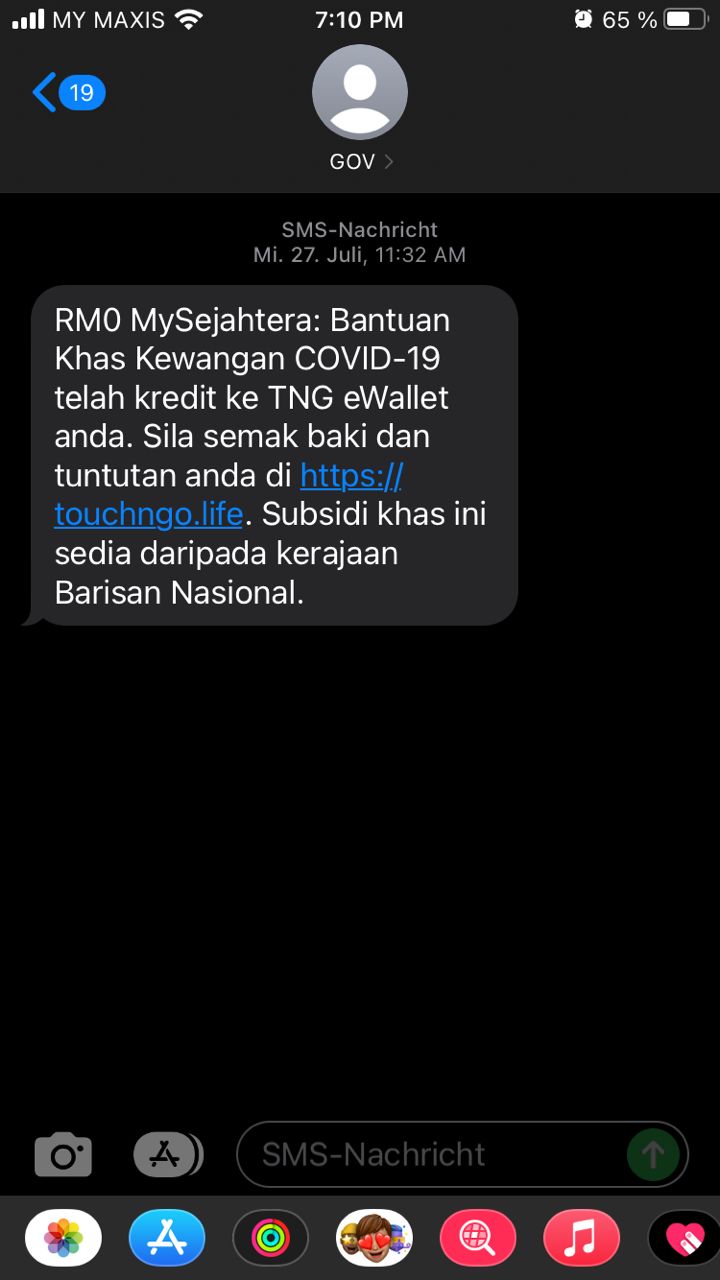

On 27 July, Clinton received an SMS from the sender “GOV” which is short for Government. When he clicked on the contact details, there were no numbers and nothing else was shown.

The message reads:

“RM0 MySejahtera: Bantuan Khas Kewangan COVID-19 telah kredit ke TNG eWallet anda. Sila semak baki dan tuntutan anda di https://touchngo.life. Subsidi khas ini sedia daripada kerajaan Barisan Nasional.”

As it came from “GOV” and nothing seemed amiss, Clinton thought that it was credible and tapped on the link where he was brought to a Touch ad Go E-Wallet login page.

There, he keyed in his login details twice and it resulted in failures. Feeling suspicious, Clinton then came out of the webpage and went into his Touch and Go e-wallet application where he noticed several unauthorised transactions.

“A total of RM4,890.00 (16 transactions) was auto reloaded to my TnG account via my linked Citi Bank credit card and a total amount of RM4,547.00 (in 9 transactions) was transferred via Duitnow to a CIMB Bank account number.”

After seeing those transactions, Clinton called CitiBank to cancel his credit card and refund the money. He called TNG to tell them of the scam, to block his account and to get his money back as well.

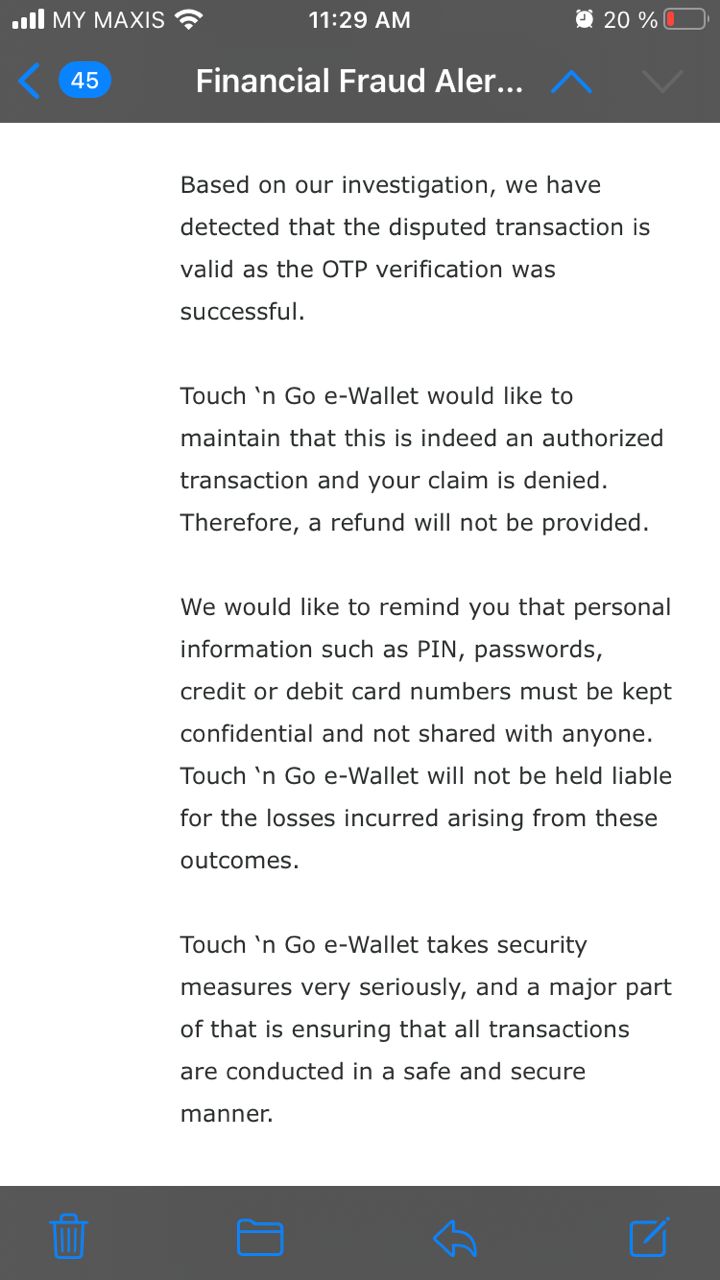

However, TNG declined the 27-year-old’s request because they said that it was an authorised transaction as “OTP verification was successful”.

“An OTP was used to log into my account however there were NO stops NOR checks done during the auto-reload to DuitNow transfer.”

“I only received 2 OTPs on that day, but there were 16 transactions in and 9 transactions out.”

“So the scammer was able to auto-reload and transfer the money without any sort of confirmation.”

Clinton had lodged a police report and Citibank’s investigations are still in limbo.

“I’m not blaming anyone, I just want my money back as it is used to fund my education.”

The student had also said that he believes reversal transactions should be allowed for those who show adequate proof.

“If the banks have all the details of the transaction route, where it came from and where it ended up (which I provided to them), I don’t understand why a credit reversal cannot be done when requested.”

“I know for a fact that banks can put the account in a debit amount if the person who took my money does not have the funds anymore.”

For illustration purposes only.

So, he created a petition asking for financial institutions to allow users to reverse a transaction.

As of the time of writing, the petition has garnered more than 2,400 signatures. Many Malaysians have shown their support for this cause and believe that allowing reversal transactions would be safer for consumers and banks.

“This is why I created the change petition, to speak up and be the voice for those who can’t, those who are ashamed to and those who are silent. Why should the victim suffer?”

If you are interested in supporting this cause, you can do so here.

Also read: M’sians Share That Their Bank Accounts Have Been Approving Unauthorised Transactions