“I can’t wait to be an adult and start earning money!”

The good old times when we expected adulthood to be better, only to find out it was not as easy as our inner child expected it to be. With loans and other commitments staring us in the face every day, life as an adult is filled with challenges and there is no escape for us but to face them for survival.

A Malaysian man recently shared his dilemma after finding out his house loan is far from over, despite paying it for 17 long years. In a Facebook post by Sayu Kampung, the man said he bought the house back then for RM35,000. For 17 years straight, he has been paying RM200 for every month.

For illustration purposes only

“I even withdrew RM11,000 from my retirement funds (KWSP) for the house loan.”

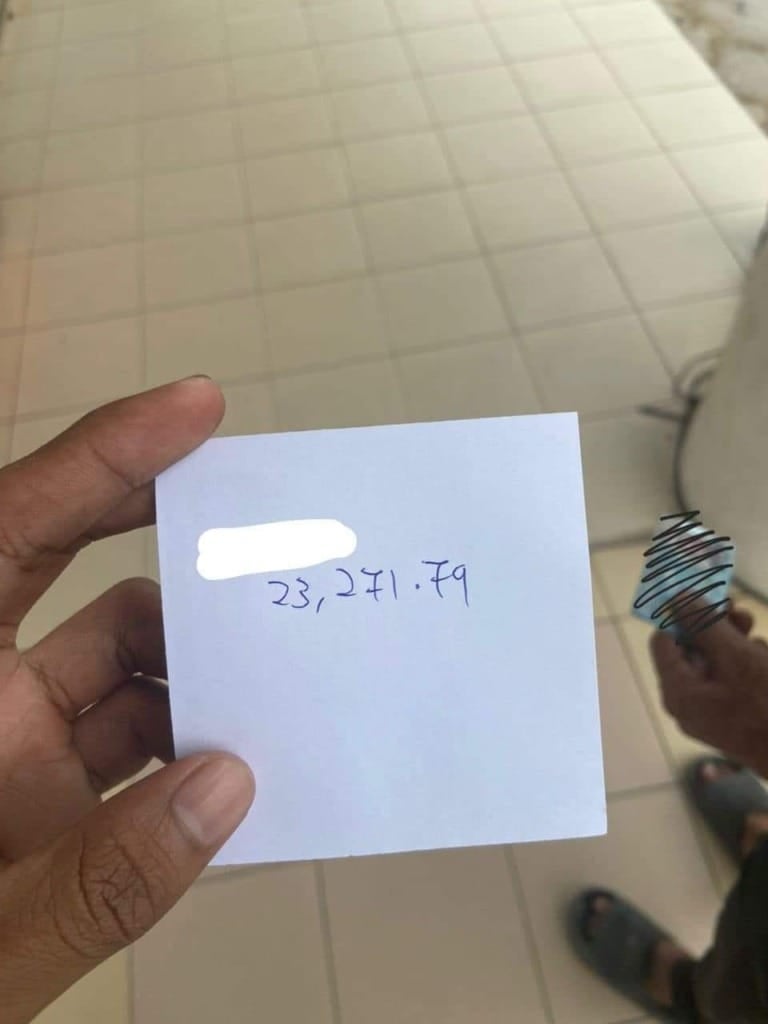

He recently decided to check on the house loan and his visit to the bank left him disappointed.

For illustration purposes only

“I found out that I still have an outstanding balance of RM23,271. By right, I should’ve finished paying my house loan,” the man sighed.

Imagine committing to a loan for nearly 2 decades, only to find out that you still have a long way to go with the loan when you genuinely thought it was over.

“Interests!”

Feeling baffled, the man sought guidance from netizens and asked if anyone else out there was experiencing the same.

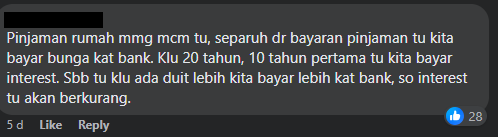

Most netizens pointed out that no one escapes the “grip” of the interest rates that the bank charges.

A netizen explained that’s how a house loan works, with half of the payment going to the interests alone.

“On a 20-year loan, we spend the first 10 paying the interest. If you have extra money, pay more so the interest will be lesser.”

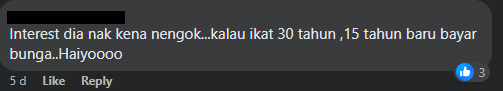

“You have to be aware of the interest rate. On a 3-year loan, the 1st half will be spent on paying the interest alone.”

“If you want to avoid high-interest rates, don’t tie yourself to a long-term agreement. Spend within your means because the explanations should’ve been given in the agreement. There’s no point making a fuss now that you’ve signed it.”

Another netizen suggested he pay twice a month to speed up the settlement.

“1 through auto debit, another 1 through manual payment at the counter.”

Just a reminder to ALWAYS go through the terms and conditions in the agreement before signing any documents. To those who are still in college, enjoy your student life before commitments come knocking at the door.

As for the others, how do you manage your finances to keep yourself on the right track?

Also read: M’sian Lawyer Reveals Many Youths Today Face Bankruptcy Due to Vehicle & Credit Card Loans