You can soon withdraw a part of your retirement fund. Sort of.

KWSP has just introduced 3 accounts, namely the Retirement Account, the Sejahtera Account, and the Flexible Account. The Flexible Account is also known as Account 3, which is an additional account to the existing 2 accounts that all contributors currently have.

Here’s a quick breakdown.

- Account 1 (AKA the Retirement Account for retirement savings)

- Account 2 (AKA the Sejahtera Account, withdrawals allowed for education, health, housing expenses, and more according to KWSP)

- Account 3 (AKA the Flexible account, withdrawals can be made ANY TIME)

With the existence of the Flexible account now, there’s a slight change to the flow of monthly contributions. Here’s what changed.

- 75% goes into Account 1

- 15% goes into Account 2

- 10% goes into Account 3 (this can be withdrawn any time)

According to a statement by KWSP shared on its official website, the balance in the first 2 accounts will remain untouched, and effective May 11, Account 3 will start with ZERO balance. There is a reason why the account restructures happened, and according to KWSP, it’s for the benefit of the contributors.

“The main focus of the KWSP account restructuring initiative is to empower contributors in making decisions to balance future needs for retirement with short, medium and long term financial needs.”

This restructure is aimed at all contributors aged 55 and below. Now, what if you need to withdraw immediately and the occasion doesn’t allow you to wait for future contributions into the Flexible Account?

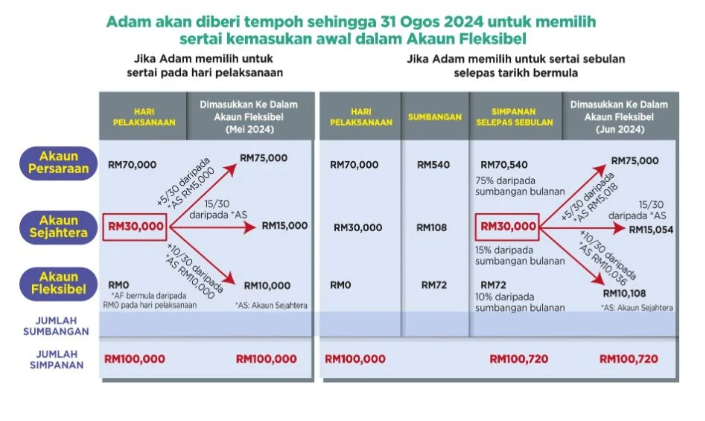

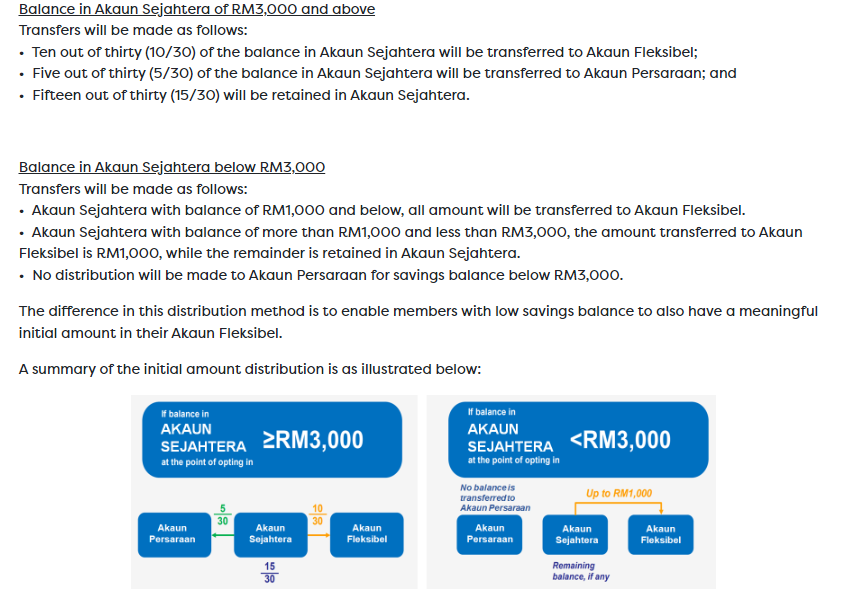

You can choose to opt-in, and here’s what it means, according to the statement.

“The transfer of the initial amount to Akaun Fleksibel and other accounts (if applicable) is based on the balance in the member’s Akaun Sejahtera on the date the opt-in application is made.”

You can refer to the breakdown below for the transfer.

Keep in mind that you can only OPT-IN 1 TIME, starting from May 12 until August 31, 2024. You can do so at any KWSP branch or simply through the i-Akaun phone application. You can read more about the details in the statement.

What do you think of this restructuring? We would also like to remind contributors to withdraw only if it’s necessary, and spend the money wisely.

Also read: “Riding motorcyle to work, job hopping” – 45yo M’sian Already Has More Than RM1 MILLION in KWSP