Malaysians are changing the way they think about “home,” as months spent weathering the COVID-19 outbreak and various Movement Control Orders (MCOs) cause them to re-evaluate the way they live and work – the much-talked-about “new norm”.

These changes are particularly relevant for younger Malaysians. A recent study by PropertyGuru, Malaysia’s largest property site, found that enforced isolation during the MCO has spurred a new wave of homeownership aspirations among renters and those staying with family. But are such aspirations a pipe dream, given the economic hardship brought about by the pandemic?

Rebuilding after the storm

The question is a crucial one, as unprecedented employment and income loss put the spotlight on bread and butter issues. Against this backdrop, the spectre of recession looms, with the conclusion of the first phase of Bank Negara Malaysia’s financing moratorium in September seen as a key breakpoint for the nation by analysts.

The good news is that developers aren’t sitting idle, and the property has historically adapted well to periods of crisis. While this is undoubtedly a challenging time for home seekers and the nation as a whole, renters and first-time purchasers can look forward to and leverage on the following trends in the new norm:

1. Property is getting cheaper

This may seem strange, as conventional wisdom is that property serves as a store of value in times of crisis. Wouldn’t decreasing prices contradict this?

The answer is that prices may decrease in the short term, while increasing in the long term. This is in fact the ideal scenario for purchasers. It means they can pick up cheaper properties as developers adjust prices post-MCO, without sacrificing long-term appreciation.

Another way property is becoming cheaper is that developers are building smaller. This means that even if prices go up, say from RM600 PSF to RM800 PSF, young purchasers can opt to start with a 450 sq ft studio, instead of an 800 sq ft family unit, for an entry price of RM360,000 instead of RM640,000.

This works out well for young home seekers, who tend to prioritise location and lifestyle over raw square footage. Meanwhile, developers can maximise smaller parcels available closer to urban centres.

Finally, the return of the National Home Ownership Campaign has placed downward pressure on prices. This applies not just to participating projects with 10% discounts, but to other offerings in the market competing with them as well. If you’re in the market for a good deal, it’s easy nowadays to shop for properties below certain price points.

2. Lower entry barriers point towards a bull run

Again, this may seem counter-intuitive, as home loans may seem harder to come by than ever as banks assess employment and income risks post-MCO. However, banks now have unprecedented liquidity and are offering historically low-interest rates, thanks to concerted Overnight Policy Rate and Statutory Reserve Requirement reviews.

In other words, banks are more able and eager to lend than ever. They are still exercising due diligence, though, and the emphasis here is on quality borrowers. For younger home seekers, this is the primary hurdle.

The PropertyGuru Malaysia Consumer Sentiment Study H2 2020 shows that renters, those who live with parents and middle-income demographics have the most difficulty securing home loans. Poor credit histories, down payments and unstable income, are commonly cited as key issues.

Thankfully, home loan solutions exist to help applicants better understand their home loan eligibility, along with housing programmes catering for a variety of income backgrounds. With prudent financial management, homeownership is still within reach for many Malaysians.

These factors, along with increased interest in property among investors during crisis periods and new wealth generated among some segments during the pandemic, point towards a bull run for property post-recovery. Home seekers with the leverage to purchase or invest during this period will benefit from these market movements.

3. Responsible co-living as a game-changer

Addressing perennial issues of affordability and rising land costs, co-living as a concept also answers an emerging problem in urban areas: social isolation. The irony is that as urban populations grow, some Malaysians feel less connected to their neighbours and the communities around them.

Co-living has already found its way to the domestic market. Current projects focus on the “hardware” side of the concept, primarily in terms of shared facilities, similar to co-working spaces. However, the social issues discussed above arise from the “software” of current developments – the people factor.

As such, co-living moving forward should emphasise the engineering of social interaction, within social distancing guidelines. This includes the organisation of activities for residents who wish to participate, with appropriate health safeguards and the goal of increasing social inclusion through shared interests, as practised in communities such as Youtopia.

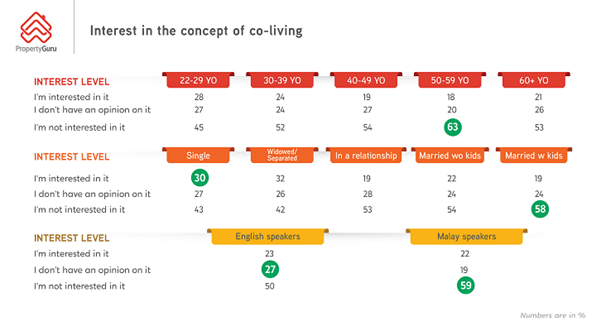

These trends have existed since before the COVID-19 outbreak, and will remain relevant in the new norm. As homeownership evolves in urban environments, co-living must evolve as well. This is underscored by healthy demand among Malaysians for the concept, with one in four respondents in PropertyGuru’s Consumer Sentiment Survey H2 2019 reporting interest. These sentiments were higher for widowed/separated individuals and young singles.

In short, homeownership is changing, and part of that change includes catering for the needs of younger home seekers. While that doesn’t mean buying a home will be as simple as running to the grocery store, it is far easier than it has been in the past.

With sufficient financial literacy and diligence, as well as an ever-increasing array of property options, tools and information sources available, homeownership is far from impossible in the new norm.

Source: Faizul Ridzuan, CEO, Far Capital

Also read: M’sian Reveals How He Got Kicked Out Of Rented Subang Unit Once Owner Found Out He Was Indian