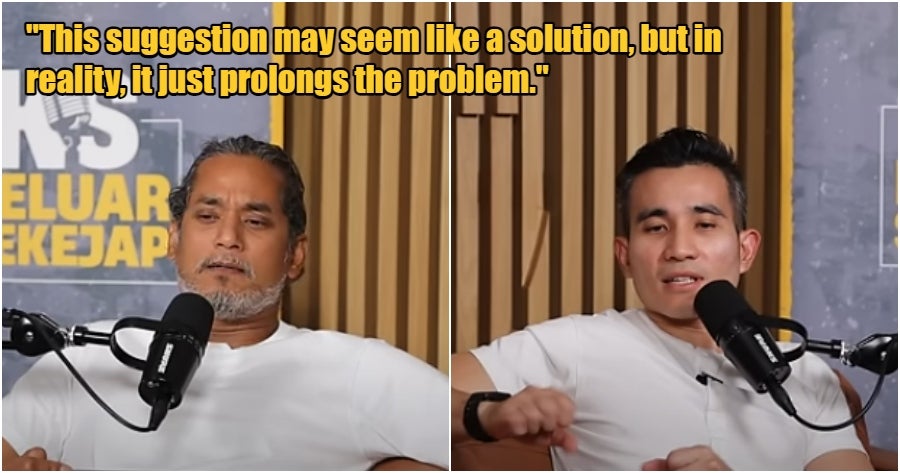

Second Finance Minister Amir Hamzah Azizan recently appeared on the ‘Keluar Sekejap’ podcast hosted by Khairy Jamaluddin and co-host Shahril Hamdan.

Speaking as a guest on the podcast, Amir Hamzah Azizan revealed that the government has no intention of bringing back the Goods and Services Tax (GST) anytime soon.

“GST is far-reaching and affects everyone”

This came in response to a question from Shahril, who asked whether it would be easier to implement a more comprehensive tax system like GST, which could potentially generate more revenue for the government to channel back to those in need.

Amir explained that the decision was mainly because reintroducing GST is “impractical” under the current economic conditions.

“Existing and new businesses have already adapted to alternative tax structures since GST was zero-rated in 2018. Because of that, fully bringing it back could take at least another two years,” he said.

He added that the government has never rejected the GST system itself, but believes now isn’t the right time to bring it back.

“It should suit Malaysia’s current economy”

Amir added that the government believes any tax reform must be practical and suited to Malaysia’s current economic structure.

He also acknowledged that companies tend to favour GST because of the input-output tax mechanism, which allows them to claim back what they charge.

“But ultimately, the burden still ends up on the people. When we implement a tax, we need to ask ourselves: is the revenue we collect worth the effort?”

You can watch the discussion starting at the 23:20 mark:

What are your thoughts on this? Let us know down in the comments!