Southeast Asia seems to be in focus as the region is recently experiencing multi-dimensional changes. With the increased usage of internet trading platforms, there has been a noticeable growth in the number of online forex traders, which has gradually started to define new changes in the trading landscape to an extent where young, enthusiastic traders are making their way into the digital trading ecosystem. These positive trends indicate the shift of the region toward new investment opportunities.

Both novice and expert traders from Southeast Asia have greatly embraced the opportunities provided by the forex market in recent years as its popularity continues to rise. In addition, let’s examine some of the key trends responsible for this growth and see how these trends will advance in the future and transform investment possibilities in the region.

How Popular Forex Trading Has Grown in Southeast Asia

The volume of forex trading in Southeast Asia has expanded considerably. According to statistics, Malaysia, Thailand, and Indonesia are leading countries in terms of the number of forex traders. An International Monetary Fund report (2023) revealed that forex trading volume in Southeast Asia surged by 15% in the last five years, showing the underlying demand for investment forex trading in the region.

The ease of access to online trading platforms has notably contributed to this increase. Trading has been made easier than it has ever been because technology is now part of everyday life. The forex market is not only reserved for professional traders and capital-rich individuals anymore; now, anyone with an internet connection can participate. In fact, ADB data indicates that active traders in Southeast Asia have more than doubled in the last three years.

Cumulatively, these shifts mirror trends of participation in the region’s forex market and indeed, the fastest growing financial market in the world, is also the Southeast Asia Forex market. It is cardinally important to note that the overwhelming portion of trading that nowadays surpasses $6 trillion a day worldwide, signifies the constantly growing portion of Southeast Asia in the pie, strengthening the region’s position in international prospective financial markets.

Southeast Asia Market: An Untamed Frontier

As traders from different backgrounds start using online trading platforms, the forex trading industry is adapting to these changes. Young traders, for instance, can now access myriad mobile apps and desktop trading platforms with ease. The proliferation of MT4 and MT5 trading software has increased the appeal for young traders who are tech-savvy. They are favourable for MetaTrader 4 and 5-powered brokerages that offer DIY/ self-service trading.

The implementation of such technology has resulted in a rise of Millennial and Gen Z traders from Southeast Asia looking for new ways to diversify their investment portfolios. Moreover, forex trading is arguably one of the leading options at hand. In fact, a Statista survey conducted in 2024 shows that 45% of Southeast Asia’s young population aged between 18-35 expressed willingness to start trading.

So, where do these novice traders begin their journey from? Start off should be straightforward, as practically every trading website these days offers step-by-step instructions on simple account creation.

Practically provided to fledgling traders is a demo account where they can fine-tune their trading tactics without risking their finances. After who knows how long, traders can confidently access real trading accounts which, from what I know, provide a plethora of options in terms of funding, catering to traders of all financial standings.

The role of modern-day educational materials can similarly not be neglected when it comes to novice traders. Many trading platforms provide additional resources in the form of free webinars or tutorial videos. These resources underline the importance of basic forex trading tutorials. Student traders are encouraged to utilise these materials to familiarise themselves with essential market trends and risk mitigation techniques.

People who are looking to know more about how to start forex trading require a stepwise guide that begins with creating an account on any such platform, and thereafter, selecting the optimal account that aligns with their requirements.

From that particular point on, traders are free to experiment as much as they want with navigating currency pairs, implementing countless strategies, and leveraging different types of sophisticated market analysis tools before employing substantial amounts of money.

Tips for Beginners in Forex Trading

An enthusiast stepping into the domain of forex trading for the first time would certainly feel a mix of anticipation and overwhelm. The forex market is characterised by high volatility, which in a way captures its opportunities and risks as well. The right knowledge and properly devised strategies can help novices take calculated steps towards building their portfolio over time.

One primary thing to emphasise is that it’s a must for one to undergo educational training in forex currency trading or simply have a good understanding of it. Getting acquainted with the fundamental concepts, algorithms involved within trades, edges like pips, spreads, and margin trading, currency pair quotation systems, and global economy effects on such systems is crucial for success within trading.

In addition, trading small amounts or learning the ropes through demo accounts is an effective way of tackling it and makes a good learning experience for them. Each new trader’s entry into the true world dynamics must consider the premise of successfully eliminating the risk of learning disparity. Every new beginner trader should always aim to master the strategy of reducing risk and maximising learning.

Risk management is also important while trading forex. Placing stop-loss boundaries and the decision to exit a specific trade are critical components in minimising the losses incurred. Forex trading carries some level of market uncertainty, so establishing clear boundaries on winning and losing trades is essential for reducing financial losses.

For someone new to this, it can be helpful to learn from more seasoned traders through online trading communities or mentorship programs. Learning from other people’s experiences helps avoid blunders.

Southeast Asia is set to become a more significant global player in the forex market due to its growing online trading platforms. Forex trading will significantly affect the investment landscape in Southeast Asia as the youth continue to participate.

To sum up, as forex trading keeps booming in Southeast Asia, it is vital for novice and professional traders alike to remain updated, exercise patience, and manage risks properly. With the correct methods, this emerging new market has heaps of opportunities, and the rewards are promising for forex traders who invest time and effort into learning how to traverse the forex world wisely.

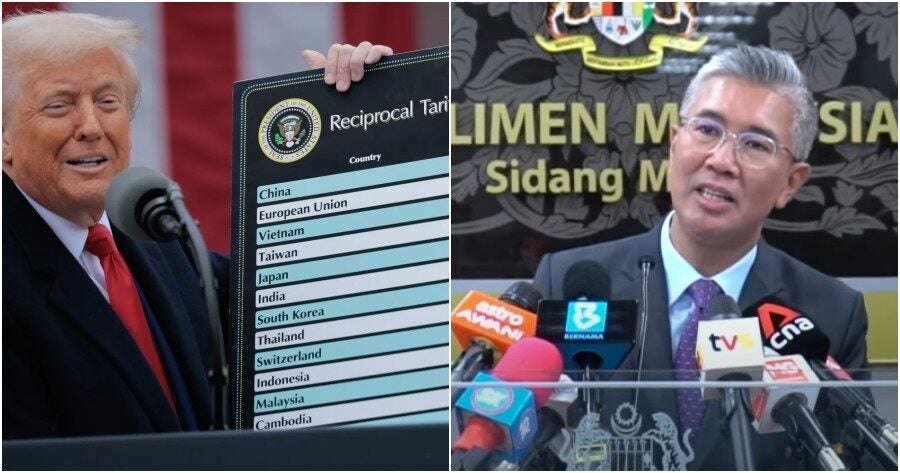

Also read: “We want zero tariffs” – Tengku Zafrul Lists Washington’s Demands to Reduce Tariffs Against M’sia