The KWSP withdrawal earlier this year has undoubtedly helped a lot of Malaysians to ease the burden off of their shoulders. Looking at the financial benefits that it has brought upon the rakyat, Perikatan Nasional (PN) promised that if they win in the upcoming GE, another round of KWSP withdrawal will be possible.

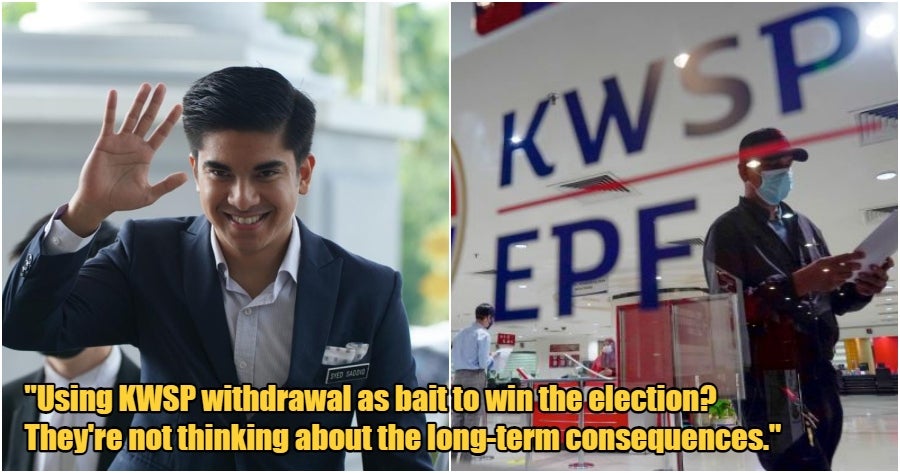

It is certainly great news for people who need major financial help, but is that really the only way left to solve one’s financial crisis? As for Syed Saddiq, he does not think another round of withdrawal of the retirement fund is a wise move.

“The more withdrawals made, the longer you need to work”

The funds in KWSP is undoubtedly our own money but Saddiq said that the parties who use KWSP withdrawal as bait to win the election are not thinking about the long-term consequences.

“It helps in the short-term goals, but do they not think about the long-term impact that it will bring to the rakyat?”

The co-founder of MUDA also said that it is concerning that there are parties who use KWSP withdrawals as “election candies” to gain votes from the rakyat without taking into account the repercussions that will follow for the EPF contributors.

Months ago, KWSP themselves revealed that if you are planning to retire in 30 years’ time, a fund of around RM900,000 to RM1 million should be safe and sound in your KWSP account. This also means that the more withdrawals we make, the longer we need to (continue) work as the funds in our accounts decrease. Not only that, but a few conditions that are bound to happen also make KWSP withdrawals seem to be a bad idea, namely,

- No more subsidised food

- The increased cost of raw materials

- OPR rates that go up every 2-3 months.

In his Facebook post, Saddiq said that according to data by KWSP, 52% of EPF contributors have less than RM10,000 in their account while 27% of them have only as low as RM1,000 in their retirement funds.

“I strongly disagree with using KWSP withdrawals as a promise in the election. This is irresponsible,” Saddiq emphasised.

Peratusan penyimpanan KWSP adalah pada kadar yang sangat membimbangkan.Sebelum ini pihak KWSP mendedahkan sebanyak 52%…

Posted by Syed Saddiq Syed Abdul Rahman on Sunday, November 6, 2022

This makes us wonder, while the i-Lestari, i-Sinar, and i-Citra withdrawals in the past have eased some Malaysians a lot, what does this mean for the EPF contributors in the future, financially? Will they be forced to work longer, even past their retirement age in the future? Do you agree with Saddiq’s take on the implications of another KWSP withdrawal?

Also read: Here’s Why It’s Not A Good Idea To Rely On KWSP Withdrawal Every Time Disaster Hits