Boost Bank by Axiata and RHB (Boost Bank), a homegrown digital bank approved by Bank Negara Malaysia (BNM) and the Ministry of Finance (MOF), today announced the launch of its app, with a pioneering embedded onboarding journey, that is now officially open to the public.

A unique feature is the fact that all existing Premium Wallet users on the Boost eWallet app, will be able to easily open a Boost Bank account in a seamless onboarding process. This positions Boost Bank at the forefront of embedded banking, that conveniently syncs with Malaysians’ daily routines. The Boost Bank app is now available for download on the Apple App Store here and Google Play Store here.

Revolutionising Financial Access for the Unbanked and Underbanked

Boost Bank is one of the few banks in Malaysia that will enable users who do not have an existing bank account to be digitally onboarded. This is in line with our founding mission of reaching out to the underserved and unserved sectors of society.

The unique partnership between Boost and RHB Banking Group (RHB), positions Boost Bank as the first digital bank in the market to merge the technology-first mindset of a fintech with the trust and stability of a large financial institution. This synergy ensures that users enjoy the best of both worlds — innovative financial solutions delivered with the agility of a fintech, whilst providing the reassurance and reliability of a well-established banking institution.

In addition to Boost Bank’s captive ecosystem, we will also be leveraging marquee partners that we’ve grown with over the years, to take our propositions to the market. In the coming months, some partnership promotions that users can look forward to across both West and East Malaysia include CelcomDigi, MYDIN, Bataras Sdn. Bhd., CKS RETAIL Sdn. Bhd., FARLEY (KCH) Sdn. Bhd., Servay Hypermarket (Sabah) Sdn. Bhd., and Boulevard Hypermarket and Departmental Store Sdn. Bhd.

Through these partnerships, Boost Bank will meet the financial needs of the underbanked and unbanked by providing rewards and savings on daily necessities. Users can also expect higher promotional interest rates to be announced soon, for users who transact with our launch partners.

Securely Maximise Your Savings with Boost Bank

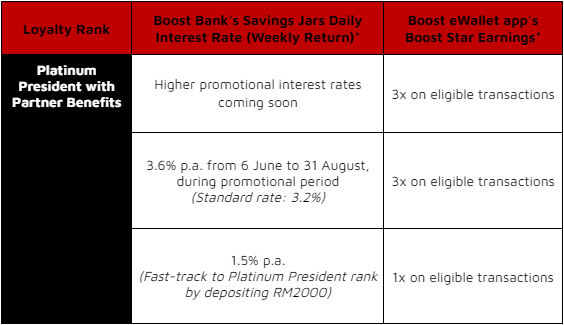

Boost has an existing and award-winning loyalty program for many years, known as the BoostUP Loyalty Programme, that has been well-received in the market. As one of our key value propositions, we are launching a new exclusive rank called “Platinum President” for users who open a Boost Bank account and fulfil certain criteria*. All users need to do is simply deposit a minimum of RM2000 into the Boost Bank’s Savings Jar and/or Savings Account, where they can receive promotional daily interest rate of up to 3.6% p.a. from now until 31 August*.

After the promotional period, the daily standard Savings Jars interest rates will be 3.2% p.a. for Platinum President users*. Those that rank up to Platinum President on the Boost Bank app will be automatically upgraded to the highest rank on the Boost eWallet app as well to earn up to 3x Boost Stars for every ringgit spent on eligible transactions, upon successful linking of the two apps*. This is a unique opportunity for users, even those with lower ranks, to immediately leapfrog to Platinum President by embracing our digital bank.

There will also be upcoming partnership offers and additional rewards in the coming weeks with one of our launch partners, MYDIN, whereby users can potentially earn higher promotional interest rates with Partner Benefits on Boost Bank’s partners’ Savings Jars*. Funds on the Boost Bank app can be utilised to perform DuitNow transfers, including to the Boost eWallet app, where it can be used to conduct QR code payments and online transactions nationwide*.

Furthermore, in compliance with regulatory standards, each deposit is protected by the Perbadanan Insurans Deposit Malaysia (PIDM) for up to RM250,000*. PIDM provides assurance for users that their funds have a safety net, even during economic crises or unforeseen circumstances.

To safeguard users’ accounts, the Boost Bank app has implemented the ‘Freeze Account’ for emergency situations, ‘Device Binding’ for access control, and ‘Cool-Off Period’ for new device logins, as part of its comprehensive security measures. As an added layer of defence, the digital bank is also supported by a 24/7 Fraud Hotline at +60162999831. These safety measures are in place to enable users to protect their accounts conveniently and quickly if they suspect unauthorised malicious activities.

Vivek Sood, Group CEO and Managing Director of Axiata Group Berhad, shared: “At Axiata, we are dedicated to growing an inclusive and robust digital banking ecosystem in Malaysia. The launch of Boost Bank is a key milestone as we improve accessibility of financial services for the people of Malaysia. Through Boost Bank, our goal is to enrich the digital banking landscape for those with limited to no access to traditional banking, thus advancing towards a more inclusive digital society. Boost Bank will complement the availability of financial products on top of existing Boost eWallet app’s fintech features. As Axiata progresses on our Telco-TechCo journey, we remain focused on enhancing our offerings to consumers in digital businesses and creating sustainable value for our shareholders.”

Sheyantha Abeykoon, Group CEO of Boost, said: “Today marks a pivotal moment at Boost, as we fully realize our vision of becoming a full-fledged digital bank, and become the first in market that integrates embedded banking effortlessly, and is a testament to the robust fintech ecosystem and track record of excellence we’ve established. By drawing on diverse learnings from across our business, Boost Bank is poised to deliver an unmatched banking experience that intuitively integrates into our users’ daily lives, meeting their needs and cultivating deep, meaningful relationships. The future we envision at Boost Bank is one where financial empowerment is guaranteed for all, with our ongoing innovations and strategic partnerships serving as the foundation towards this transformative vision.”

Fozia Amanulla, CEO of Boost Bank, added: “This journey, years in the making, culminates in a moment of immense pride for our innovative team as we successfully launched Boost Bank today. At the heart of our innovation lies a commitment to pioneering a movement where digital banking is empowering every individual with financial tools that are as intuitive as they are impactful. Through our synergy with Boost’s technological expertise and RHB Banking Group’s rich legacy, we are offering more than just banking services, but a financial journey that’s seamlessly integrated and profoundly accessible. For us, keeping our users in mind has been the cornerstone that guided every aspect of our user journey design, when developing the Boost Bank app.”

Mohd Rashid Mohamad, Group Managing Director/Group Chief Executive Officer of RHB Banking Group, stated: “We are honoured to be part of this historical milestone, which marks a new era in Malaysia’s financial services landscape. Boost Bank represents more than just digital banking; it signifies the creation of a resilient and inclusive financial ecosystem. Together with Boost, we are pioneering a path that embraces innovation and addresses evolving customer needs, particularly those of the underserved and unserved communities. The Boost Bank app will bridge financial inclusion gaps by providing our customers access to digital financial services that are agile and, more importantly, secure. This endeavour underscores RHB’s unwavering dedication to enhancing our digital propositions and fostering financial inclusivity for all Malaysians, in alignment with our Sustainability Strategy and Roadmap which aims to empower more than two million individuals and businesses across ASEAN by 2026.”

Exciting Proposition to Look Forward to

As the digital bank continues to grow, Boost Bank will expand its digital bank app features and solutions to better serve the needs of all Malaysians. An upcoming product development that is already in the pipeline, which users can look forward to, is the Debit Card.

The Boost-RHB Digital Bank Consortium, in which Boost holds 60% equity, and RHB owns the remaining 40%, was among the five successful license applicants announced by BNM in April 2022, which then commenced operations following the official regulatory approval earlier this year on 15th of January 2024.

For more information, please visit Boost Bank’s website here.