A home is by far the biggest investment in our lives and for most, unfortunately, owning a house in Malaysia seems like an unattainable dream these days. With a staggering 60% of home loans being rejected last year, this is definitely a worrying trend that needs rectification.

So why is it so hard to get a home loan approved? In order to find out, we got in touch with a few Malaysians who have had their application rejected last year to share their predicaments. Here are their stories.

1. Having an unstable income and non-existing credit score

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 9](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-10-1024x724.jpg)

Source: teoalida

For Faris, a 24-year-old Front of House Supervisor at a 5-star hotel, it is his dream to own a house and has been saving up for it ever since his University days. Frugal in his expenditures and stuck with his old motorbike to commute even though he can afford a new car, he found the perfect house under RM250,000 on sale last year and made an offer.

However, even though he is more than capable to pay the 10% downpayment, his home loan was rejected and could only watch by as the house was sold to another suitor. The bank explained that his basic salary was too low even though his monthly income was sufficient for the loan.

“My salary was around RM3,700 per month. However, as with many in the hospitality industry, our basic salary is much lower than that as we implement the service point system.”

What this means is that:

- His monthly salary fluctuates according to his hotel’s revenue each month.

- The only constant is his basic salary which at the time was only RM1,000.

- Banks do not see the service point system as an additional fixed monthly allowance.

- Thus he is categorized as having an unstable income and needs to put a higher downpayment for the application to go through.

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 7](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-8.jpg)

Source: bizjournals

Furthermore, the bank also clarified that he had no credit score history. Having no credit card, car loan or even a student loan in the past, the bank explained that there was no repayment trend that they could refer to in order to justify the loan.

“It is really ironic that my cautious financial habit contributed to my home loan being rejected when I did it to save up for the house in the first place.”

Not deterred, Faris recently accepted a better offer at another hotel after making sure that they provide higher basic pay. He found another house listing on PropertyGuru and even got his home loan Pre-Approved via the site. Hopefully, he won’t be disappointed a second time!

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 14](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-15.gif)

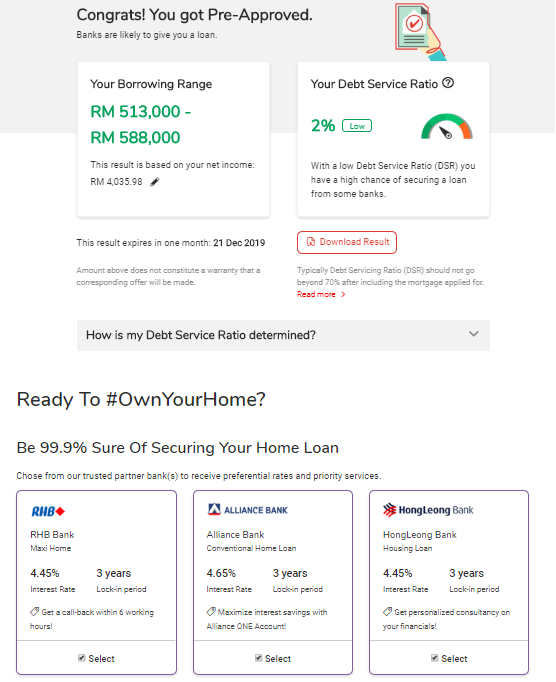

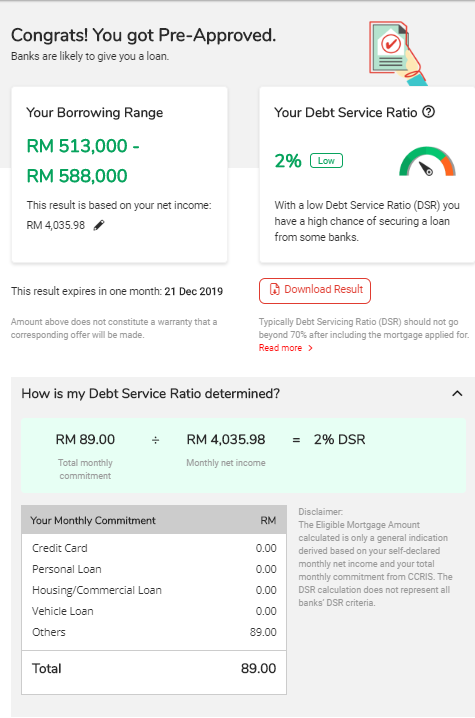

In case you’re wondering, yes, you can actually get your home loan Pre-approved with PropertyGuru. Southeast Asia’s pioneering and most trusted property technology company, they have made it their life’s mission to empower Malaysians to own their own home and through a revolutionary new tool called PropertyGuru Loan Pre-Approval, the process takes less than 5 minutes!

The first of its kind, PropertyGuru Loan Pre-Approval helps Malaysians to avoid loan rejections and be 99.9% sure of home loan approval!

Sounds awesome! Read on until the end of the article to find out more about PropertyGuru Loan Pre-Approval and how it can even securely check your DSR score without any charges.

2. The seller or developer is blacklisted

![[Test] Malaysian Bank Loan Executives Share Why They Rejected More Than Half Home Loan Applications - World Of Buzz 9](https://worldofbuzz.com/wp-content/uploads/2019/04/test-malaysian-bank-loan-executives-share-why-they-rejected-more-than-half-home-loan-applications-world-of-buzz-10.jpg)

Source: apuy-puye

Vanessa, a 28-year-old video producer has been renting a house with her husband for the past 2 years and felt like last year was the right time to own a place of their own. They found a 2 storey house near Kajang up for sale and quickly got in touch with the owner. A price was fixed and a pre-agreement was made.

With a combined monthly household income of RM15,000, their financial record is superb. However, their home loan still got rejected. The reason? The owner of the house was bankrupt and blacklisted by the Credit Tip-Off Service (CTOS).

“We were really lucky as we only entered into a pre-agreement and did not sign a Sale and Purchase Agreement contract!”

As per Malaysian law, anyone who is declared bankrupt is barred from:

- Making any deals or transactions regarding their properties!

- It is also illegal for them to enter into a Sale and Purchase Agreement without prior consent from the Insolvency Department.

- However, this also depends on the number of assets he has in comparison to his liabilities.

That’s why it is very important to do a background check on the sellers and developers before entering into an agreement.

“Good thing we never gave any downpayment or deposit to the property owner or we might have lost it!”

![[Test] Malaysian Bank Loan Executives Share Why They Rejected More Than Half Home Loan Applications - World Of Buzz 11](https://worldofbuzz.com/wp-content/uploads/2019/04/test-malaysian-bank-loan-executives-share-why-they-rejected-more-than-half-home-loan-applications-world-of-buzz-12.jpg)

Source: Malay Mail

3. The bank evaluates the property differently than the seller

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 8](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-9-1024x683.jpg)

Source: Todayonline

Divinish, a 30-year-old Human Resource manager did not face the same issue as Vanessa but his home loan application was also rejected due to complications from the seller’s side. He found the perfect house in Shah Alam that is at a prime location and most importantly near his office.

Although a bit pricey, he met the owner and agreed on the price. Well, a sub-sale house in a prime location should be worth it in the long term even if it’s a little overpriced, right? The bank didn’t share his opinion though.

“When I went to the bank to finance the purchase, they evaluate it much lower than I expected; RM50,000 lower to be exact!”

Each bank has their very own property evaluator and none of the banks he enquired would justify the financing amount that he was asking for the house. Divinish was left with the options of either forking out a substantially larger downpayment or negotiate a lower price with the seller.

“The seller would not budge from her initial asking price and after much deliberation I do not find it worth it to fork out such a large sum for just a downpayment.”

4. A Debt-Service Ratio (DSR) score that is too high

![[Test] Malaysian Bank Loan Executives Share Why They Rejected More Than Half Home Loan Applications - World Of Buzz 15](https://worldofbuzz.com/wp-content/uploads/2019/04/test-malaysian-bank-loan-executives-share-why-they-rejected-more-than-half-home-loan-applications-world-of-buzz-16.jpg)

Source: The balance

With a salary upwards of RM4,000, Chloe was pretty confident in her chances of having her home loan approved. After all, it was only a 3 bedroom apartment in the outskirts of Kuala Lumpur that was well within her budget. What she didn’t know was that she had a high Debt-Service Ratio (DSR) which resulted in her home loan being straightaway dismissed by the bank.

“I was pretty shocked when the bank rejected my application as I always pay my bills and commitment on time.”

However, Chloe later realized that one’s DSR score is unaffected by how prompt your repayments are (that is credit score), but instead on the amount of monthly commitment you have.

Specifically, it’s a method used by banks to calculate whether or not you can afford the loan you’re applying for which is of the utmost importance when applying for a loan.

Here’s the formula used to calculate DSR:

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 6](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-7.png)

Each bank has its very own DSR evaluation but you should ideally keep it within the 60% range. Your monthly commitments include bank debts (car loan, credit card bills, and personal loans.) and non-bank debt (PTPTN loan etc.).

As for Chloe, her DSR score hovered around the 80% range which is higher than what was allowed by the bank she applied for.

“I never knew my monthly commitment would add up to be that high!”

![[Test] Malaysian Bank Loan Executives Share Why They Rejected More Than Half Home Loan Applications - World Of Buzz 10](https://worldofbuzz.com/wp-content/uploads/2019/04/test-malaysian-bank-loan-executives-share-why-they-rejected-more-than-half-home-loan-applications-world-of-buzz-11.jpg)

Source: Freepik

Well, with PropertyGuru Loan Pre-Approval, you can actually check your DSR score and find out exactly how much the bank will loan you. Plus, it takes less than 5 minutes and even helps you get your home loan Pre-Approved!

The only bank-preferred loan solution, PropertyGuru Loan Pre-Approval can help you:

- Be sure of how much home loan you can get from the bank.

- Verify your eligible loan amount online instantly.

- Get better bank rates and save more!

Here’s how you can get Pre-Approved in just 5 mins and for FREE:

1. First, fill in your basic details

2. Next, fill in your monthly income by entering your basic, fixed and monthly income deduction.

Not too sure about them? Just click the “i” after each category and PropertyGuru will clarify what you should be filling in that tab.

3. Finally, upload a photo of your MyKad for verification by following the mentioned do’s and don’ts.

Unlike other DSR or loan calculators out there, PropertyGuru Loan Pre-Approval provides you with the most accurate indication of how much banks will lend you! This is a result of the secure access PropertyGuru has to your credit information hence why verification of your MyKad is needed.

You’ll get your eligibility result with the price range of the home loans that you’re eligible for as well your DSR score!

What’s more, you can straight away find homes within your financial range through PropertyGuru trusted properties listing as well as the most preferential interest rates on your home loan from various banks.

You can even see the breakdown of your DSR score including your current monthly commitment when you expand your result at the bottom.

As you can see, WORLD OF BUZZ only has an RM89 monthly commitment, hence our credit score is super awesome at just 2%.

Ground-breaking right? PropertyGuru Loan Pre-Approval is the only way to secure your home loan! Get Pre-Approved here.

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 11](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-12.jpg)

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 13](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-14-1024x1024.jpg)

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 1](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-2.png)

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 2](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-3.png)

![[Test] Young, Successful &Amp; Renting? M’sians Share The Surprising Reasons Why Their Home Loans Were Rejected - World Of Buzz 4](https://worldofbuzz.com/wp-content/uploads/2019/10/test-young-successful-renting-msians-share-the-surprising-reasons-why-their-home-loans-were-rejected-world-of-buzz-5.png)