It doesn’t take an expert to know that marriage is a life-changing phenomenon for many, kan? Marriage not only helps you gain a lifelong partner; it also teaches you compassion, the importance of commitment and guarantees oneness with another human being!

So if you’re a husband looking to support and provide financial security for your wife, then here’s how the Employees Provident Fund (EPF) can get you covered on that end!

Husbands can now transfer 2% of employee share contribution to their wives’ Employees’ Provident Fund (EPF) accounts with EPF’s i-Sayang initiative!

Launched in collaboration with the Ministry of Women, Family and Community Development (KPWKM), the i-Sayang initiative was introduced during International Women’s Day 2023 to empower women’s rights and ensure the financial peace of mind of married couples in the long run!

To better understand how i-Sayang works, here’s how you can benefit!

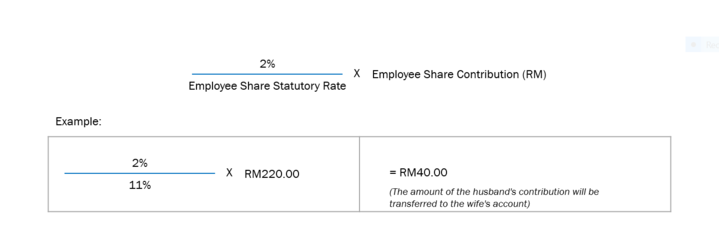

2% of the husband’s employee share contribution goes straight to the wife’s EPF account!

When the husband (contributor) registers for i-Sayang, 2% of the monthly employee share contribution received from his employer will be transferred to his wife’s (recipient) EPF account.

To illustrate, here’s an example of how the i-Sayang contribution will work:

- Husband’s wages: RM2,000

- Employee share statutory rate: 11%

- Employee share contribution amount: RM220.00 (11% of RM2,000)

- i-Sayang contribution amount: RM40.00 (2% of RM220.00)

With this formula in mind, this means that the wife in the example will get RM40.00 transferred to her EPF account monthly! Meaning that if your wage is higher than in this example, you’ll be able to contribute more to her account thanks to your higher EPF contribution amount!

i-Sayang only allows a maximum rate of 2% EPF contribution to your wife’s account as that is the limit set by the Government. This rate allows for a majority of husbands, who are EPF members, the chance to provide their wives with long-term savings and income security that is currently enjoyed by EPF members.

However, if you are able to AND want to contribute more, then you are encouraged to make additional contributions to your wife’s EPF account through other voluntary contribution channels!

The application can be made voluntarily by the husband! Here’s how!

To register for the i-Sayang initiative, husbands can apply voluntarily through one of two channels:

- Online through i-Akaun (members only); OR

- Nearest EPF branch with the completed i-Sayang Registration Application Form

Once the application is approved, a transfer of 2% to the wife’s EPF account will occur automatically two (2) months after an employer contribution is credited to the husband’s EPF account. Senang je! You won’t even need to present any supporting documents for the registration process too! Just fill in the application form online or at your nearest EPF branch!

And to make it easier, your employer won’t need to separate the contribution for employees who registered for i-Sayang! All they need to do is make contributions as usual and then EPF will do all the separating work for both of you! Now that’s what we call convenience!

“That sounds wonderful! What’s the catch?”

To start off, you need to make sure that both you and your wife fulfil the following requirements:

Husband (contributor):

- Can be Malaysian or Non-Malaysian

- EPF Member

- Below 75 years of age

- Marriage has been registered under Malaysian Law

Wife (recipient):

- Must have Malaysian citizenship

- EPF Member

- Below 75 years of age

- Marriage has been registered under Malaysian Law

Do note that the transfer of this contribution cannot be cancelled unless the wife (recipient) divorces or passes away. To request cancellation, the husband (contributor) must present one of the following supporting documents:

- Divorce Certificate; OR

- Wife’s (recipient) Death Certificate

So are you ready to give your lifelong partner financial support and income security in the long run? Then register for i-Sayang now to take that big first step!

For more information on the i-Sayang initiative and all things related to EPF, visit their website now and follow them on their social media pages: