Previously, we reported on the latest data on ‘Buy Now Pay Later’ (BNPL) in Malaysia, as shared by Finance Minister II Datuk Seri Amir Hamzah Azizan in the Dewan Negara on 11 March.

Now, more information about BNPL in Malaysia has been revealed, this time by the Consumer Credit Oversight Board Task Force (CCOBTF), including how a majority of users are from the B40 group.

73% of BNPL users in Malaysia are from the B40 group

For illustration purposes

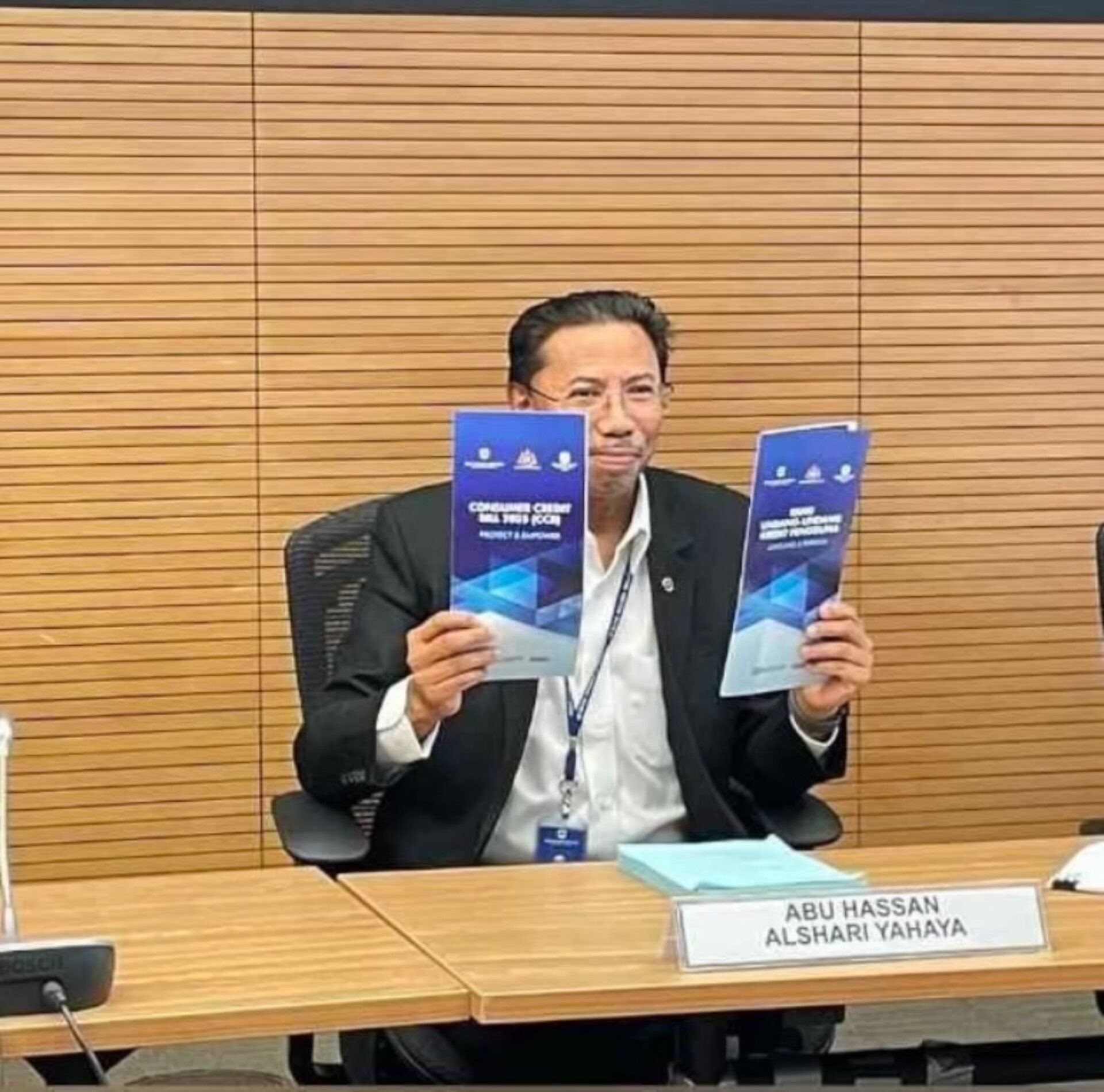

Abu Hassan Alshari Yahaya, head of the CCOBTF and assistant governor of Bank Negara Malaysia (BNM), was quoted by Utusan as saying that 73% of BNPL users in our country are from the B40 group, earning less than RM5,000 per month.

Meanwhile, 21% of users are from the M40 group, earning between RM5,000 and RM10,000 a month.

Besides that, CCOBTF also found that 69% of users rely on BNPL as their sole source of financing.

For illustration purposes

Previously, it was revealed that there were 5.1 million active BNPL users in Malaysia as of December 2024, with a majority of them aged between 21 and 45.

Furthermore, 149 million BNPL transactions worth RM12 billion were recorded in Malaysia last year, almost double from the year prior. Currently, there are twelve companies offering BNPL services, four of which are Shariah-compliant.

The BNM assistant governor warns that BNPL could easily become a debt trap for Malaysians

For illustration purposes

Abu Hassan added that CCOBTF conducted an online survey on 21,070 BNPL users nationwide between August and September 2024, which found that 79% of users rated their financial awareness as satisfactory or good.

Despite this, the BNM assistant governor warned that BNPL has the potential of becoming a debt trap, with younger individuals and those in the lower-income bracket being the most susceptible.

Hence, he stressed the importance of the upcoming Consumer Credit Bill to regulate BNPL providers that currently fall outside any legal framework in our country.

Abu hassan alshari yahaya

So, what are your thoughts on BNPL? Share your thoughts with us in the comments.