Wanna start building your wealth? Then you may want to get into investing, a worthwhile method to make your money work for you by compounding and growing in value over time! “But I have very little money on me right now. Can I really start investing?” Contrary to popular belief, you don’t need to be a gajillionaire to start investing right away! So to get you on the right track, here are a few tips for you to delve into investments with little money!

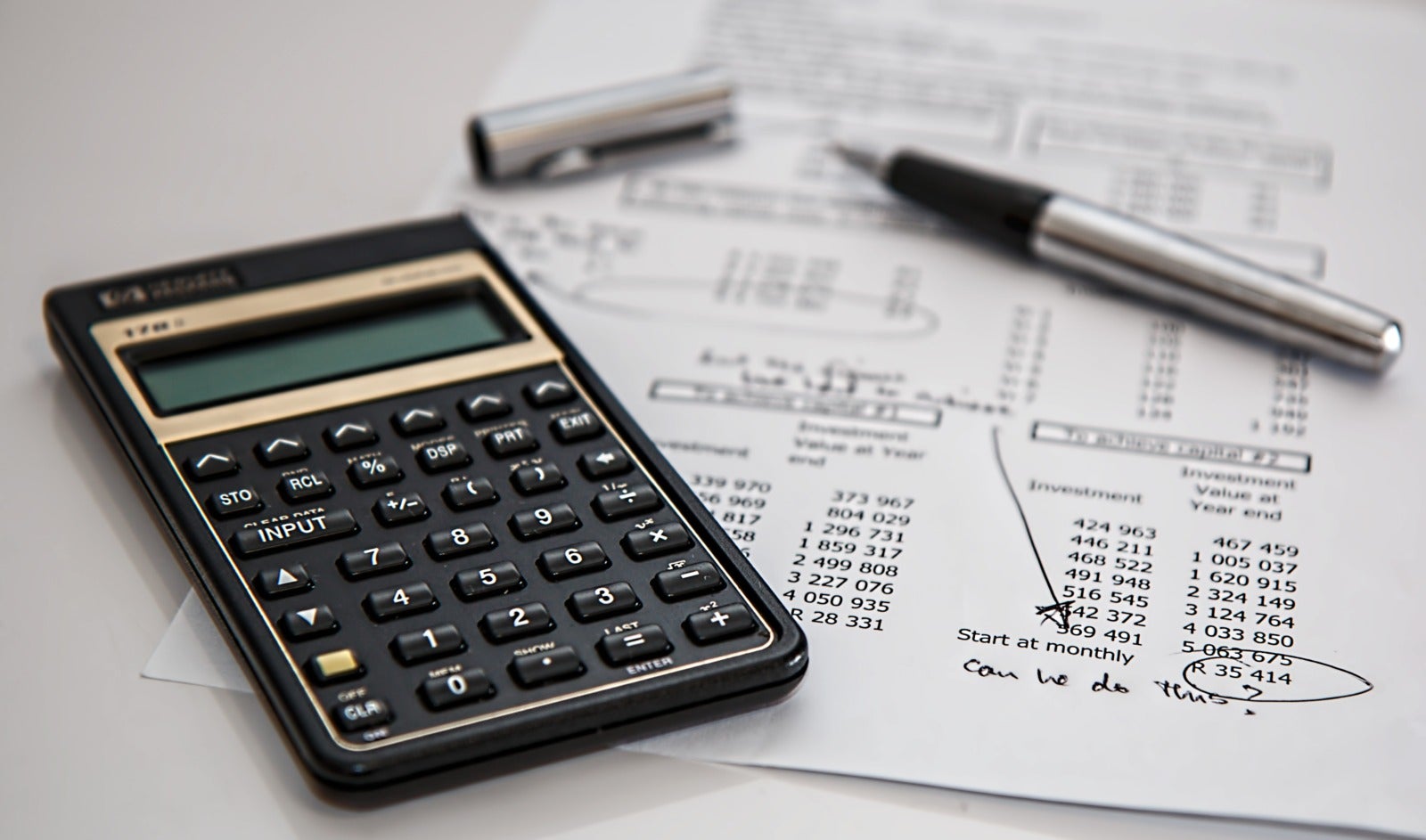

1. List down all your income and expenses

Step one is to get a good look at your income streams and where your money usually goes. To that end, you need to sum up your revenue from all known sources such as your job, business, savings interests, etcetera, and then compare them against all monthly expenses including rent, bills and such. Once you’ve done the math and found out how much monthly profit you’ve been incurring, you can decide where and how much money to allocate to your investments. If you could afford it, put aside between 10-15% of your monthly earnings for investments, as suggested by financial experts!

2. Be SMART about setting your investment goals

Next, you need clear objectives on what to do with your investment returns. Without clear goals, you won’t be getting optimal value from your investment gains! This is why when it comes to investment goals, financial gurus usually live and die by the SMART method:

- Specific: Make specific and clear goals

- Measurable: Frame each goal so that you know when you have achieved it

- Achievable: Make sure your goals and your methods to achieve them are practical

- Relevant: Determine how realistic your goals are and how they relate to your life

- Time-based: Keep track of each goal’s progress using specific timeframes

If you’re still undecided on which concrete financial achievements you want to go for, feel free to hit up a financial advisor to get sound advice on how to handle your investment returns!

3. Start your investment with a low amount

And now comes the main part: investing! For now, you should start small with low monthly investment capital. Wanna know how to pull it off? Have a look at these low-risk investment vehicles that will give you sizeable returns even with such a meagre amount!:

- Unit trust funds: This is a form of collective investment provided by various investment banks and firms with a fixed charge of management fees and transaction fees.

- Bonds: A generally low-risk form of investment that individuals and organisations can make. Bonds typically offer the potential for stable and predictable income.

- Exchange-traded funds (ETF): ETFs are popular among investors due to their lower costs than traditional mutual funds and tax-efficient model.

- Employees Provident Fund (EPF): People who are currently contributing to their EPF savings through employment can still top up their savings and enjoy around 6% returns per annum (based on their track record).

- Real estate investment trust (REIT): REITs are a popular way for individuals to invest in property but don’t have the capital to purchase them outright.

And if you REALLY can’t afford the monthly payment, you should still set some money aside and not withdraw it until you have enough capital to start your investment journey. Rome wasn’t built in a day, after all!

4. Open a high-yield savings account

We all know that savings accounts are vital for stashing away money for major life expenses, right? However, most people tend to falter at finding the right savings account, which means at best, they’ll earn minimal returns and at worst, they’ll end up losing money! Therefore, you need to read up on accounts that offer rates above the typical standard of 1.5% per annum. That being said, these accounts typically require customers to go above and beyond with their spending and saving, so make sure their T&Cs are suited to your financial habits!

5. Find an appropriate online broker with low or no minimum deposit

Now is the best time to employ an online broker! With firms looking to capitalise on the uptick of investors, hiring costs for brokers have lowered without compromising on stellar service! Alas, no broker is one-size-fits-all, so it’s up to you to decide which broker fits your investing goals! In addition to aligning with your goals, you’ll also need to consider the following aspects:

- Low or no minimum deposit amount: The best online brokers are those with little or no cash requirement to facilitate quick and easy access to the financial markets.

- Account fees: Read up on the fee structure of a broker. The more you can minimise fees, the better.

- Tools, education and features: Brokers typically acknowledge that many of their new users are also new to investing. So find one that offers free educational resources, webinars, video tutorials, glossaries and the like.

- Reliability: It’s crucial for new investors to determine which brokers have a good track record of reliability. Better so if they’ve obtained licenses in several countries which showcases that they have strong trading compliance standards.

- Frequency of promotions: Brokers tend to reel in new customers with exciting promotions such as cash bonuses and rewards!

And what do you know; we’ve found a global online broker currently offering a special deal just for you!

Tiger Trade is offering deals to let people enjoy the best investment experience!

To really get you started on your investing journey, Tiger Trade is giving away a lot of bonuses to new users! That way, you’ll get off to a smooth start on your investments and get rewarded too while you’re at it!

To get you started, here are some of the awesome deals New Users get to enjoy!:

- Account Opening:1 GoPro share (NASDAQ:GPRO)

- First Deposit ≥ SGD 1,000: 1 sure-win draw attempt (Tesla and more)

- First Deposit ≥ SGD 10,000: 1 Apple share (NASDAQ: AAPL)

To get in on the New Users deals and rewards, simply follow one of these easy methods!:

1. Click this link and sign up now!

2. Go search “Tiger Trade” in the App Store or Google Play, download and create an account using our special invite code: WOB6666.

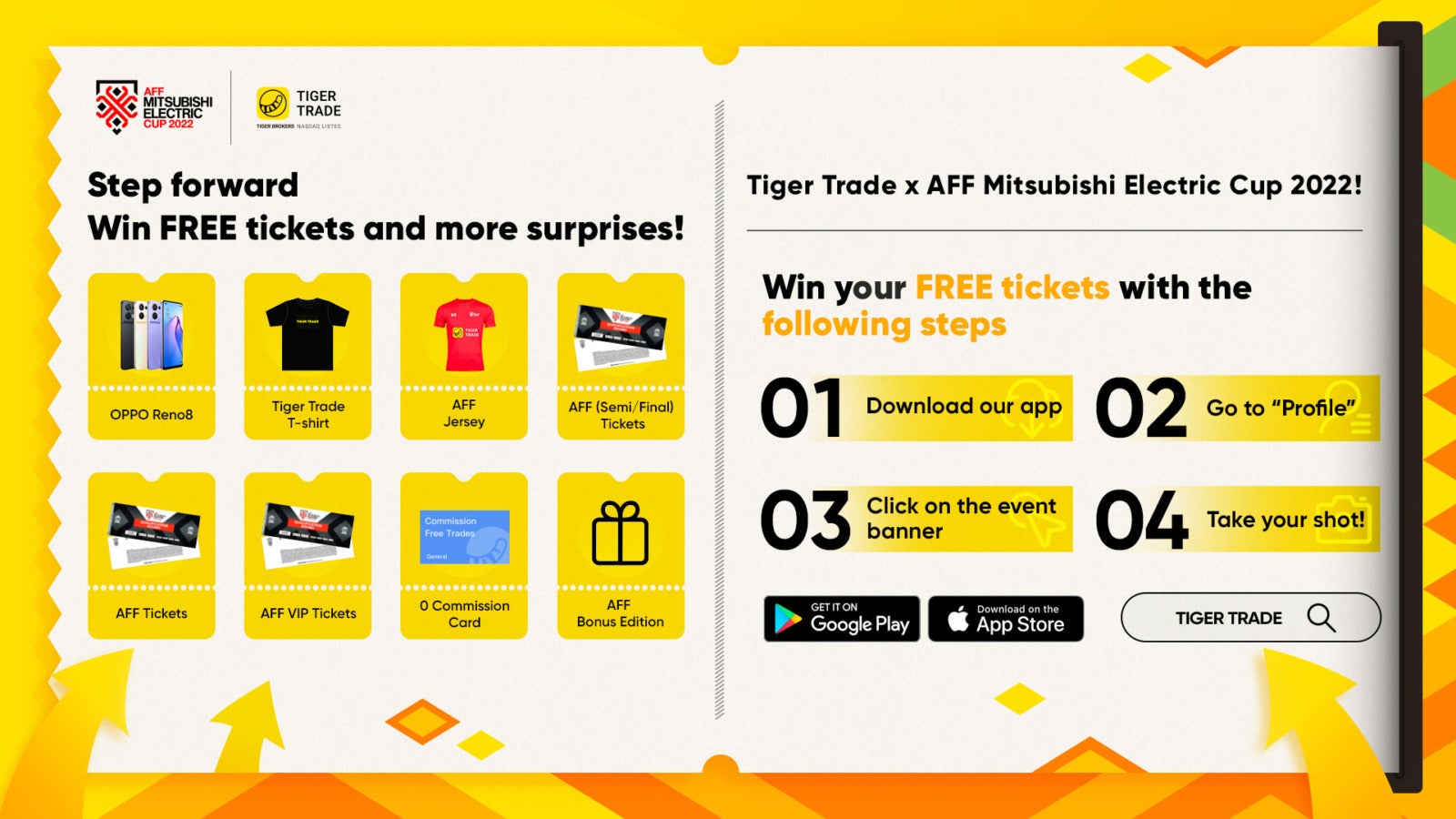

Speaking of rewards, Tiger Trade wants you to Step Forward and Win FREE tickets to AFF Mitsubishi Electric Cup 2022 and other awesome prizes!

As the official sponsor for the AFF Mitsubishi Electric Cup 2022, Tiger Trade has a treat for investors who are ushering in football season this year-end! Stand a chance to win one of these super-cool prizes by using Tiger Trade!:

- Oppo Reno8

- Tiger Trade T-shirt

- AFF Jersey

- AFF (Semi/Final) Tickets

- AFF Tickets

- AFF VIP Tickets

- 0 Commission Card

- AFF Bonus Edition

Step forward to win one of these spectacular prizes by following these simple instructions!:

1. Download the Tiger Trade app (available on the App Store and Google Play).

2. Go to “Profile”.

3. Click on the Tiger Trade x AFF Mitsubishi Electric Cup 2022 event banner.

4. Take your shot!

“Who is Tiger Trade and what is so special about them?”

Tiger Trade is a well-known leading global online broker founded in 2014 which primarily focuses on global investors. With the mission of making investing more efficient for all, Tiger Trade uses next-generation technology to help clients trade a wide range of securities across multiple global markets and currencies!

To that end, Tiger Trade has established offices in Singapore, New York, Beijing, Auckland and Sydney while amassing more than 1.7 million people as loyal account holders who now trust Tiger Trade as their one-stop destination to trade stocks tailored for global investors! Plus, they also have brokerage licenses in Australia, the United States, Singapore and other countries to better safeguard and account for their clients’ assets!

To aid in helping investors achieve a better experience, Tiger Trade specialises in the following details:

- Active Investment Community: Interact with other investors to get in on the latest trends and investment opportunities. Plus, you can also participate in education programmes to brush up on investing knowledge!

- No minimum deposit: With fast registration and no minimum deposit, you can easily access margin financing and T+0 trades.

- Professional Management Services: Get wealth management services and a wide range of fund products to cater to your investing needs!

Don’t believe that Tiger Trade is the best online broker? Then don’t take it from us; take it from this prestigious group of shareholders which includes Interactive Brokers, Xiaomi, ZhenFund and noted investor Jim Rogers, who have gotten behind this innovative online broker platform!

So get started on your investing journey now with Tiger Trade by downloading their app, available on the App Store and Google Play! To learn more about Tiger Trade and the Step Forward and Win campaign, visit their website now!