Do you think you’re financially responsible?

If you’re a young adult and you can’t confidently answer the above question, don’t feel bad! Managing our finances takes constant learning and no one becomes a professional overnight. But in order to help you along this journey, we’ve asked a few Malaysians to share some important financial tips that they wish they knew before they turned 30 so that you can be better prepared for your future!

1. Try not to delay paying off your student loans

When it comes to growing credit scores, many Malaysians would instantly think of credit cards. But are you aware that paying off your student loans is also a great way to build your creditworthiness?

By making sure you maintain a healthy repayment rate every month, you will make yourself look good to potential lenders and this will greatly benefit you in the future!

2. You need to separate emergency savings from retirement savings

Unfortunately, many Malaysians would only lump all of their savings into one big fund. This is not good practice because you won’t clearly know how prepared you are for the future OR in case of any unwanted emergencies. Plus, people in their 20’s also often overlook the importance of retirement funds as they believe they have a lot more time to save up due to their young age.

In reality, it was announced that only 3% of Malaysians now can actually afford to retire. We should learn from this lesson and start saving up for our retirement as early as we can!

3. Planning to buy a house in your 20’s? Make sure you can REALLY afford it

It’s true that purchasing our own property would be a great investment step. But it also goes without saying that it requires a huge commitment. So, if you’re still in your 20’s, you need to really assess your finances and ask yourself if you’re ready or if you have enough savings set aside to commit.

If you’re not, that’s okay too! You should not feel pressured to own these ‘assets’ just because your peers do. There is also nothing wrong with staying with your parents after you’ve started working. In fact, it can actually help you to save up and accumulate your funds to afford that ‘forever home’ that you deserve in the future!

4. When it comes to big hire purchases, choose below your means

The key rule to remember is: Just because you can afford it, doesn’t mean you have to get it!

For example, when buying a car, your monthly payment amount should not exceed 20% of your pre-tax salary. So, if you’re earning RM3,000, your monthly car instalment should not exceed RM600!

By choosing below your means, not only can you save up more money in general, but you can also be more prepared in case your car runs into a problem (which they almost always do!).

5. Invest in life insurance as soon as you can afford it

Did you know that insurance plans will vary according to your age? The younger you are, the cheaper it’ll be for you! It is also very important to have because we will never know when an emergency would occur.

However, if you’re worried about committing to such a big amount every month, make sure to sign up for life insurance with a ‘Return of Premium’ (ROP) package. ROP packages function like a savings account. During the term period, you’ll be paying a flat-rate amount (and you’ll enjoy coverage in times of emergencies, of course) but if you survive the term, you’ll be able to get your money back!

6. Follow this classic budgeting rule to manage your monthly salary

We often hear of the 50-30-20 rule but not many actually follow it. The rule is pretty self-explanatory; the numbers represent the ratio of which you should be allocating your after-tax income into these categories:

- 50% for needs

- 30% for wants

- 20% for savings & debt

The reason why it’s important to follow this rule is that it will give you the perfect balance on how to spend your income. While it is important to save and be responsible with your money, it is also equally important to satisfy your ‘wants’ and reward yourself from time to time. You worked for it so you deserve it!

If you’re still a bit unsure of how good you are with money, why not try out this online game that actually teaches about financial literacy. Ever heard of it?

We’re talking about none other than the online experience game called Mind Your Ringgit!

Launched by Visa in support of the Financial Education Network co-chaired by Bank Negara and Securities Commission Malaysia, this choice-based game is back with a refined storyline to take the players on a virtual life journey where they’d have to make important financial decisions.

The main objective of the game is to teach Malaysians on basic financial concepts, how to manage your finances in times of crises and to also remind them of the importance of dividing your budget equally to satisfy your health, wealth and happiness!

So how can I start playing? Easy!

- Head over to the Mind Your Ringgit website here.

- Sign up to create your account.

- Verify your account to start playing the game!

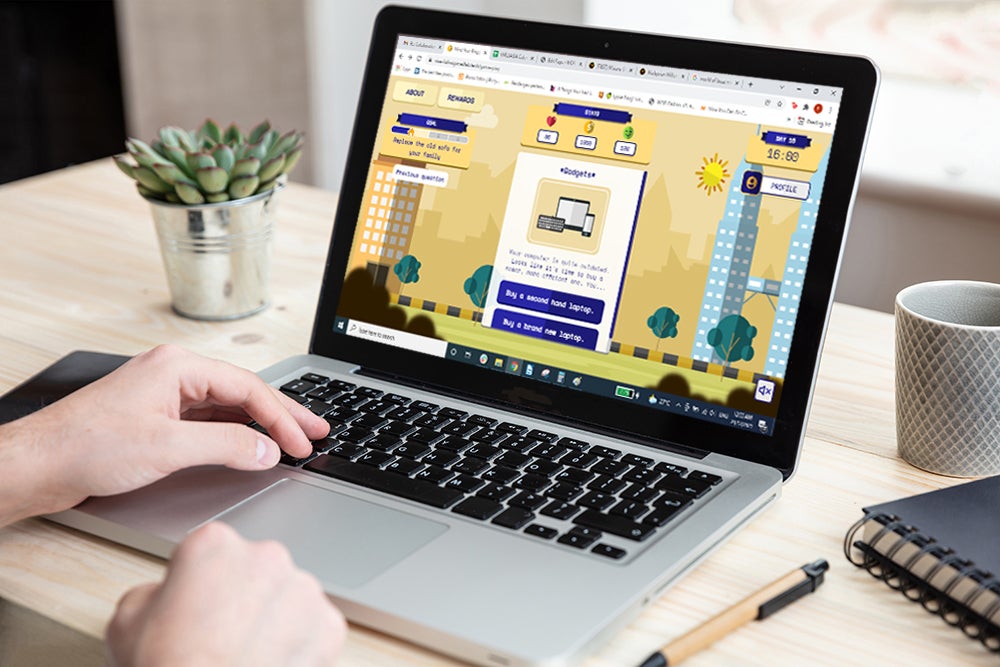

The game will start from the point you graduated and will take you on a full adulting journey where you’d face several realistic scenarios such as landing your first job, moving into your own place and paying off your student loans. It’s like the perfect rehearsal for real life events!

Every decision you make will impact the amount of money you have along with your happiness and health. At the end of the game, you can assess your financial skills by looking at how much money you’re left with!

Oh… and did we mention that you can also win awesome prizes if you complete the game?

Yup, that’s right. Not only is the game great for educational purposes, but you can also win some super cool prizes:

- 30 winners per month from January to February will win RM50 Shopee vouchers by random selection.

- 2 winners with the highest average score will win the grand prize of Samsung Galaxy Z Fold3 or the runner up prize which is a Nintendo Switch.

Psstt.. the highest average score will be calculated like this! ?

Score count = Travel Goal Average + Automobile Goal Average + Education Goal Average + Home Enhancement Goal Average

Calculation of average = (Cumulative total Wealth + Health + Happiness of particular goal) ÷ Total number of times a particular goal is replayed.

However, do remember that while this game is available indefinitely, the contest period to win these prizes will end on 28th February so make sure to join now!

So, if you’ve always felt like you’re not good with managing your finances or if you’d just like to put your knowledge to the test, there’s no better way than to practise your skills with the Mind Your Ringgit game! You’ll be able to learn a lot of basic information on financial management and you might even snatch some cool prizes along the way. What’s not to like about that?! ?

To find out more or to start playing the game, simply head over to their website here.