Thailand is ramping up initiatives to boost its tourism industry and attract international tourists to the country this year, including introducing a new 90-day “Muay Thai Visa” and cutting alcohol as well as entertainment taxes.

Well, there’s one more reason for international travellers, including Malaysians to visit the country in 2024 as the country has now changed its value-added tax (VAT) rules, allowing travellers to easily get tax refunds for purchases made while in the country.

As reported by Thailand-based publication The Nation, the country’s Revenue Department has announced new regulations for VAT refunds for tourists which it said “aligns with the current situation”. The changes went into effect on 1 January 2024.

Moreover, in a Facebook post by the Thai Revenue Department, the country’s purchase threshold for customs declaration has been increased from THB5,000 (approximately RM663) to THB20,000 (approximately RM2,651).

This means that you can now get VAT refunds directly from the country’s Revenue Department without going through customs procedures for purchases up to THB20,000 instead of just THB5,000. Hence, you no longer have to wait in long queues and undergo meticulous document inspections from Thai Customs to get VAT refunds if you’re claiming for purchases under THB20,000.

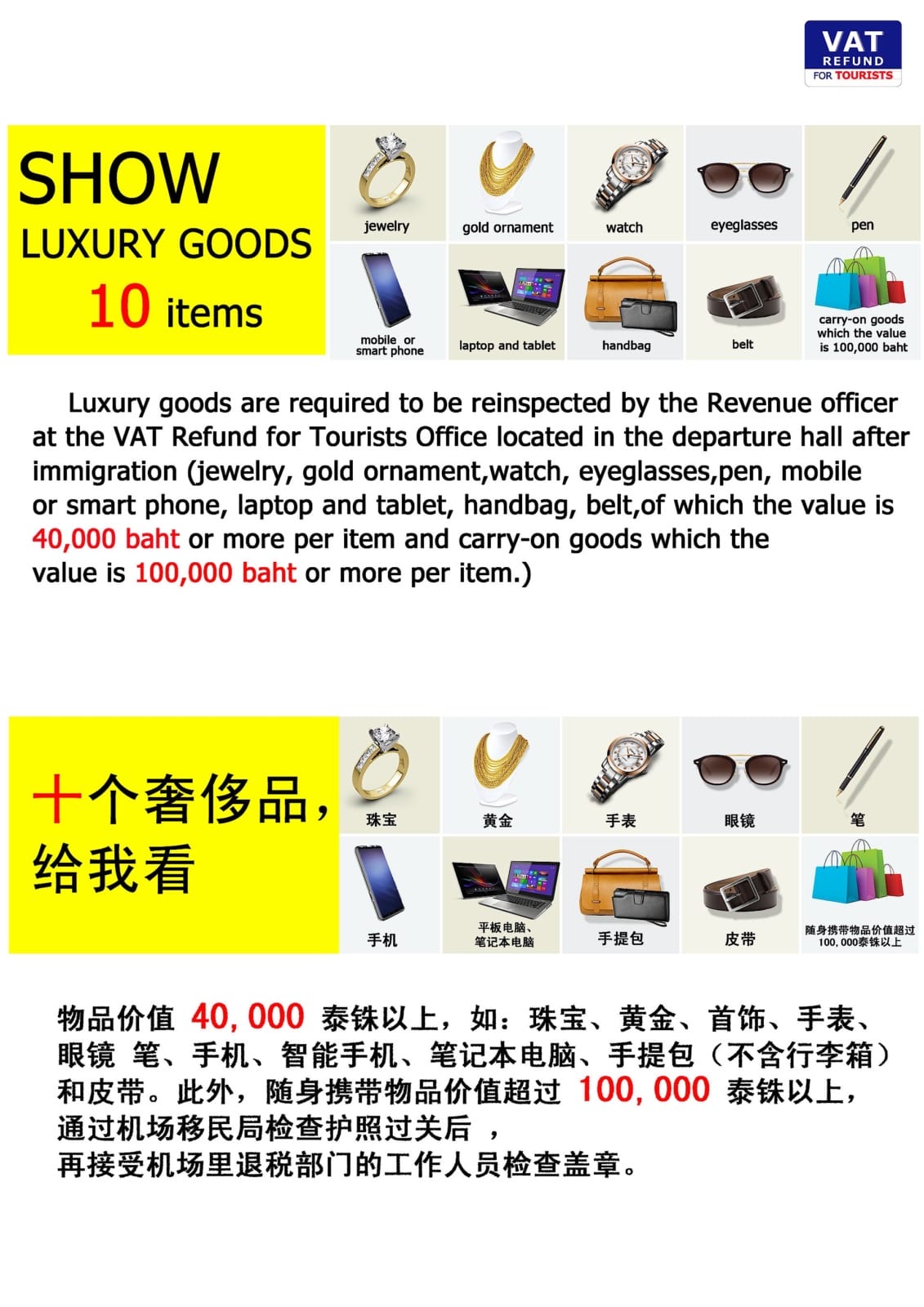

Besides that, Thailand has expanded the categories and values for goods to be declared. These include items such as jewellery, gold ornaments, eyeglasses, watches, smartphones, laptops or tablets, bags (excluding travel bags) and belt buckles.

Moreover, the value threshold has been adjusted to THB40,000 (approximately RM5,289) for certain items and THB100,000 (approximately RM13,221) for items that can be carried on board.

In order to be eligible for a VAT refund, international tourists in Thailand must adhere to these conditions:

- Not of Thai nationality

- Not domiciled in Thailand

- Not an airline crew member departing Thailand on duty

- Depart Thailand from an international airport

- Purchased goods must be taken outside Thailand within 60 days from the date of purchase

- Goods must be purchased from shops displaying the “VAT Refund for Tourists” sign

- The total purchase amount must be at least 2,000 baht (including VAT) from the same business establishment on the same day

- On the day of purchase, customers must present their passports to the sales staff and request the P.P. 10 form from the store, along with the original tax invoice

- On the day of departure from Thailand, before check-in, the goods and the P.P. 10 form must be presented to customs officers for inspection and stamping

For illustration purposes

For more information, visit the Thailand Revenue Department’s official website here.

So, what do you guys think of the country’s changes to its VAT rules? Share your thoughts with us in the comments!