This sounds like a good initiative!

During the tabling of the 2019 Budget in early November 2018, Finance Minister Lim Guan Eng announced that any employer who decides to help their employees settle their PTPTN (Perbadanan Tabung Pendidikan Tinggi National) debts will be given tax relief.

According to Siakap Keli, the initiative was well-received by PTPTN borrowers as it was seen as a way to encourage employers to help ease the burden of their workers. The PTPTN repayment by the employers could also work as an incentive for top performing employees. Good idea!

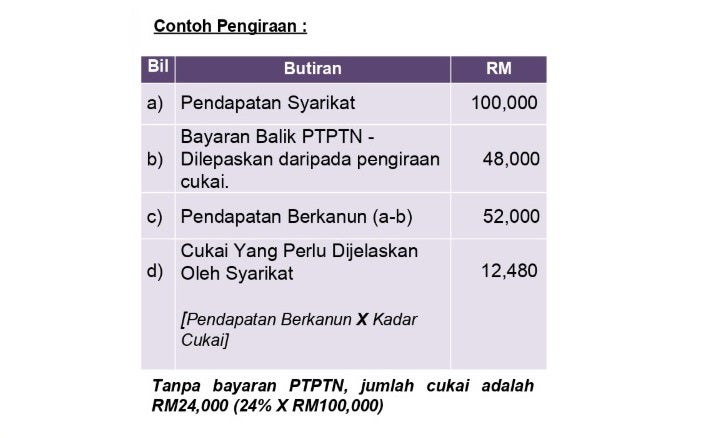

An example of the tax relief calculation is as shown below:

Source: siakap keli

In the example above, it’s shown that the employers will potentially pay lesser tax if they manage to pay off their workers’ PTPTN loans.

Therefore, bosses who want to settle their workers’ PTPTN debts can do so using any of the three ways mentioned below:

- Through the PTPTN website. It works just like the employers’ KWSP/Perkeso contribution!

- Through a monthly company check.

- Through a one-year “Lump Sum” payment starting 1 January until 31 December 2019.

Source: siakap keli

Before that, the employers will have to make sure that the employee works full-time in their company. Not only that, the bosses are not allowed to make claims or ask for compensation from the employees after repaying their PTPTN debts.

On a different matter, parents/adopted parents/legal caretakers will all be given a tax relief if they open an SSPN savings account for their children. FYI, The SSPN individual tax relief has been increased to RM8,000 from RM6,000 for SSPN-i savings. Plus, an additional RM6,000 is given for SSPN-i Plus Takaful. Nice!

This is a good opportunity for employers to reward their top performing workers as previously suggested. What do you think about this initiative? Let us know in the comments below!

Also read: Money Will Now Be Directly Deducted From PTPTN Borrowers’ Salary to Repay Loan, Here’s How