Back in May, The Malaysian Department of Insolvency (MDI) reported that more than 280,000 Malaysians have been declared bankrupt as of March this year.

As the country is struggling with inflation and the surge in prices of goods, it’s scary to see the numbers of bankruptcy staring at us, as if we’re next if we don’t manage our finances wisely. Just recently, a Malaysian financial consultant, Tee, made another shocking reveal via his Facebook post.

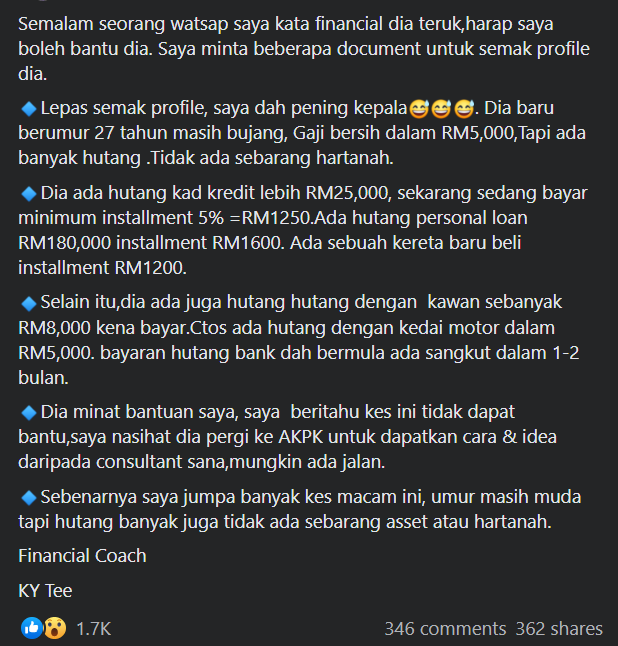

Tee admitted that based on his 10 years in the field, he has seen a lot of youngsters who are surrounded by massive debts. Recently, he met a 27-year-old Malaysian who came to him for help with financial tips. Tee asked for his documents but after seeing the debts, he seemingly hit a dead end.

‘He earns RM5,000 per month but he has a massive amount of debt, and he doesn’t even have a property yet.’

Credit card & loans!

Here’s what the 27-years-old’s commitments look like,

- More than RM25,000 worth of credit card debts (a monthly instalment of RM1250)

- Personal loan debt of RM180,000 (a monthly instalment of RM1600)

- Car loan (a monthly instalment of RM1200)

For illustration purposes only

To have these debts greeting us on a monthly basis are terrifying enough, but his debts don’t end here.

‘He owes his friend an amount of RM8,000. Besides that, CTOS records show his debt with a motorcycle shop amounting to RM5,000. He hasn’t paid the bank in 1 to 2 months,’ Tee explained.

As the case has been proven a little too tough for Tee to handle, he then suggested the young man head to the Counselling and Credit Management Agency (AKPK) in hopes that the officers there will be able to assist him.

Now, if you do the simple math, the young man will have to fork out an amount of RM4,050 on a monthly basis out of his RM5,000 wage just to pay his debts.

This means he has RM950 left to spend for the remainder of the month, excluding his need to pay his friend and the bank for the motorcycle. Commitments have never been tough and we certainly hope the young man will manage to find a way to survive this!

There has never been a wrong time to plan your finances well and this is certainly not the time to splurge out of your means. How much do you manage to save every month?

Also read: “It’s simple” – M’sian Couple Shares How They Managed To Save RM13,359 in Just 365 Days!