No one wants to get caught in a situation where you need to buy an essential item urgently but you don’t have enough money for it, kan? Not to mention, the thing(s) you need to buy could run out by the time you get your next paycheck.

But if you still want to shop without worrying about expenses at the moment, then we have the BNPL (Buy Now, Pay Later) solulu for you!

Enjoy superb benefits, promos and more when you shop now and SPayLater with Shopee!

With SPayLater, you can shop smart, save more and enjoy the flexibility of paying later! Here’s what you stand to get when you sign up to SPayLater ?:

1. Enjoy waived processing fees during this promo period

Typically, SPayLater charges a 1.5% processing fee for instalment options. But for this limited time period, you can enjoy 0% fees on your repayments when you choose either the 1-month or 3-month tenure options!

Urgently need to replace broken appliances at home or buy daily essentials to make it through the rest of the month? Then this is the perfect time to shop around and enjoy the flexibility of SPayLater’s instalment plans—now without the usual fees. Whether you’re online or in-store, this is the perfect time to buy what you need and pay later with fewer worries!

2. Vouchers and discounts galore for all users

As a token of Shopee’s appreciation for SPayLater users, some amazing offerings await when you shop with SPayLater!

New SPayLater customers can enjoy RM15 off of their first purchase, allowing for a great first shopping experience with the platform.

Returning users also stand to benefit from special promotions such as RM30 OFF vouchers, up to RM50 in-store vouchers and other perks that will make for an even more rewarding shopping experience. Whether you’re new or are returning to SPayLater, keep an eye out for these deals to maximise your savings!

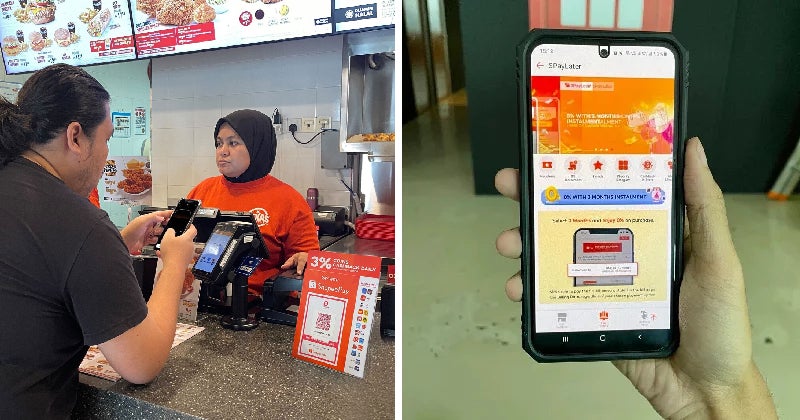

3. Take advantage of exclusive in-store promos at major retailers

Shopping in-store has never been more rewarding thanks to SPayLater’s in-store promos! Did grocery day arrive a bit earlier than expected this month? Or are you in need of tools for your business that you don’t quite have the funds for yet? SPayLater has you covered on those and more for in-store purchases!

From electronics and living goods to groceries and even pet food, SPayLater can be used for all these and more in-stores at any Duitnow QR merchants nationwide for brands including Lotus’s, MYDIN, Zus Coffee and Al-Ikhsan. Plus, from now until 16 September only, don’t miss out on 1 Sen Deals with 31% OFF (capped up to RM31) at selected stores. Grab these limited deals before they’re gone by clicking here to check them out.

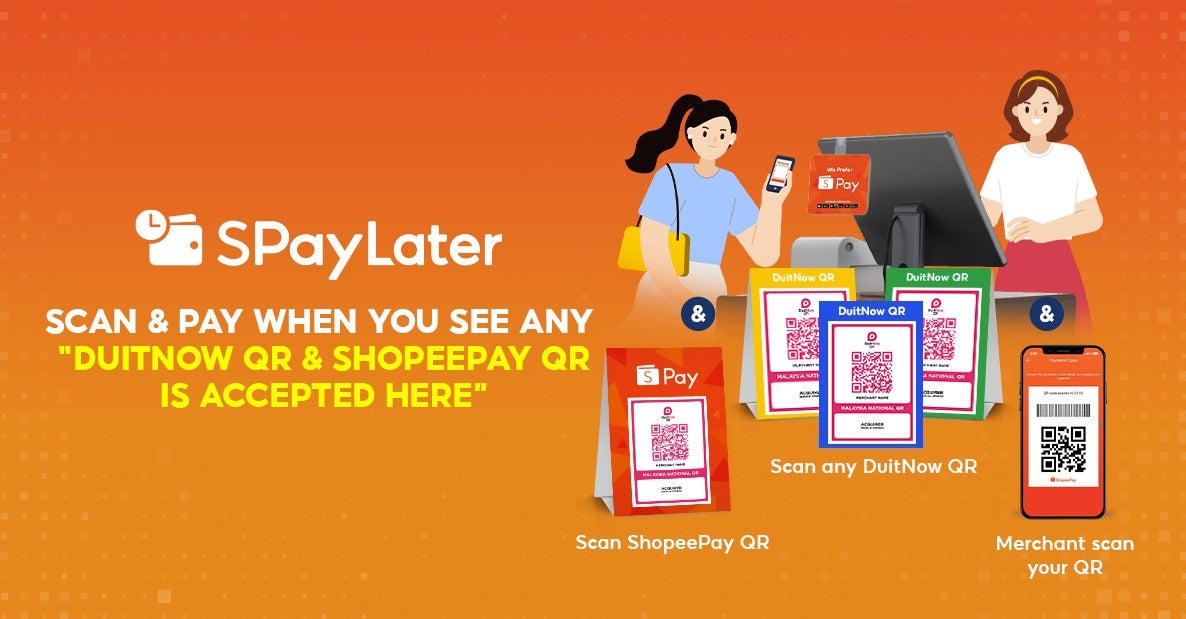

How to use SPayLater in-store? Here are two easy ways:

- Scan the merchant’s DuitNow QR code using your ShopeePay e-wallet and select SPayLater.

- Alternatively, you can present your ShopeePay QR code for the merchant to scan.

And here’s how you can utilise the 31% Off voucher in-store:

- Scan the merchant’s DuitNow QR code using ShopeePay e-wallet or let the merchant scan your ShopeePay QR code.

- Apply the discount voucher and select SPayLater as your payment method.

To get the most out of SPayLater, find out about all of SPayLater’s exclusive promos with partnering brands here to unlock deals and discounts that make your money go further!

“But why SPayLater? How does it work ah?”

SPayLater is more than just a payment method – it’s a financial tool that allows flexible payment methods and gives users the ability to break down their payments into instalments, making for a more worry-free and well-planned shopping experience. It also helps Malaysians to budget their spending more wisely and with fewer worries.

Here’s why SPayLater is the go-to BNPL for Malaysians:

- Personalised credit limit

SPayLater sets a personalised credit limit for you that aligns with your spending habits and financial needs, letting you track your expenses with ease. Whether you’re a frequent shopper or only use the service occasionally, SPayLater’s credit limits ensure you spend and shop responsibly within your means. Plus, SPayLater’s credit limit is based on the user’s management of purchases and repayments. Users who repay and manage their expenses well may see a credit limit increase in time, whereas users who struggle may have their credit limit lowered to prevent overspending.

- Safety and Shariah Compliant

SPayLater is Shariah Compliant as certified by Amanie Advisors (“Amanie”), a global Shariah advisory firm and a registered Shariah advisory company with the Malaysian Securities Commission (SC). If you’re late on your payment, you’ll be locked from using SPayLater and be imposed a late fee of RM10 which doesn’t compound or stack.

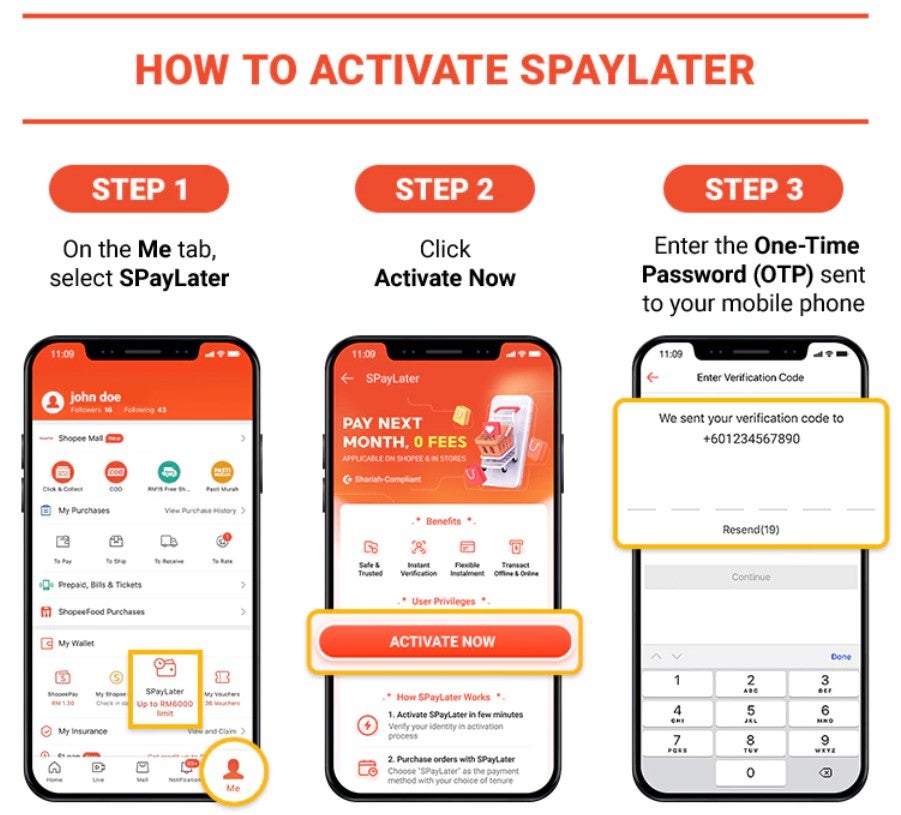

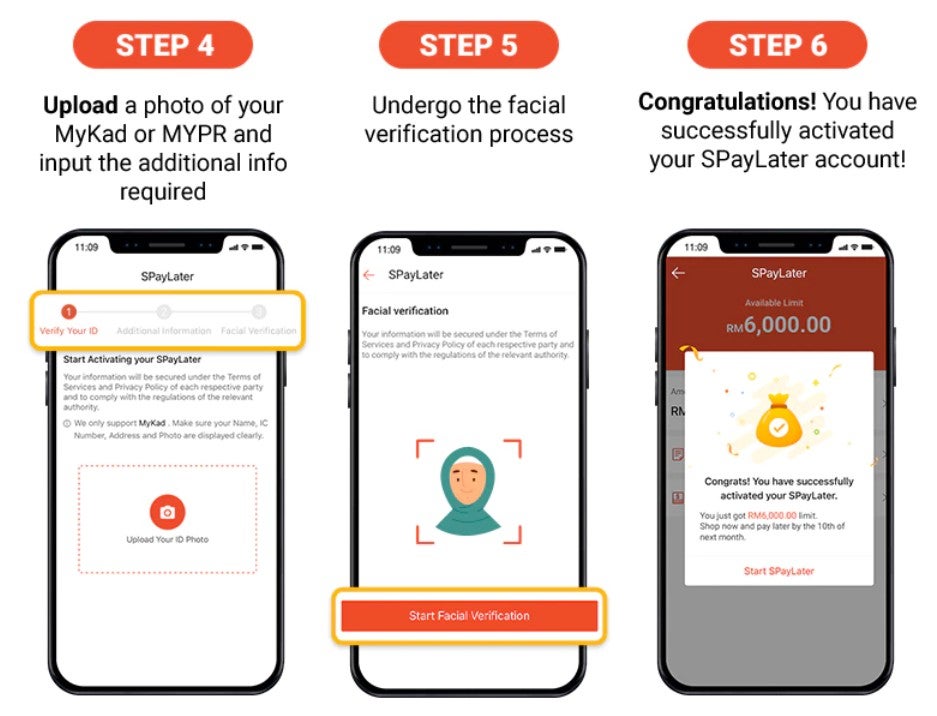

Now that you know about all of the benefits of SPayLater, here’s how you can activate it on your Shopee app:

Buy now, SPayLater!

With this offering by Shopee, you can now shop smart, save more and enjoy flexible shopping while spending wisely. So sign up now for a seamless shopping experience!

If you haven’t already, download the Shopee app now via the following links:

For more info on SPayLater and all things related to Shopee, visit their website now and follow their socials: