From cryptos and stocks to properties, memang would feel overwhelmed by the excessive number of investment options lah. Fortunately, with the right tools and assistance, investing our money is absolutely doable and still brings in reasonable returns!

If you’re like us, unsure of where to start your investment journey, here’s one bank that we can all turn to for simpler investing:

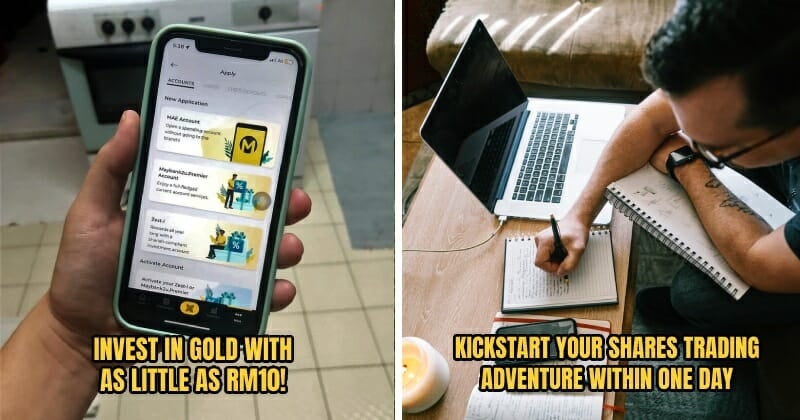

With MAE and Maybank2U apps, you can easily apply for various types of investments that suit your financial needs, all without EVER going to the bank!

Here are some of the investment options that you should check out and grow your wealth with! And be sure to read until the end to find out how you can get even more returns (in a different way) when you invest with Maybank, ya? ?

1. Maybank Islamic Gold Account-i (MIGA-i): A solid hedge against inflation

Anyone been told by their parents or aunties to ALWAYS invest in gold? Well, now you can, but online! Maybank helps you open a Shariah-compliant gold, physical gold-backed investment account, which lets you easily buy, sell, redeem or transfer physical gold on M2U web, as well as check on your investment on the go via M2U web/app and MAE app.

Maybank Islamic Gold Account-i (MIGA-i) also comes with a Future Order feature that lets you automatically buy or sell gold at the price of your choosing, which is pretty convenient ah. Additionally, if you have more than 100g gold in store, you’ll be notified via SMS notification if you can get 10% profit for selling them – no need to constantly check the value of gold!

If you’re looking to maintain the value of your Ringgit in the midst of heightened inflation, then gold is an investment worth considering!

Other benefits:

- Get real-time updates on market price

- Request for delivery of physical gold

- Resell the same physical gold

- Seamlessly transfer gold to other gold accounts

Requirement: Invest as little as RM10 to get started on your gold investment!

2. Maybank eFixed Deposit/-i: The ol’ reliable

Fixed deposit (short for “FD”) is basically an account where you store your money for a fixed period of time and earn the exact amount of interest/profit from when you signed up for it, though you won’t be able to access it until it’s matured. More importantly, FD lets you earn higher interest/profit rates than your typical savings account!

Additionally, Maybank eFixed Deposit/-i also offers a pretty reasonable board rate of 2.85%* p.a for 12 months! It’s low-risk, steady, and reliable, making it a great option for those who want to start simple.

Requirement: Get your fixed deposit savings started from as low as RM1,000!

*Interest/profit rates quoted are accurate at the time of writing. All rates are subject to change without prior notice. Kindly refer to the Maybank2u website or contact the nearest Maybank branch for the latest rates.

3. Maybank Unit Trust: Let the pros grow your money

Wanna invest in something with potentially higher returns? Then Maybank Unit Trust may be your answer, letting you allocate a fixed amount of funds for their professional fund managers to diversify and manage it to help you get the earnings you deserve.

With the luxury of modern tech (i.e. M2U web), you can conveniently open a Maybank Unit Trust account without going to any branches, as well as find out your recommended portfolio based on the risk you’re most comfortable with.

Plus, you can enjoy sales charges as low as 1%* so you can maximise your wealth even more! So if you’re looking to diversify your investment portfolio, then opt for Maybank Unit Trust and let the pros of Maybank’s fund managers help you out!

Requirement: Begin your unit trust investment journey with just RM1,000 onwards.

4. Maybank Share Trading: Take charge of your investments

Prefer to be more hands-on in your investments? Now you can open a Share Trading account with Maybank and start buying/selling shares in Malaysia’s stock market.

Simply complete your account application on the M2U website, wait for your share trading (cash account) to be approved, then you can start trading – it’s that fast and easy!

Share trading is more suited for investors who prefer to have control over their own investments. While it may come with higher returns, it may also come with associated risks. So, be sure to do your research before buying stocks ya? Don’t play play ah!

Requirements:

- Open to Malaysians between the ages of 18 and 65

- Simply pay RM10 to open a CDS (Central Depository System) account – that’s it!

5. Maybank Islamic Zest-i Account: Invest + Rewards = Profit!

If you’ve decided to start investing with Maybank, then might as well open a Maybank Islamic Zest-i Account to maximise your income!

This Shariah-compliant investment account actually rewards you all year long with mouth-watering prizes just by investing, which is pretty ons tbh. With prizes like the iPhone 14 Pro 128GB, Perodua Alza 1.5AV, and even a 1kg Maybank Islamic Gold Account-i up for grabs, totes worth it leh!

Plus, Maybank Islamic Zest-i Account lets you earn potential profits from your investment based on the profit sharing ratio with the bank, which means profits that the bank earns will be shared with you.

Requirements:

- Minimum placement of RM50 for account opening.

- Maintain a Month End Balance of RM200 minimum to continue participating.

“Wah, didn’t expect investing to be so easy wei!“

Seriously tho, online banking has made everything SO much simpler! Despite all that is happening right now, it’s truly a blessing to be able to enjoy these conveniences literally right at our fingertips. Better yet, now we can even earn rewards just for utilising these features – how awesome is that?!

In fact, this is the absolute ? perfect time for you to start investing with Maybank – here’s why:

From now until 28 Feb, sign up for selected Maybank products & stand a chance to win over RM388,888 worth of prizes in Maybank’s “Bank Online for Awesomeness”!

You read that right! The more products you sign up for, the more entries you earn, and the higher your chances of winning THESE prizes!

- Grand Prize: 1 x Proton X70

- Second Prize: 30 x SAMSONITE luggage sets

- Third Prize: 15 x 1 year’s worth of Petronas petrol (worth RM6,000 each)

While New-to-Bank customers can earn up to FIVE entries, existing Maybank customers can also earn entries by applying for a wider variety of participating products, comprising:

a) Credit Card & Credit Card Services

- Maybank Credit Cards*

- Maybank Personal Loan/Financing-i*

- Maybank EzyCash/-i

- Maybank EzyPay Plus/-i

- Maybank Balance Transfer/-i

b) Current & Savings Accounts

- Maybank Islamic Zest-i Account*

- Maybank2u.Premier Account*

- Maybank2u Savers/-i Account*

c) Investment Products

- Maybank Islamic Gold Account-i (MIGA-i)

- Maybank eFixed Deposit/-i

- Maybank Unit Trust

- Maybank Shares

d) Insurance/Takaful Products

- Maybank Car Insurance/Takaful*

- Maybank Trip Care360/Takaful Trip Care360*

*Available to both New-to-Bank and Existing Maybank customers.

Most importantly, be sure to apply for Maybank’s products online via the MAE app or Maybank2U (web/app) to be in the running ya?

Come join us and “Bank Online for Awesomeness” before the promo ends on 28 February! Might win a brand new car and other prizes ey!

For more info on Maybank’s “Bank Online for Awesomeness”, head on over to maybank.my/OnlineOnlyOffer. And don’t forget to download the MAE and M2U apps for free to be eligible ah!

Disclaimer:

All Maybank products mentioned above are subject to terms & conditions.

Maybank and Maybank Islamic are members of PIDM. Protection by PIDM is subject to insurability criteria. Please refer to the list of insured deposits displayed at www.maybank2u.com.my for further details.

The contents of this article do not constitute financial advice. Readers should conduct their own research before making a financial decision.