It’s the end of the month, you’re broke and wondering where all your money disappeared to. The truth is, we’ve all been there before. It definitely doesn’t help that the cost of living in Malaysia is constantly rising while our income & minimum wages remain stagnant.

What’s shocking (and incredibly worrying) is that 37% of Malaysian millenials only have one month’s worth of income saved up! Yikes! ? Well, thankfully, it doesn’t have to stay that way forever! Here are a few things you can do to change that reality for yourself:

1. Adopt the ‘save first, spend later’ habit and have three separate savings accounts

After getting our monthly salary, many of us tend to prioritise spending it first. After all, there will always be something we want or need to buy, right? In actuality, it’s really important to set aside your savings before you even think about spending any of it!

Once you’ve set aside your savings for the month, you can see clearly whether or not you can afford to spend. Ideally, you should have at least three savings accounts to manage your money. These savings accounts can be for:

- Retirement – 10% of your monthly income

- Emergencies – 5% of your monthly income

- Major purchases – 5% of your monthly income

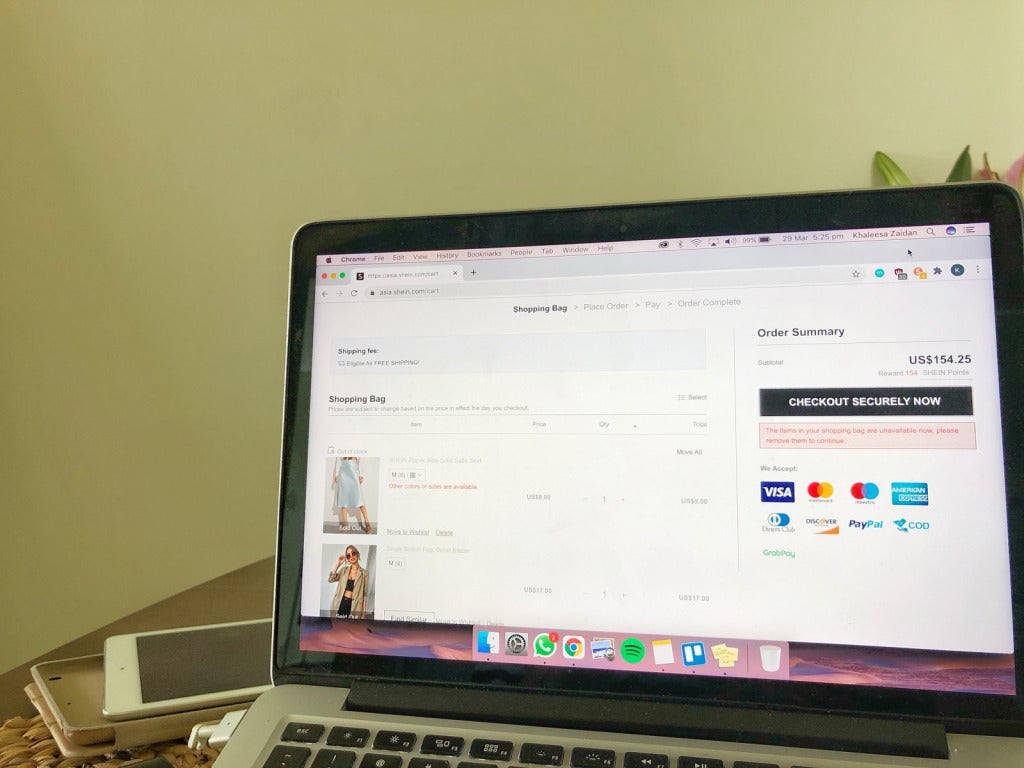

2. Avoid storing your payment information on online shopping platforms

While it may be convenient, this practice actually makes it a lot easier for you to click checkout and say goodbye to your hard-earned money!

Getting rid of that extra step of entering your credit or debit card information means you’re more likely to make impulse purchases. So we recommend you avoid storing your banking information such as your card number from any of the shopping platforms you frequent and instead manually fill in the information when you need to buy something. Trust us, this works 😉

3. Purchase and make everything in bulk so it’s cheaper

It’s no secret that buying things in bulk is a lot cheaper so if you’re looking to grow your savings and be more financially savvy, you should definitely try making purchases in bulk!

As an example, when you plan ahead and meal prep for the whole week, not only will you save time & electricity but you’ll definitely save money too! When it’s time for lunch or dinner, you won’t make impulse purchases by ordering takeaway food because you’ll have your meals ready in the fridge. Plus, buying groceries in bulk is way cheaper too!

4. Set clear goals for which big-ticket items you want to purchase in the future

Everyone has their own set of goals. Some of us have set a target age to purchase our first home while the rest of us want to buy our own car and stop using our parent’s car. Whatever it is, you should have a plan that helps you work towards achieving said goals.

For example, if you want to purchase a house, you should first identify a budget range that you’re comfortable with and then calculate how much you’ll likely need to pay the bank every month. Once you have that figure, you’ll be able to see if this is something you can afford in the near future or if you have to wait a bit longer to make that purchase.

5. Visit the ATM weekly and only withdraw what you need for the week, nothing extra!

We tend to only go to the ATM when we are low on cash but did you know that this actually makes it a lot harder for us to track our spendings because we’re consistently withdrawing money? Having less cash in your wallet will make you think twice before spending it!

One way to limit your ATM visits is to set a weekly budget and withdraw that amount every Monday morning and make sure you stick to that budget for the rest of the week. You should also bring just enough cash for each day to avoid overstepping your weekly budget!

Additionally, ATMs also charge RM1 for withdrawing with a debit card that doesn’t match the bank’s ATM. While it may not seem like a lot, the RM1 you spend on every withdrawal can end up amounting to a large sum of money that you could’ve saved!

That’s why you should check out MBSB Bank’s Visa Debit Card-i as they’re offering ZERO withdrawal fees from any MEPS ATM until 31st December 2021!

Yasss, that’s right! We’re building our savings so we must take note of every single ringgit we spend and why would we want to spend an extra RM1 just to withdraw money?!

With MBSB Bank’s newest & latest Visa Debit Card-i, you can enjoy:

- Zero withdrawal fees from any MEPS ATM ’til 31st December 2021 if you sign up now! ??

- A dual-function card which means you can make payments with it and use it as an ATM card!

- Quick & easy payments just by tapping your MBSB Bank Visa Debit Card-i on any contactless card reader machine! #staysafe

YAY to lighter wallets!

Do note that in order to enjoy contactless transactions, there is a maximum limit of RM250 per transaction, and a cumulative total of RM750 per day with 3 consecutive transactions per day.

Nice! Who can apply for this card and how do I do so?

In order to apply for the MBSB Bank Visa Debit Card-i, you’ll need to be at least 18 years old with an MBSB Bank Savings or Current Account-i!

All you need to do is head to the nearest MBSB Bank branch to open a Savings or Current Account-i and you’ll be given the MBSB Bank Visa Debit Card-i on the spot! Yes, it’s THAT easy. ?

Remember to bring your IC or valid passport (for non-Malaysians) when you’re going to apply for the card!

Yay! Are there any annual fees at all?

Annual fees for the MBSB Bank Visa Debit Card-i will be waived for the first year! However, you will be charged RM8 for every subsequent year.

Do note that if you have a debit card that is tied to the Basic Savings Account-i or Basic Current Account-i, your annual fees will be waived for the subsequent years too!

To know more about this awesome card and how convenient it is, watch the video below:

So this card is pretty awesome, right? We think so too! Head over to MBSB Bank’s website to learn more about the Visa Debit Card-i and apply for one online through M FAST Online Application today!