Apart from our personal savings account, the retirement fund (EPF) also serves as an alternative for us to have enough funds after bidding farewell to our jobs.

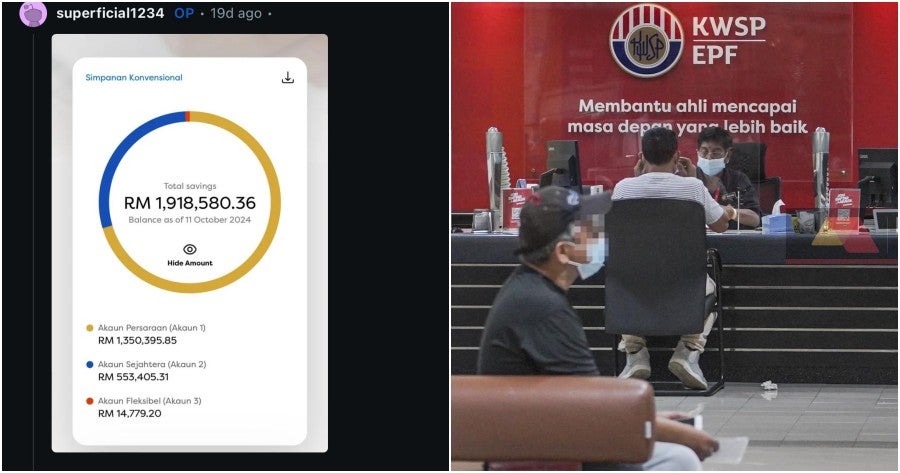

Securing RM100,000 when you’re hitting 35 seems possible, although that might not be the case for everyone, but is it even possible to secure nearly RM2 million at that age? In an idea that seems too far-fetched to many of us, a Malaysian woman recently shared how she managed to secure over RM1.9 million at the age of 35.

In a viral Reddit post that is currently circulating on X, the unnamed woman said that to achieve her financial status, she has a high-paying job, which she did not disclose.

“I never job hopped. I’ve been with the same company since my graduation, and I got to where I am purely through promotions and increments.”

What else has the woman done that she has achieved so much financially at only 35?

Relying solely on the EPF deductions will not be enough. According to the post, the woman also contributed by depositing a certain amount into her EPF on her own.

In the meantime, the woman also said another key to achieving nearly RM2 million is NO WITHDRAWALS.

“I’ve never touched anything from my EPF, even though I am eligible for a withdrawal anytime as I have reached the RM1 million mark.”

Last but not least, it’s the benefits – compounding effect.

She revealed that it took her 10 years to reach the RM1 million mark but only 3 years to get to the second million.

“My dividend alone was RM80,000 last year, and this will keep growing.”

In the comment sections, she also revealed that her income goes up to RM50,000 a month, with her annual bonuses ranging between RM200,000 to RM300,000.

To those with a similar salary range, what do you think of this? As for the others, do you make self-contribution to your EPF savings?