As we strive to survive during such turbulent times, a lot of us have realised the importance of having a safety net in the form of a savings fund. But with the uncertainty of current times, some of us have been considering withdrawing from our retirement savings just to keep surviving.

However, before you commit to such a huge decision, we’re here to give you a bit of perspective. We talked to a few retired Malaysians and they’ve shared five reasons why they actually regret withdrawing from their retirement funds early.

1. “I used up a lot of my savings to pay off my house and car loans”

“I wanted to live out my golden years debt-free. So, before retiring, I used my retirement savings to pay off my housing and car loans. I thought it was genius because I wouldn’t have too many monthly commitments. But now, I realise that it’s a struggle to keep up with the bills and maintenance fees that come with the house and car!” – Chen, 71

We understand the feeling of wanting to retire without any debts. But to do so, you might want to reconsider your lavish lifestyle after retirement. Even if you’ve paid off all your loans, the bills will still be piling up which means you might not have much left to sustain your basic needs!

One way to avoid debt after you retire is to avoid making big purchases when you’re nearing retirement. On the contrary, we’d recommend downsizing instead so that you won’t have a bunch of unnecessary monthly commitments to worry about.

2. “I thought my savings were unimportant as I could always rely on my kids later on”

“I used up quite a huge chunk of my savings to send my kids overseas to study. Back then, I just wanted to give them the best and I wasn’t that worried about my savings. I’ve always assumed that I could rely on my children later on.” – Rafi, 68

Though it must be nice to have someone to look after you at a later part in life, we wouldn’t recommend relying solely on your kids due to the ever-challenging job market and economy. A past study revealed that the starting salaries for Malaysian fresh grads are actually decreasing and the wage growth has also remained stagnant! Hence why it can be challenging for your kids to provide for you seeing as to how they’re also struggling with their own career.

3. “I wanted to grow my savings more but ended up losing money due to scams and failed investments”

“I started saving for retirement quite late so I thought maybe I can speed up the process by taking some of my savings out to invest them and make it grow faster. Unfortunately, not all my investments worked out and I even got fooled by a few scams as I was being very hasty in my decisions. As a result, I ended up losing more money than actually profiting from it.” – Mona, 63

Investing some of your money to prepare for the future can actually be a good thing, but only IF you know how to do it wisely. Not only has this case proved just how crucial it is to start saving up early, but it has also taught us that we should all be more careful when investing, especially at a time when scams are getting more prevalent in our society.

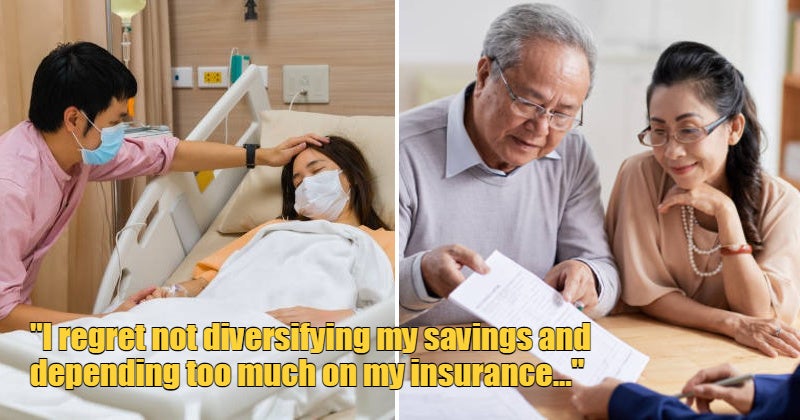

4. “I regret depending too much on my insurance to cover for me in times of emergencies and not diversifying my savings”

We’ve all faced situations where we’re strapped for cash and we didn’t have a choice but to use up our savings. But this practice can be very damaging to our future.

“I thought having one savings account is more than enough, especially since I also pay for insurance. But when my husband was ill and had to be hospitalised for a long time, he actually exhausted his insurance plan. We ended up having to tap into our retirement savings which I never got to fully rebuild.” – Lisa, 83

This is why we strongly urge Malaysians to set up multiple savings accounts, and you can do so simply by dividing your monthly wage (after deducting your commitments, of course) into a few crucial categories. For example, 30% for savings, 20% for emergencies, 20% for bills, 15% for retirement and so forth.

Other than that, an easier way to account for your retirement savings is by making monthly contributions to your EPF. This way, the savings will be automated every month so you can focus on other matters.

5. “I thought I could rely solely on my pension to survive so I used up my savings for leisure purposes”

For pensioners, they’d have the comfort of knowing that they’ll live out their retirement days receiving a small monthly “allowance”. But does that mean they don’t have to save up at all?

“After working hard all my life and raising five kids, I figured I’ve earned some time to let loose. So, I took my wife on various vacations using our savings. We figured it wouldn’t be a problem since I’d have my pension (and kids) to rely on. But a couple of years back, my son’s company almost went bankrupt and needed a lot of money to recover. How I wish I held on to my savings!” – Lee, 74

Even if you waited until a specific age to withdraw from your savings, use it wisely because you’ll never truly know when you or your family might need a large sum of cash in the future.

In fact, this case solidifies the recent study that revealed how most Malaysians are not financially prepared to retire.

According to a study, 68% of Malaysians will outlive their retirement savings within just FIVE years!

On top of that, the life expectancy rate for Malaysians is actually rising for both males and females. Simply put, we’re now expected to live longer but we won’t be able to afford it. It paints a grim picture for most Malaysians, which is why we want to remind everybody of the importance of saving up for retirement! Some of the things you can do from now to avoid this include:

- Continuing your EPF contribution without reducing the percentage and try not to withdraw earlier than you should.

- Invest in a private retirement scheme (PRS) that enables you to save in a long-term way.

- Automate your savings through online banking where they would automatically deduct an amount on a monthly basis.

- If you have some extra cash on hand, put it towards low-risk unit trust funds.

- Purchasing gold when you have extra money so you can have the option to sell it if you need to.

As we’ve said multiple times, you can never be too prepared for your future. And it is never too early or too late to start planning for it so make sure you do your part from now on!

How are you planning to live out your retirement years? Share your thoughts below!